The BRICS nations are coming of age.

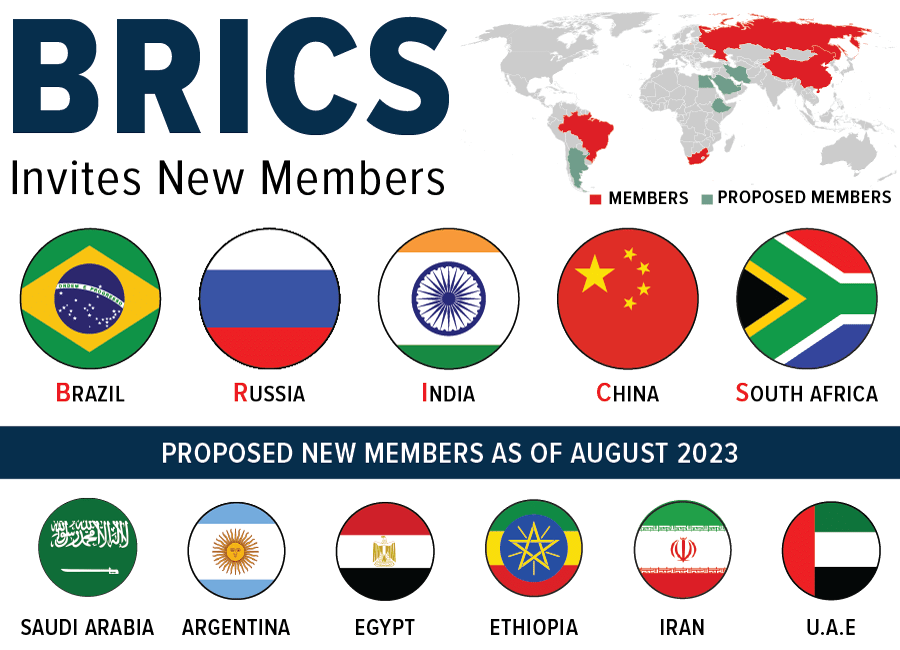

At its annual summit in Johannesburg this week, the bloc of five emerging countries — Brazil, Russia, India, China and South Africa — announced plans to expand for the first time since 2010. On January 1, 2024, the BRICS will welcome six new members: Saudi Arabia, Argentina, Egypt, Ethiopia, Iran and the United Arab Emirates (UAE).

The expansion will further establish the group as a counterbalance to the G7’s global influence, catapulting BRICS’ share of global GDP to 36% as well as covering nearly half of the world’s population.

With dozens more nations expressing interest in joining the bloc, the BRICS are clearly positioning themselves for a multipolar world, one that is not dominated by the U.S. and other members of the West.

I expect the BRICS’ rise to create both opportunities and challenges for investors. Understanding the geopolitical, economic and regulatory landscape will be critical for navigating this environment successfully.

The Dollar’s Dominance Challenged

Perhaps most notably, Russian President Vladimir Putin — speaking remotely due to an International Criminal Court (ICC) arrest warrant for alleged war crimes — discussed the BRICS’ push to conduct trade in local currencies instead of the U.S. dollar, a move that would significantly reconfigure global trade dynamics.

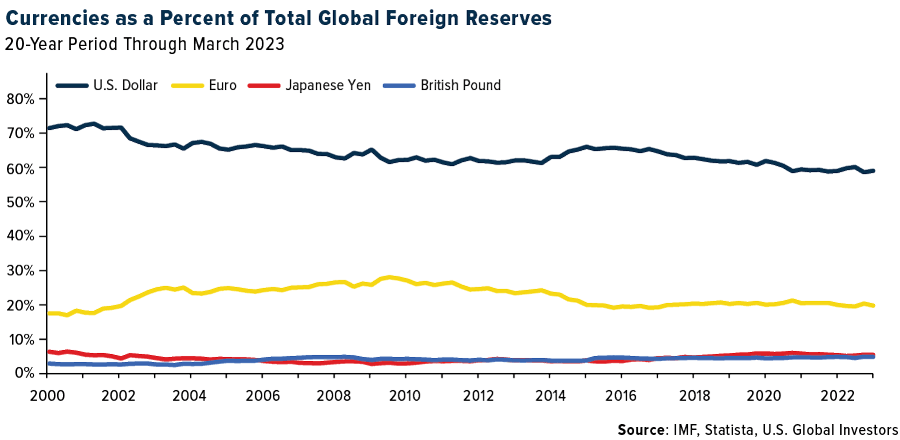

Since the Bretton Woods Conference in 1944, the dollar’s status as the world’s primary reserve currency has offered the U.S. tremendous benefits such as cheaper financing and unparalleled leverage in the form of financial sanctions. But now, with BRICS nations seeking an alternative to the greenback (and growing their ranks from five members to 11), the currency landscape may see a new major tectonic shift, contributing to greater volatility in the Treasury market, exchange rates, inflation and more.

At the heart of this strategy lies the New Development Bank (NDB).

Established in 2015 as an alternative to Western lenders such as the World Bank and International Monetary Fund (IMF), the NDB has been making waves. Its recent decision to release an Indian rupee bond and to consider local currency bonds in other countries reflects its intent to diversify away from the dollar.

Former Brazilian leader and NDB’s current president, Dilma Rousseff, shared the bank’s ambitious plans to lend between $8 billion and $10 billion this year, with approximately 30% of the lending in local currencies. The U.S.-based financial system is “going to be substituted by a more multipolar system,” Rousseff told the Financial Times.

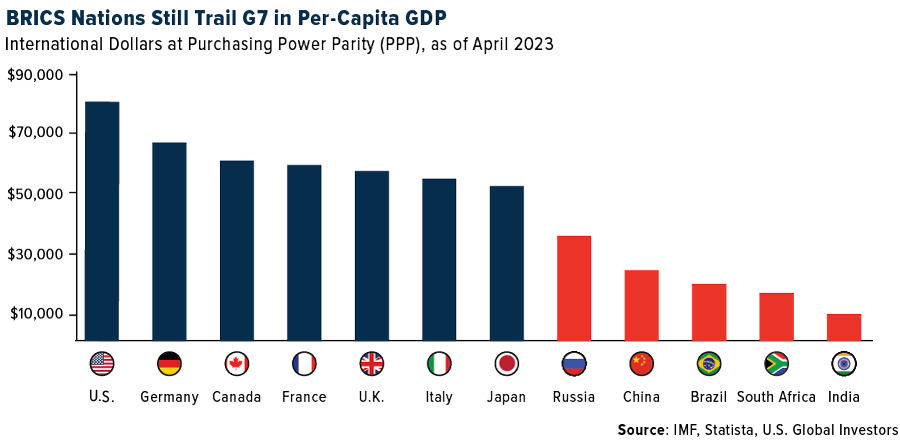

My own opinion is that the U.S. dollar will not be completely dethroned as a reserve currency, though we may end up seeing it share the stage more prominently with the euro, Chinese yuan, Bitcoin or some other currency. In their current roster, the BRICS represent over 32% of the world’s GDP, which is slightly more than the G7’s 30%; however, GDP per capita, an indicator of economic prosperity, remains a gap that the BRICS must bridge.

As the BRICS nations evolve and expand their influence, a more diversified global governance is inevitable. The current trajectory promises a world where traditional powerhouses, including the U.S. and European Union (EU), must adapt to new realities.

As an investor and an observer, staying nimble will be paramount.