$30 trillion in U.S. wealth will transfer to younger women in the next 10 years

Younger women in the United States are poised to become a much bigger investing force over the next decade as around $30 trillion in wealth will be transferred into their hands by older generations, according to a study from the Bank of America Institute.

The study, led by Bank of America Institute economist Taylor Bowley, said the first of these generational transfers is already underway and that in the near future women will control more money than they ever have.

“As women become more active in financial decision-making, understanding their goals and risk preferences increases its importance. Women tend to think longer term and prioritize capital protection when making financial decisions,” Bowley wrote in an article for the institute highlighting the study’s findings.

“Plus, women (among affluent households) are more likely to make sustainable investments and give to female-focused philanthropic efforts,” she said.

But Bowley pointed out that gaps in gender parity remain and progress on women’s financial health has not been equal across all regions. It means that “the Great Wealth Transfer won’t be equal either. This could further drive a gap between wage equality, entrepreneurship, rising political empowerment and better access to leadership positions for women,” she wrote.

When women invest and give, impact matters

A separate study from Bank of America Private Bank also finds that U.S. women are more likely to believe sustainable investing can have a positive impact on society and, as a result, they make an effort to invest with impact. All told, 85% of affluent women in the U.S. consciously align their purchasing decisions with their values at least some of the time and 10% of affluent women participate in sustainable or impact investing.

In 2022, 86% of affluent women indicated that their households gave to charity and 10% participated in sustainable/impact investing. And according to the 2023 Bank of America Study of Philanthropy, affluent women are driving positive change through their economic influence and strategic philanthropy, with most (85%) household charitable giving decisions made or influenced by a woman.

Affluent women were also significantly more likely to select women’s and girls’ issues as one of their top three most important causes/issues compared to men. The top three reasons affluent individuals indicated that they gave to support women’s and girls’ causes in 2022 included: the desire to improve the world for women and girls, the belief that supporting women and girls is the most effective way to solve other social problems, and the desire to improve the world for their children.

One intended purpose of giving to support women and girls — reproductive health/rights — was up significantly in 2022 compared to five years earlier (51% of affluent individuals who gave to women’s and girls’ causes in 2022 gave for this reason, compared to 36% in 2017).

Other wealth study highlights

- About 33% of the world’s wealth was held by women in 2022, about half of that held by U.S. women. But women around the globe are increasing their financial firepower, according to data from the World Bank, which tracks laws and regulations that affect women’s economic opportunity.

- Much of the $30 trillion that will be inherited by women in the U.S. will come from transfers by Baby Boomer men to their wives and children. Baby Boomer wives tend to be younger than their husbands and have an average lifespan that is five years longer, allowing them time to make an investing impact.

- Globally, more women are accessing banking services: 81% of countries with data saw increases in women’s financial participation between 2018 and 2022, according to BofA Global Research. However, women face lower lifetime earnings, longer life expectancy and higher likelihood to take time off to be caregivers.

- On average, U.S. women earn $0.83 for every $1 earned by men, which contributes to them having a 34% lower median retirement income than men, according to the U.S. Bureau of Labor Statistics, ASEC 2022 Current Population Survey. This means that women tend to think longer term and prioritize capital protection when making financial decisions.

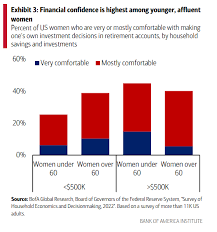

- Only 28% of U.S. women are very or mostly comfortable making investment decisions vs. 39% of men, especially around retirement. Women also tend to be more risk-averse than men, allocating a smaller percentage of their investments to equities and riskier assets like cryptocurrency than men.

- Even as money is spread more evenly between women and men, that money will remain concentrated in wealthy countries and among wealthy families.. Over 40 countries globally still lack gender-equal inheritance laws, and almost two-thirds of these are lower-middle and lower-income countries.

- The top 1 percent of earners receive inheritances at twice the rate of those in the bottom 50 percent of earners. Among those who inherited, the average inheritance of those in the top 1 percent is 11x higher than the average inheritance of those in the bottom 50 percent. All told, close to half (41%) of reported inheritances (by value) went to the top 10 percent of earners.

Read more: Women of Impact: Kristin Hull and Nia Impact move mountains