Bitcoin is poised to go parabolic and four other predictions for 2024

Bitcoin, like the broader market, has notched a strong ending to 2023 after trading rangebound for most of the year. If today were the last day of 2023, the king of digital assets would have returned about 155%, the most since 2020, when it rose 305%.

With only five trading days remaining in December, now is an ideal time to share my top five Bitcoin and digital asset predictions for 2024. (These are my personal predictions, not those of U.S. Global Investors.)

1. A spot Bitcoin ETF will launch in the U.S., sparking a price revaluation.

There are no guarantees in life, but a U.S.-based spot Bitcoin ETF now appears to be imminent.

Bloomberg Intelligence puts the odds of the Securities and Exchange Commission (SEC) approving a filing by Jan. 10 at 90%. It’s possible we’ll see back-to-back launches of Bitcoin ETFs in January—as many as 10, Bloomberg estimates.

How will this affect the price of the underlying asset? Spot Bitcoin ETFs are available in other markets, including Canada and Europe, but it’s worth noting that the U.S. accounts for approximately 60% of the total global equity market value. One data analytics firm says that the demand spurred by a spot ETF could push the price of Bitcoin to between $50,000 and $73,000. Some readers will find this estimate too conservative.

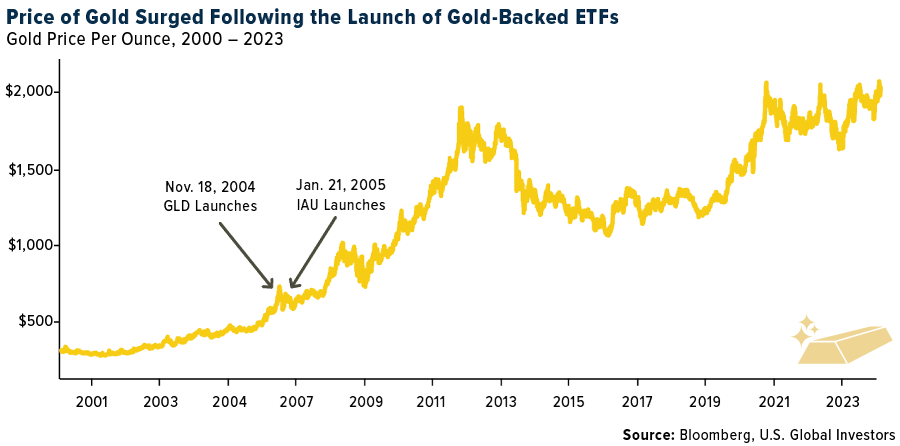

It may be instructive to review what happened to the price of gold—Bitcoin’s analog cousin—after the launch of the first U.S.-based gold commodity ETF, SPDR Gold Shares GLD . Before GLD and the similarly gold-backed iShares Gold Trust IAU , investors were limited to physical bullion (which can be costly to move and store) and the futures market (which may not be appropriate for every investor).

Making its debut in November 2004, GLD increased overall demand for gold by reducing the frictional costs associated with investing in the metal and making it more accessible to a broader investor base.

Since that time, the price of gold has increased nearly 360%.

While I’m on this topic, a spot Ethereum ETF could also be made available in 2024. The SEC’s decision on two specific filings, from VanEck and Ark/21Shares, is expected in May. Unlike Bitcoin, Ether is not considered a commodity, but I believe such an ETF will similarly drive demand for crypto.

2. Smaller miners will struggle to survive after ‘the halving.’

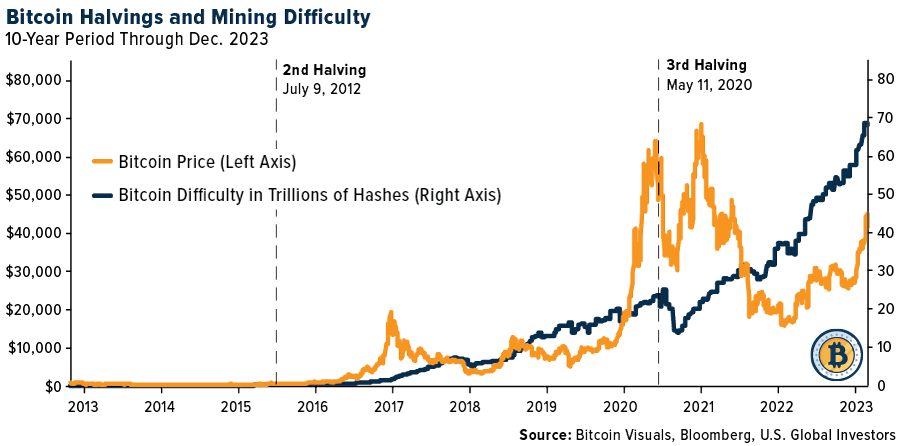

As many of you know, Bitcoin was programmed to have a limited supply. The number of tokens that will ever exist is capped at 21 million, and every four years, the digital asset undergoes an event called the halving. The next halving is expected in April 2024, after which the mining reward will be trimmed by 50%, from 6.25 BTC per block to 3.125 BTC.

This is a double-edged sword. On the one hand, the price of Bitcoin has historically rallied immediately before and after previous halving events as investors act on the reminder that supply is highly restricted.

On the other hand, smaller and less well-capitalized crypto miners will likely struggle to survive as the difficulty rate continues to climb and the mining reward is reduced by half. At the end of last month, crypto miners Hut 8 and US Bitcoin Corp. completed their merger, and I expect to see additional business deals as the industry positions itself for this new era of mining difficulty.

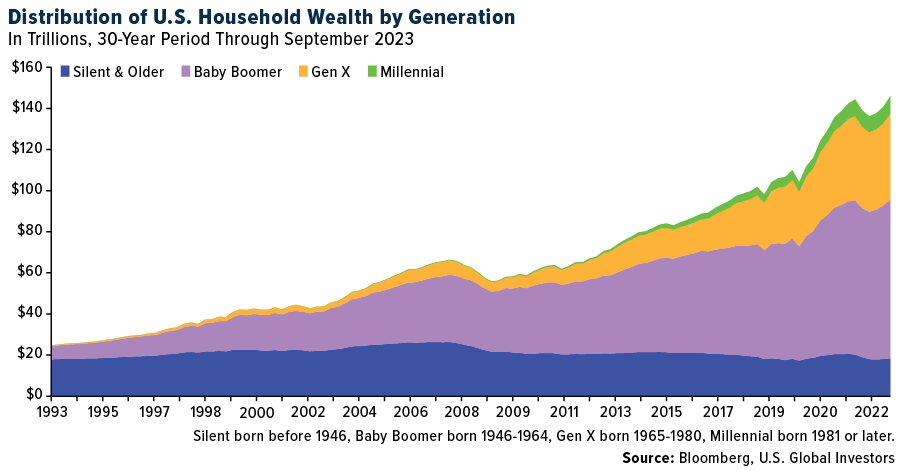

3. The $84 trillion wealth transfer will greatly benefit digital assets.

The world is about to witness the largest transfer of wealth in human history. Over the next two decades, members of the Silent Generation (those born before 1946) and Baby Boomers (1946-1964) will leave their heirs an estimated $84.4 trillion, with Millennials (1981-1996) being the primary beneficiary.

This will have a number of major ramifications, but as blockchain firm Galaxy reminds us, Millennials and younger generations “have a higher preference for crypto” than their parents and grandparents. Not only are members of this cohort “digital natives,” but they’ve also lived through a series of financial setbacks (the Great Recession, high inflation, restrictive borrowing costs) that, in many cases, have sullied their trust in traditional financial institutions and assets. A 2022 Investopedia survey found that Millennials as a whole were more likely to invest in cryptocurrencies than in stocks, mutual funds, ETFs, commodities and real estate.

Says Galaxy’s Charles Yu, “Shifting wealth from older generations into the hands of this crypto-friendly population is likely to result in greater inflows into Bitcoin and the broader crypto asset class.”

4. NFTs and ordinals will make a huge comeback.

Non-fungible tokens, or NFTs, have lost much of their cache since the bull run of 2021-2022. Many of these digital assets, permanently inscribed on the Ethereum blockchain, used to trade hands for millions of dollars. Today, however, an estimated 95% of NFTs are “worthless,” according to dappGambl.

Is the market ready for a renaissance? I believe so, though the Bitcoin network is fast becoming the preferred platform. One year ago this week, people began inscribing text, images and other media on Bitcoin, and by May, it was being reported that the Bitcoin blockchain was the second-most popular NFT platform after Ethereum.

Ordinals, as NFTs on the Bitcoin network are called, now account for over half of all daily Bitcoin transactions, and trading volumes recently hit a new record high, soaring to $36 million on Dec. 12.

5. Bitcoin miners will continue to be good stewards of energy resources.

Bitcoin mining is often criticized for its energy consumption, but much of this energy comes from renewable sources such as hydroelectric power, wind and solar. What’s more, in the first half of 2023, the global Bitcoin network used only 0.21% of the world’s energy, an inconsequential amount, according to the Bitcoin Mining Council (BMC).

Another important development is the use of stranded gas, a byproduct of oil and gas operations, which is used in mining to prevent waste and reduce carbon and methane emissions. This approach is financially beneficial for miners, as it generates more revenue compared to selling the gas at market prices. It can also help comply with regulations limiting gas flaring.

On a final note, excess heat from Bitcoin mining can be recycled, as HIVE Digital Technologies is doing in Lachute, Quebec. Heat from its Bitcoin operations is being used to warm a neighboring facility, an approximately 200,000-foot swimming pool manufacturer.