Lehman Brothers Collapse and Gold

Everyone knows that the global financial crisis was positive for the gold prices in the long-run. However, the behavior of the price of the yellow metal was actually quite complicated around the ‘Lehman moment’. As one can see in the chart below, gold rallied in the second half of 2007, as the global economy started to reveal signs of an impending turmoil.

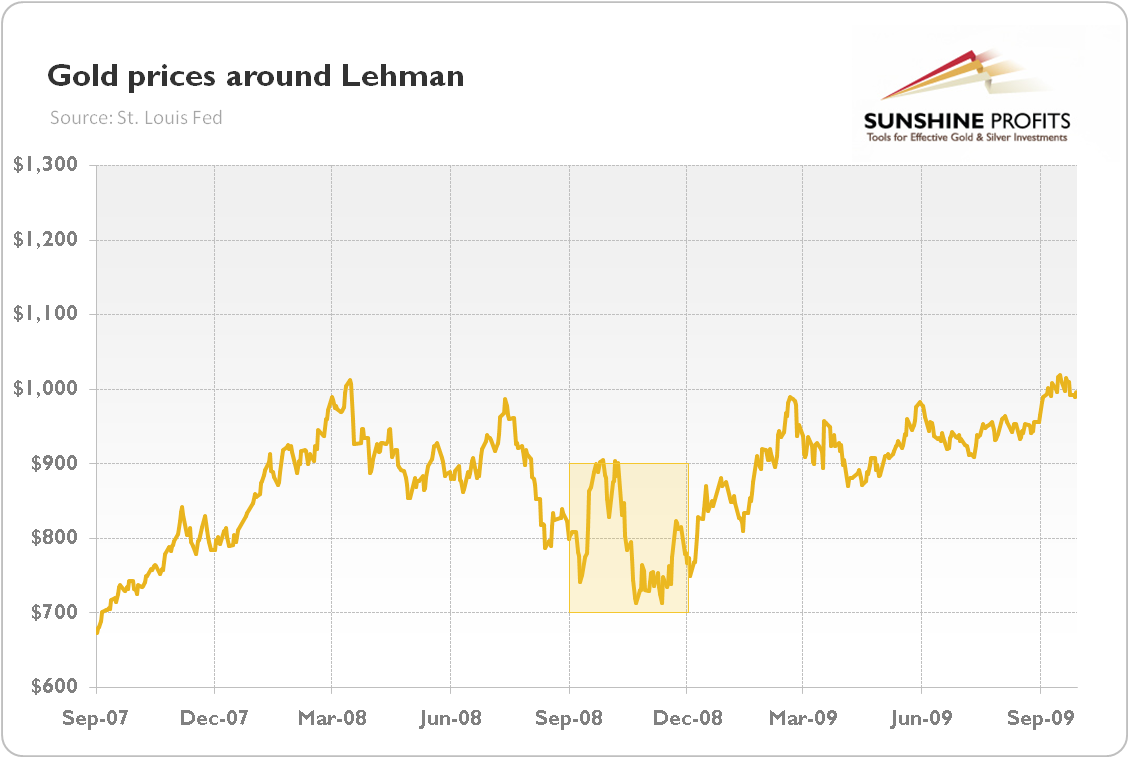

Chart 1: Gold prices (London P.M. Fix, in $) around the Lehman Brothers’ bankruptcy (from September 2007 to September 2009)

By the way, let’s emphasize one thing which is very often wrongly presented: the Lehman Brothers did not trigger the crisis. The company collapsed as a result of the unprecedented loss due to the continuing subprime mortgage crisis (as a reminder, in 2007, Lehman underwrote more mortgage-backed securities than any other firm) and the lack of political will to bail it out (just compare the Fed’s and Treasury’s decision to let Lehman fail with its tactic support for Bear Stearns, which was bought by JPMorgan Chase in March 2008.

OK, let’s return to the chart. After the rescue of Bear Stearns, the price of gold plunged from $1,011 to $750 just before the Lehman Brothers’ bankruptcy on September the 15th, 2008. After that, it initially increased from $750 to $775. Gold continued the rally until September the 29th, when it reached $905. However, it started to decline then, plunging to $712.5 (lower than before the rally) on October the 24th, 2008. It moved above $1,000 again not earlier than mid-2009.

Hence, the collapse of the Lehman Brothers was initially positive for gold, as it increased fear among traders. However, investors quickly started to desperately need liquidity. So they sold their assets, including gold, to obtain necessary US dollars (Lehman Brothers also had to liquidate its positions, including precious metals). The implication is that when gold serves as a source of liquidity, its price might actually fall at the beginning of the crisis as a result of fire sales.

Now, the question is: who will be the next Lehman Brothers. Many analysts bet on Deutsche Bank, but it may just be someone else. One thing is certain: if we have another financial crisis in the US (the epicenter of the crisis is important, the replay of the Asian Financial Crisis may not be supportive for the gold prices), gold might not behave the same as in 2008, but its prices should generally rise.

We encourage you to learn more about the gold market – not only about the link between Lehman Brothers and the yellow metal, but also how to successfully use gold as an investment and how to profitably trade it. Great way to start is to sign up for our Gold & Silver trading Alerts. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Related terms:

-

Asian financial crisis

The Asian financial crisis in the late 1990s with devaluation of local currencies caused unexpected havoc in global markets, with a domino effect, including a crisis in Russia, declines in stock markets around the world, and the fall and bailout of the U.S. hedge fund Long Term Capital Management (LTCM).

Read more

-

Deutsche Bank and Gold

Founded in 1870. One of the major drivers of the Collateralized Debt Obligation Market prior the Great Recession. The 17th largest bank in the world by total assets. German investment bank headquartered in Frankfurt, around which there is plenty of controversies and allegations of improper behavior. Deutsche Bank. Let’s analyze its link with gold – and whether its collapse is coming, which some analyst are afraid of.

Read more

-

Gold as an Investment

Gold had served as money for thousands of years until 1971 when the gold standard was abandoned for a fiat currency system. Since that time, gold has been used as an investment. Gold is often classified as a commodity; however, it behaves more like a currency. The yellow metal is very weakly correlated with other commodities and is less used in the industry. Unlike national currencies, the yellow metal is not tied to any particular country. Gold is a global monetary asset and its price reflects the global sentiment, however, it is mostly influenced by the U.S. macroeconomic conditions.

Read more

-

Goldman Sachs and Gold

One of the largest investment banks in the world, founded in 1869 in New York. A primary dealer in the United States Treasury security market, which has revolving door relationship with the U.S. government. It’s believed by many to be the world’s most evil investment bank, which faces many controversies and legal issues. Goldman Sachs. The bank that allegedly runs the world and whose tentacles squeeze the globe. Let’s analyze its link with gold – and whether its collapse is coming, which some analyst are afraid of.

Read more

-

Great Depression

The Great Depression was the longest and most severe economic depression ever experienced by the global economy. It took place during the 1930s, began with the U.S. stock market crash of 1929 and ended after World War II.

Read more

-

Great Recession

The Great Recession is the period of global economic decline during the late 2000s. It was initially related to financial crisis of 2007-2008, but quickly transformed into a downturn in real activity and later into the European sovereign debt crisis. According to the National Bureau of Economic Research, which officially declares the peaks and troughs, the recession in the U.S. began in December 2007 and ended in June 2009, but in other countries the scale and timing of the recession varied. It was the largest economic downturn since the Great Depression.

Read more

-

JP Morgan Chase and Gold

One of the largest investment banks in the world, headquartered in New York. The largest U.S. bank, the world’s sixth largest bank by total assets and the world’s second most valuable bank by market capitalization. JP Morgan Chase. An eternal enemy of precious metals bulls, accused of selling uncovered shorts on Comex. The bank that allegedly manipulates gold and silver markets. Let’s analyze its link with gold – and whether its collapse is coming, as some analyst are afraid.

Read more