GBP/USD: Downside Correction Likely

- GBP/USD has extended its gains as polls show solid Conservative lead.

- Caution is warranted amid uncertainty about the elections and upcoming US data.

- Thursday’s daily chart is showing overbought conditions.

“The madder Hulk gets, the stronger Hulk gets.” Prime Minister Boris Johnson compared himself to the Incredible Hulk back in September when referring to unshackling the UK from the manacles of the EU. The comic character’s burst of rage may represent pound bulls, who seemingly have shrugged off caution and have begun pricing in a Conservative landslide victory.

At the time of writing, sterling is shining at a seven-month high around 1.3150, more than 200 pips up this week. The most recent opinion polls have shown that Labour’s attempts to catch up with the Tories have stalled. And that has triggered pound buying.

A ComRes poll has shown that both parties have lost 1%, leaving the ruling party with a substantial ten-point lead against the opposition. YouGov’s recent poll reflects stability with a nine-point gap.

The recent surveys also seem to confirm YouGov’s Multi-Regression Post-stratification (MRP) poll, a broad statistical exercise that correctly projected the 2017 outcome. After forecasting a hung Parliament in 2017, the MRP showed a 68-seat majority for Johnson’s party which now seems insurmountable.

Nevertheless, memories from the Tories’ failure to win a majority two years ago and some profit-taking may trigger a downside correction.

Investors prefer an outright victory for Johnson as that would provide clarity on Brexit, ratifying the PM’s Withdrawal Bill. Moreover, markets are wary of Labour leader Jeremy Corbyn’s radical spending and nationalization plans, in addition to prolonged uncertainty around leaving the EU.

Weak US data, trade hopes

The US dollar has struggled after ADP showed a meager increase of only 67,000 private-sector jobs in November, Yet while the greenback was also hit by a disappointing drop in the ISM Non-Manufacturing Purchasing Managers’ Index (PMI), the employment component of that report increased. The data precedes Friday’s all-important Non-Farm Payrolls report.

The broader market mood has improved after Bloomberg News reported that Washington and Beijing are closer to a deal despite an escalation in rhetoric by both sides. Chinese officials said that both countries are in close contact. The optimism has been modestly weighing on the safe-haven US Dollar, but investors have heard similar comments before and may remain cautious. Barring any breakthrough, the US is set to slap China with new tariffs on December 15.

Overall, speculation about the UK elections, with just one week to go, tops the agenda for pound/dollar traders. Trade headlines and positioning ahead of the US jobs report play second and third fiddles.

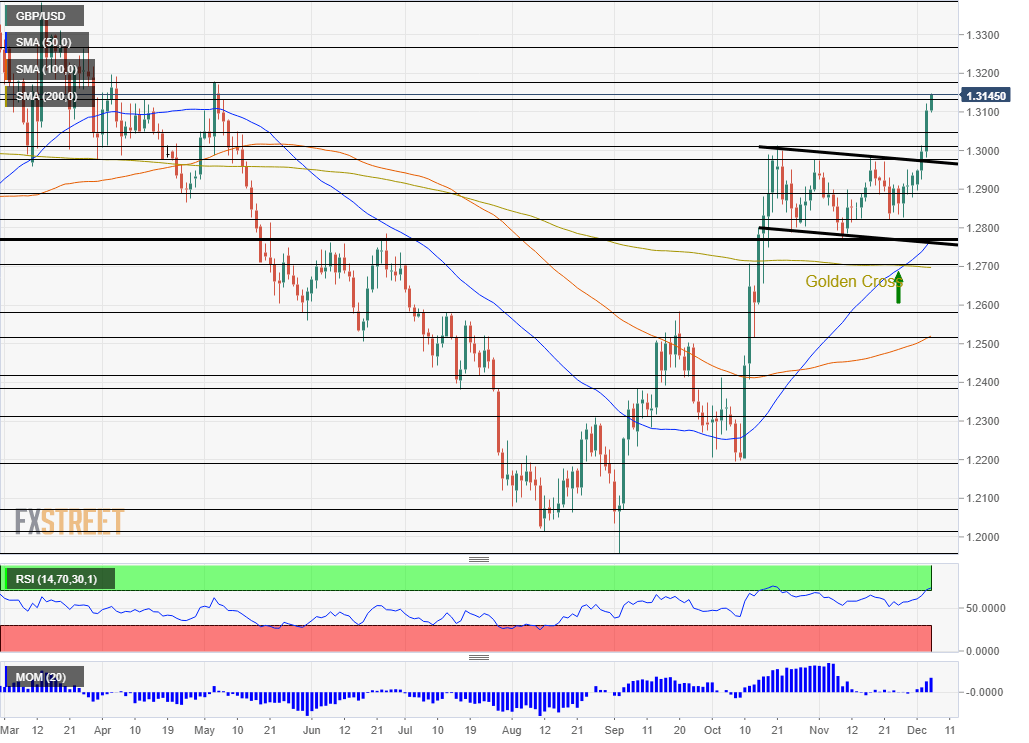

GBP/USD Technical Analysis – Overbought

The daily chart has joined intraday graphs – such as the four-hour one – in pointing to overbought conditions. The Relative Strength Index is above 70, and that implies a correction.

Support awaits at 1.3135, which capped cable back in April. Further down, we find 1.3050, a temporary resistance line in May. The October high of 1.3013 and the November high of 1.2985 are next.

Resistance is at 1.3180, a swing high from May. Next, 1.3275 and 1.3380 capped the pound in March.

_____

Equities Contributor: FXStreet

Source: Equities News