EUR/USD Analysis: China Retaliates, Dollar Down

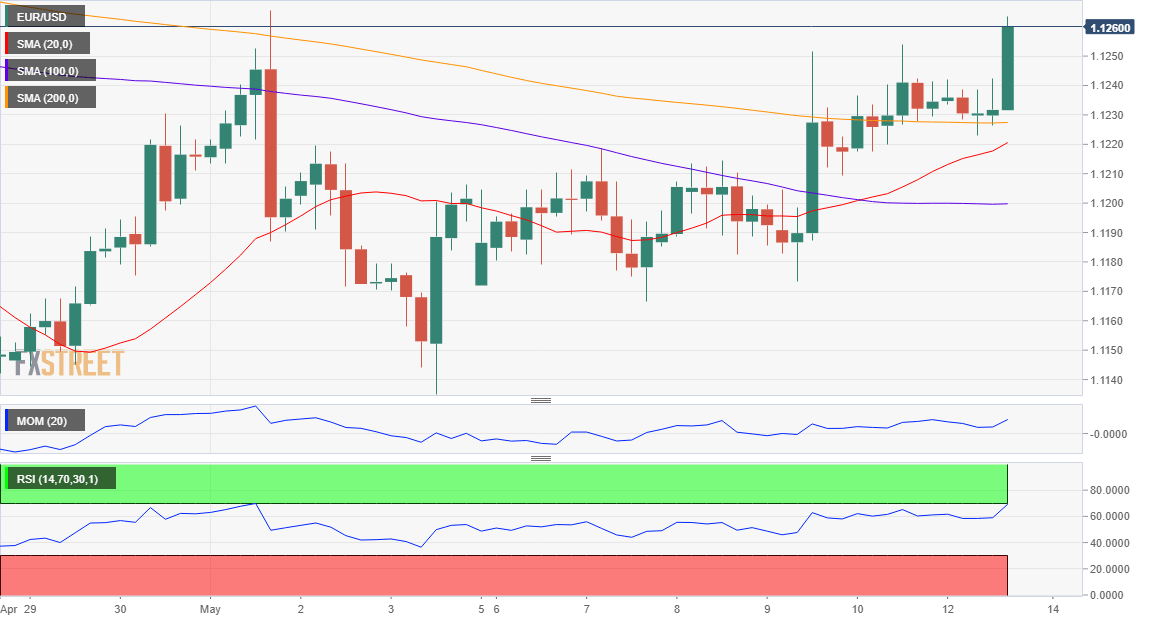

EUR/USD Current price: 1.1260

- China announced a series of measures to counter US latest round of tariffs.

- EUR/USD challenging a four-week high, bulls may push it to 1.1320.

The EUR/USD pair was trading uneventfully around 1.1230 until China finally announced its countermeasures against the latest US levies. The news sent equities sharply down worldwide, with the greenback under pressure against most major rivals except for commodity-linked currencies. According to different reports, China will now set tariffs from 5% to 25% on a total of $60 billion worth of US goods. Additionally, the country is studying other measures, which include halting purchases of US agricultural products and energy, reducing Boeing orders and restricting US service trade with China.

The EUR/USD pair jumped to the 1.1260 price zone where it stays ahead of the US session. The US macroeconomic calendar includes a couple of Fed’s speakers today, although it seems unlikely that those could overshadow concerns related to the trade war.

The pair is trading a couple of pips below 1.1264, the highest for the last four weeks, and breaking above the 61.8% retracement of its latest daily slide. In the 4 hours chart, technical indicators entered bullish territory for the first time since April, maintaining their upward slopes, while the price advances further above a bearish 20 SMA, all of which indicates that, while the current rally could continue short-term, the bullish case in the longer term is not yet firm.

Support levels: 1.1220 1.1190 1.1155

Resistance levels: 1.1280 1.1320 1.1350