The dot-com bubble was, thus, a price bubble related, like many bubbles, to the new technology, i.e. the rapid increase in the usage and adaptation of the Internet. However, the stock purchase had to be financed somewhat. Indeed, the internet bubble was developed because the new money created by the Federal Reserve went through the banking system to online companies and NASDAQ stock exchange. The easy monetary policy and cheap capital combined with psychological factors helped to fuel the bubble.

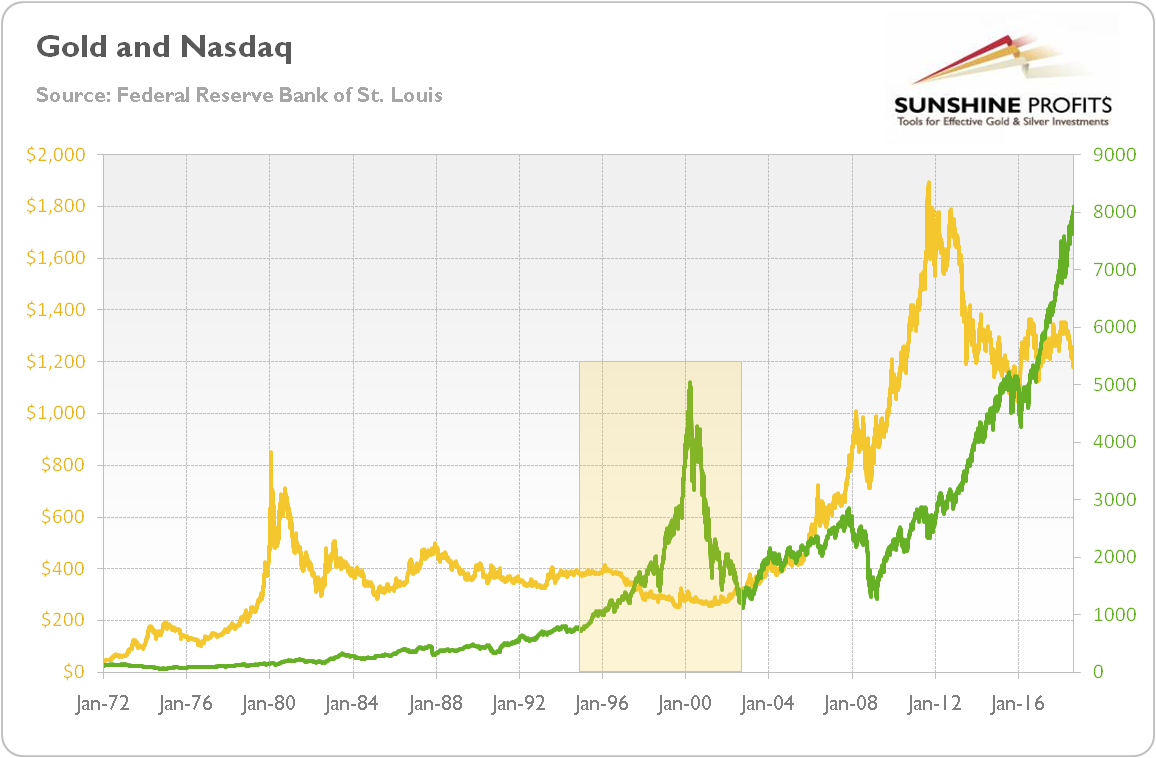

Let’s look at the chart below. As one can see, the Nasdaq index surged from 719 in December 1994 to 5,048 in March 2000. It means about 600 percent increase!

Chart 1: Gold prices (yellow line, left axis, London P.M. Fix, in $) and Nasdaq Index (green line, right axis) from January 1972 to September 2018.

Dot-com Bubble and Gold

How did gold behave during the dot-com bubble? Well, as the chart above shows, the yellow metal struggled in that period. As the funds flew into the stock market, gold was in the shadow. Another reason for disappointing gold’s performance was that the US dollar remained in the bull market.

However, when the bubble burst, and the Fed started to cut the federal funds rate in the response, gold started its impressive rally. Many people did not want to invest in the stock market anymore and they switched into the housing market (developing another speculative mania) and into… the precious metals market. The low interest rates, weak greenback and unsound US fiscal policy made gold shine.

We encourage you to learn more about the gold market – not only about the link between dot-com bubble and the yellow metal, but also how to successfully use gold as an investment and how to profitably trade it. Great way to start is to sign up for our Gold & Silver trading Alerts. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Related terms:

-

Fed

The Federal Reserve System, or sometimes referred to as “the Fed” is the central bank of the United States. The agency was created through the House Resolution 7883 by Rep. Carter Glass and it came into effect on December 23, 1913 after President Woodrow Wilson signed the Federal Reserve Act. The Fed is entrusted with the responsibility of ensuring that the country will have a safer, more stable, and flexible financial and monetary system.

Read more

-

Fiscal Policy

Fiscal policy is an economic policy which uses government spending and taxation to influence the economy. It is the sister of monetary policy conducted by central banks to affect a nation’s money supply. The fiscal policy influences aggregate demand by changes in the level of taxation and government expenditure. We say that fiscal policy is loose or expansionary when spending is higher than revenue (i.e., the budget is in deficit). On the other hand, fiscal policy is said to be tight or contractionary when revenue is higher than spending (i.e., the government budget is in surplus).

Read more

-

Gold as an Investment

Gold had served as money for thousands of years until 1971 when the gold standard was abandoned for a fiat currency system. Since that time, gold has been used as an investment. Gold is often classified as a commodity; however, it behaves more like a currency. The yellow metal is very weakly correlated with other commodities and is less used in the industry. Unlike national currencies, the yellow metal is not tied to any particular country. Gold is a global monetary asset and its price reflects the global sentiment, however, it is mostly influenced by the U.S. macroeconomic conditions.

Read more

-

Interest Rates

In economics, an interest rate is the ratio in the mutual valuation of present goods against future goods. Since people prefer goods now to later, in a free market there will be a positive interest rate to reward deferring consumption. From the financial point of view, an interest rate is a rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). To simplify, an interest rate is the cost of borrowing money, typically expressed as an annual percentage of principal.

Read more

-

Monetary Policy

Monetary policy is an economic policy which aims to achieve macroeconomic goals such as low inflation, low unemployment, high economic growth and financial stability. The second major macroeconomic policy is fiscal policy conducted by governments. Monetary policy is usually conducted by independent central banks.

Read more

-

Precious Metals

A precious metal is defined as a rare, naturally occurring chemical element that has high economic value and is chemically resistant. In the past, precious metals served as a currency. Now they are an investment or industrial commodity.

Read more

-

Price bubble

There are a number of ways to define a price bubble (also referred to as a speculative bubble, economic bubble, asset bubble or financial bubble). The simplest definition says that a price bubble is an upward deviation of the market price from the asset’s fundamental value. In other words, the bubble means an upward price movement over an extended range which then implodes.

Read more

-

Safe Haven

A safe-haven asset is an asset that is uncorrelated (weak safe-haven) or negatively correlated (strong safe haven) with another asset or portfolio in times of market stress or turmoil. It should not be confused with a hedge, which is an asset that is uncorrelated (weak hedge) or negatively correlated (strong hedge) with another asset or portfolio on average. Hence, a safe-haven asset protects investors during crises, unlike a hedge, which protects them in normal times, but not necessarily during turmoil. Thus, a safe-haven asset is expected to retain its value or even increase its value in times of market turbulence, when most asset prices decline.

Read more