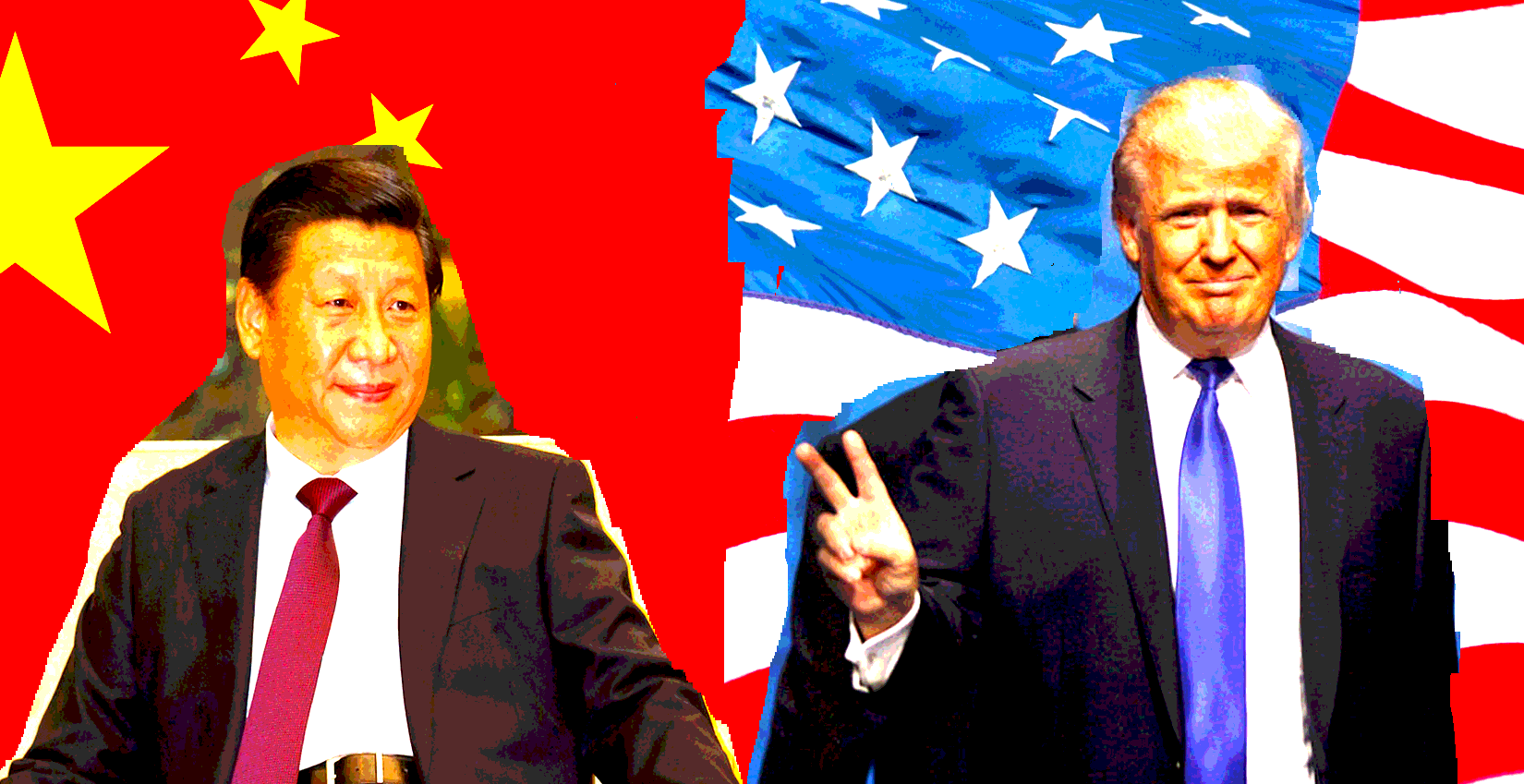

China to Impose $34bn Tariffs Before the US as Trade Dispute Escalates (UPDATED)

“The Chinese government’s position has been stated many times. We absolutely will not fire the first shot, and will not implement tariff measures ahead of the United States doing so.”

Both sides have threatened to impose similarly sized tariffs on 6 July, but because of the 12-hour time difference, the Chinese tariffs on US imports ranging from soybean to stainless steel pipes will take effect earlier.

Chinese officials are preparing to implement them from midnight

The US will implement a 25% tariff on $34bn of Chinese imports – 818 product lines ranging from cars to vaporisers and “smart home” devices – on Friday.

There had been hopes the US and

Last month, the Mercedes-Benz maker Daimler became the first major company to issue a profit warning on the back of the trade dispute. The German business makes Mercedes SUVs in the US and ships them to

Donald Trump has threatened to escalate the conflict by imposing further tariffs on up to $200bn of Chinese goods, if

China’s stock market fell sharply on Wednesday as traders worried about the escalating trade dispute. The benchmark Shanghai Composite index dropped 1% to finish the day at 2,759 points, its lowest closing point since .

US markets are closed for . They moved lower on Tuesday.

Michael Hewson, the chief market analyst at CMC Markets

“Sharp moves in the Chinese currency prompted speculation that Chinese authorities were manipulating the rate in order to offset some of the worst effects of US tariffs.”