Discover

iShares ESG Aware U.S. Aggregate Bond ETF (EAGG)

Inspire

There are more ESG-themed funds than most people realize

Invest

When choosing ESG-labeled funds, do your due diligence

In this bi-weekly series, Equities News in collaboration with Till Investors provides readers with an overview of specific mutual funds and ETFs within the sustainable investing marketplace. The goal is to help readers identify investment funds that meet their risk profile, impact interest and investment goals.

Today, we’re providing insight into a sustainable fund that focuses on bonds – the lower-risk, lower-return alternative to stocks. While the vast majority of ESG funds invest in stocks, ESG fixed income funds are carving out a niche amongst investors as well. But what does a sustainable bond fund look like, and who is it a good fit for? Let’s dig in and find out by taking a look at…

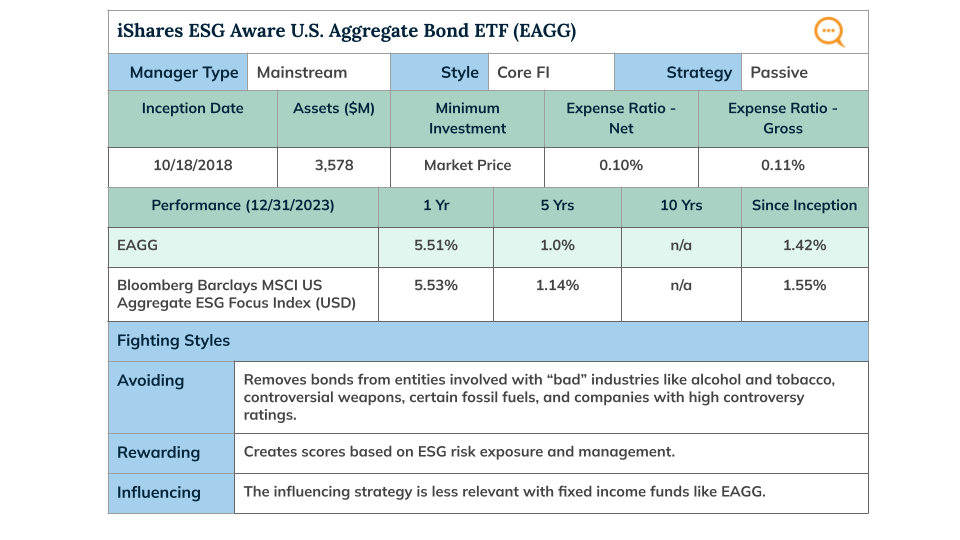

iShares is a brand of funds managed by Blackrock. Blackrock is one of the world’s largest asset managers with a diverse lineup of ESG funds. Their largest ESG bond fund is the iShares ESG Aware U.S. Aggregate Bond ETF (EAGG), with over $3.5 billion in assets. Like most iShares products, this fund is structured as an ETF, and like most ETFs, it is designed to follow an index – in this case the Bloomberg Barclays MSCI US Aggregate ESG Focus Index.

The index this fund tracks is based on the broadest market of U.S. investment-quality bonds, known as the Barclays U.S. Aggregate, or “the Agg.” It is designed to represent the broad investment-grade bond market in the U.S., including Treasuries, mortgage-backed bonds, asset-backed bonds, and corporate bonds. The ETF structure means that management costs are very low for this fund. At the same time, passively following the index means that Blackrock does minimal research into its holdings and makes no judgements about sustainability. They pay for that insight from third-party providers, specifically MSCI, a large provider of indices and portfolio analysis tools.

The fund is very clear in its fund documents about how it selects assets for this fund. The index it tracks starts by mimicking the Agg. Then, where relevant, it applies MSCI’s screening and rating process to remove entities involved with “bad” industries like alcohol and tobacco, controversial weapons, and certain fossil fuels. It also sidesteps bond issuers with high controversy ratings, while overweighting companies who score well in MSCI’s ESG ratings.

The phrase “where relevant” is doing a lot of work here. ESG screens and ratings in this fund are only relevant to corporate bond issuers. Government bonds, government-backed bonds, and other kinds of asset-backed bonds either don’t get ESG ratings or the ones they receive aren’t used in this fund’s methodology. The vast majority of any fund that is following the Agg index will be made up of these government and asset-backed securities that are included with limited ESG thought.

So, while the entire fund is labeled “ESG,” the most recent prospectus shows that only around 30% of its holdings are “subject to the Index Provider’s optimization process” – which is a complicated way to say that ESG criteria are being applied. As a result, EAGG’s portfolio looks very similar to the Agg, with just a slightly higher ESG score. The MSCI ESG Quality Score for EAGG is 6.7, while the Agg scores at 6.2 (on a scale of 1-10).

With such little difference between EAGG and the Agg, it’s unsurprising that their performance and risk metrics are very similar as well. One place where there is a difference – it’s going to cost you about 0.07% (7 bps) more in fees to choose EAGG over a comparable fund that does not use the ESG filter.

EAGG is a reasonable choice for investors who want to dip their toes into ESG-themed fixed income funds. If you want to invest in bonds to lower your risk or diversify your portfolio, EAGG provides the performance and risk profile to suit your needs. And its ESG approach is legitimate, even if it is limited. Just set your expectations that this fund isn’t all-ESG approved throughout.

Check out EAGG’s fund profile card below where we provide an overview including historical returns, expenses and identify this fund’s ‘Fighting Styles’.