Small-Cap Stocks: Strategies for Finding the Next Big Winners

The three biggest winners of my career—Tucows TCX , B. Riley Financial RILY , and Luna Innovations LUNA — have one thing in common…

They were all small-cap stocks when I bought them. So, I always come back to small caps to hunt for extraordinary gains for my readers.

- Keep in mind, “small” does not necessarily mean high-risk.

Two-thirds of all US stocks are small caps, meaning their market caps are under $5 billion. So, it’s a big group. And yes, some of those companies are newer and riskier. But many small caps are well-established players — like Topgolf Callaway Brands MODG or Energizer Holdings ENR , which each have market caps just over $2 billion.

Energizer has been making batteries for over 100 years. Callaway has been selling golf clubs for 40 years. Both have solid track records, but they’re still 1,000+ times smaller than a company like Apple AAPL , which has a $2.7 trillion market cap.

- I focus on small caps simply because they have more room to grow.

That means more potential to deliver life-changing returns. A $100 million company could grow tenfold and turn into a $1 billion company. But it would still be small enough to explode much higher.

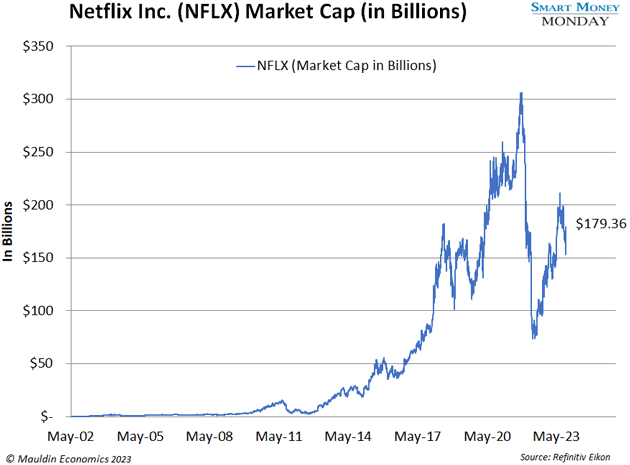

Netflix is a great example of this. The company went public in 2002, and it spent the next eight years as a small-cap stock, before peaking 4,650% higher.

Tesla TSLA had a similar trajectory. It spent three years as a small cap before surging around 5,900%.

Don’t get me wrong—most small caps won’t turn into the next Netflix or Tesla. But smaller companies often have more potential to deliver extraordinary returns.

Just think about a company that’s already huge, like Coca-Cola KO . Sure, it’s a great stock to own. But it has a $235 billion market cap, and its business is quite mature. So, the stock is unlikely to double in the next year, let alone blast off like Netflix or Tesla.

- Plus, fewer Wall Street analysts cover small caps, which gives you an advantage.

On average, only five analysts cover each small-cap stock, according to Capital Group. Large caps, on the other hand, are covered by an average of 19. And a company like Apple has dozens of analysts following it.

When fewer analysts cover a stock, you have better odds of finding a great opportunity before everyone else does and drives the stock higher. Only a handful of analysts covered Tesla when it went public. And today, over 40 do.

It’s no coincidence that three or fewer analysts cover most of the stocks I recommend. There are simply more opportunities in that niche for individual investors who can do the legwork of analyzing the stocks themselves (or know someone who can do it for them).

- And when I do that legwork on small caps, I look for four elements…

First, I look for companies without a lot of debt. This can be tricky since small caps often carry more debt than larger ones. And debt can cut both ways—it can magnify returns or wipe them out. But as a general rule, you want small caps with very little debt.

Second, I look for talented operators or investors. The best small caps often have insiders with serious skin in the game. As I mentioned in last week’s mailbag edition, I typically save my most lucrative investment opportunities for High Conviction Investor members. Many of these are smaller-cap, spinoff ideas—so, I encourage you to check out my premium advisory if you’re interested in these high-upside names.

Third, I look for cheap small caps. That means quality, undervalued companies that are “on sale” for one reason or another.

Maybe the stock is having a “Chipotle Moment,” where a great company trades at a discount because of a rare, temporary problem. Or maybe the market simply hasn’t caught on yet. Whatever the reason, you want to buy small caps that are cheap relative to the company’s earnings.

Finally, I look for growth potential. Maybe the underlying industry is growing, and the company is positioned to ride the wave higher. Or maybe it’s growing through shrewd deal-making—again, like the spinoff ideas you can find in High Conviction Investor.

As I’ve mentioned before, the only way to beat the market is by picking individual stocks with extraordinary upside. And small caps with these four elements going for them are one of the best places to look.