Cleveland Cliffs and US Steel: A Mega-Deal in the Making

As an investor, one of my favorite hunting grounds for stock ideas is deals.

I’ve written about merger arbitrage. It’s basically betting that Company A will successfully close on an acquisition of Company B. If it does, you capture a nice spread between the current price and the takeout price.

We’ve had good success here — with both Twitter and Activision ATVI .

Another one of my favorite deal setups is when Company A buys or sells something. The passive, algorithmic, robotic trading that happens rarely, in my experience, does a good job valuing the new company.

We’ve presented a handful of ideas like this in my High Conviction Investor letter.

The last deal setup I like is a merger. Company A merges with Company B. The new company realizes major synergies and begins generating substantially higher profits.

Last week, one such merger was announced. Or at least proposed.

And it’s without a doubt the most exciting merger I’ve followed in some time.

Talking About US Steel

Readers of Smart Money Monday know my take on iron ore and steel behemoth Cleveland-Cliffs CLF .

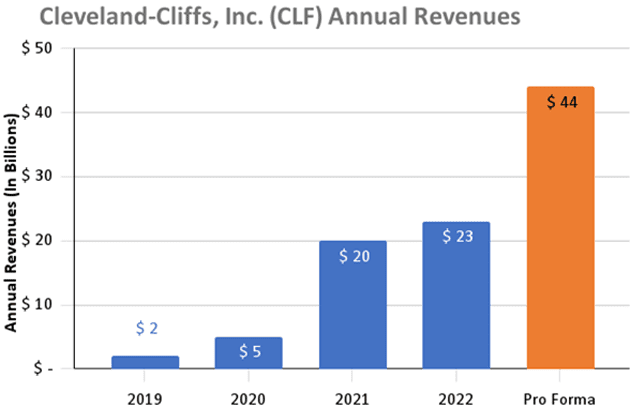

If you just looked at the numbers, you’d figure it was a high-growth tech company. Revenue has gone from $2 billion to $23 billion in just three years.

Source: CLF data

And yet, it’s not in tech. Not at all.

Cleveland-Cliffs makes and sells steel.

Its CEO and chairman, Lourenco Goncalves, is a legend in the making in the steel industry.

What Goncalves has managed to do with Cleveland-Cliffs is special. Again, $2 billion to $23 billion in revenue in just a few years. And adjusted EBITDA from $525 million to $3.2 billion over the same time frame.

Well, now he’s started what may be his final deal. And that’s his company’s—somewhat hostile—proposed acquisition of US Steel .

Last week, Cliffs proposed an acquisition for $35 per share, in a combination of cash and stock. The mix is essentially 50/50, with $17.50 in cash and 1.023 shares of CLF per US Steel share.

Goncalves took revenue from $2 billion to $23 billion. Buying US Steel would take the combined company revenue to $44 billion on a pro-forma basis. Plus, free cash flow would be a whopping $3.7 billion in a few years, after extracting some synergies.

It’s an incredible deal.

However, there are a few hurdles to overcome.

Willing Seller

The first hurdle is US Steel’s unwillingness to sell.

The board needs to approve the transaction… and so far, they’ve been claiming that Cleveland-Cliffs’ offer is “unreasonable” and that all options are on the table.

And options they have: Right after Cleveland-Cliffs’ proposal, Esmark, a privately held company, came out of the woodwork with an all-cash offer of $35 per share.

It looks good on the surface, but I’m skeptical of this offer. Esmark claims it has ~$10 billion in cash to get the deal done. I’m not so sure. The press release had zero mention of attorneys or bankers or advisors. Frankly, it seems kind of shady to me.

Next up is a rumor that Luxembourg-listed ArcelorMittal MT is interested in acquiring US Steel. That may be true, but there’s a deep irony to this. Just a few years ago, ArcelorMittal sold their US operations to… you guessed it! … Cleveland-Cliffs and Lourenco Goncalves.

So, they sold… and now want back in? That’s very odd. But stranger things have happened.

Regardless, US Steel is still exploring all options. I expect some news to come out soon. And if not, Cliffs will have to go hostile — that is, take the deal directly to US Steel shareholders.

The Unions

The biggest thing Cliffs has going in its favor is the ringing endorsement for the transaction from the United Steel Workers (USW) union.

They published an article in tandem with Goncalves’ proposal, stating their strong support for the deal.

Furthermore, USW has a clause in its contract with US Steel and Cleveland-Cliffs that allows the union to reject an acquisition. It gives them a ton of leverage — and they’re exerting it right now.

The union’s main concern is jobs. Typically, a merger results in job cuts. But when you look at Cliffs’ prior acquisitions, they actually added jobs. The results speak for themselves. Goncalves is not a slash-and-burn guy — and USW respects him for that.

The other angle that I suspect USW appreciates is global competition. The United States needs a national steel champion. Without it, there’s no place to go for the steel workers. They’ve been fighting the aggressive dumping from Chinese and other foreign steel companies for years. A combined US Steel and Cleveland-Cliffs could fend off this international threat.

USW supports the deal — a huge hurdle that Cliffs has already overcome.

And Then the Regulators

The final obstacle here is regulatory.

Will the feds allow Cleveland-Cliffs to acquire its largest competitor?

While it may seem counterintuitive, I think the answer is yes.

Here’s why.

- The steel market is a global market. Steel is sold all over the world. The US imported 30 million net tons of steel in 2022 and domestically produced around 90 million net tons. So, a big percentage of our steel is imported from overseas producers. Looking at the global market, a combined US Steel and Cleveland-Cliffs would barely crack the top 10 in terms of steel production.

- There are still two other large US players, albeit slightly different in how they make steel. That’s Nucor NUE and Steel Dynamics STLD . These companies produce steel with recycled material in electric arc furnaces versus the blast furnaces owned and operated by Cliffs and US Steel.

A combined US Steel and Cleveland-Cliffs would not be a monopoly — customers would have other sources to choose from.

What to Do

I like the potential Cliffs-US Steel tie-up. It makes a ton of sense. It creates a true US champion in steel manufacturing. And the synergies are substantial.

But the deal hasn’t been signed yet. It’s getting hostile, sadly. But common sense should prevail (I hope), and Cliffs should be able to execute its deal.

From here, I’d recommend continuing to own Cleveland-Cliffs. Even without a deal, the stock is cheap. They’re paying down debt with internally generated free cash flow. And with or without a deal, I suspect they will begin paying a steady dividend later this year.

I’m sure I’ll have more to say on this transaction. But for now, hang tight — and keep holding CLF.