What a Reopened China Means for Travel Sector, Luxury Brands

Over the holidays, thousands of Americans lived out a real-life version of Planes, Trains and Automobiles, the 1987 comedy that saw Steve Martin and John Candy trying to combat flight delays and cancellations and make it home in time for Thanksgiving dinner.

Unfortunately, many travelers didn’t experience the Hollywood ending they may have hoped for, with some families stranded in airports and others separated from their luggage.

The overwhelming majority of the recent delays and cancellations were the result of the unique flight network Southwest Airlines ( LUV ) employs. Unlike the other major carriers, which use a “hub-and-spoke” model that forces planes and crew to regroup at select hub airports, Southwest uses a “point-to-point” model.

In many cases, point-to-point lets passengers fly direct without the need to change planes. This is one of the many reasons why customers enjoy flying Southwest, myself included.

The problem with this model is that when extreme weather triggers delays and cancellations, as it did last week, planes, pilots and other crew members can find themselves scattered across the country. It becomes increasingly difficult for Southwest to marshal its troops, as it were, and the snowball grows in size.

Lawmakers and regulators have promised to investigate Southwest’s actions, and I think it’s safe to say we’ll see changes to Southwest’s scheduling system. That’s not necessarily a bad thing, especially if it helps improve the carrier’s already stellar customer service. Back in May, Southwest ranked first in customer satisfaction in the basic economy segment, according to J.D. Power.

China Opens Its Borders Just in Time for the Lunar New Year

Staying on the topic of commercial aviation, the big news last week is that the government of China has finally agreed to relax a key portion of its zero-Covid policies, among the world’s most restrictive. Starting January 8, travelers flying into the country will no longer be required to quarantine. China will also begin issuing new passports and travel permits to Hong Kong.

It’s been a long three years, and travel demand has built up to epic proportions. According to Trip.com, China’s biggest online travel agency, bookings for outbound flights jumped an incredible 254% the day after the announcement was made that quarantine requirements would be lifted. Top destinations included Singapore, South Korea, Hong Kong, Japan and Thailand.

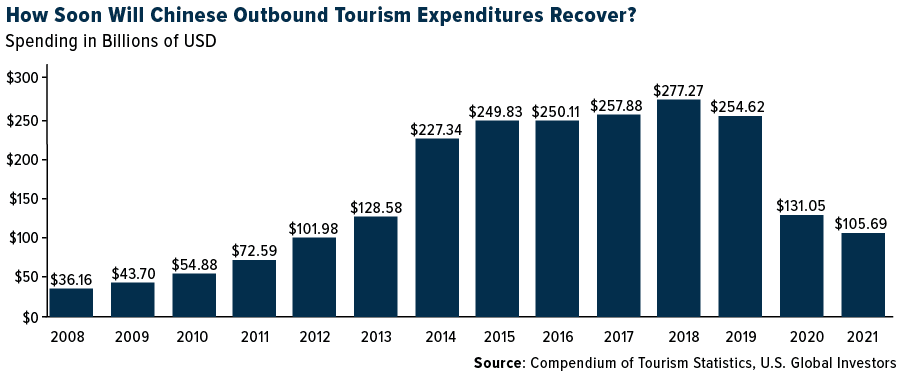

This is welcome news not just for Chinese travelers and airlines but also overseas retailers, particularly luxury goods retailers. The Chinese have historically been the world’s biggest spenders while traveling abroad, with expenditures topping $277 billion in 2018. This total fell to $105 billion by 2021, so I’m sure retailers will be rolling out the red carpet.

The Covid policy change was likely timed to give Chinese families a chance to book travel arrangements for the upcoming Lunar New Year, which starts January 22, 2023. In pre-pandemic years, this has been a time for people to travel abroad and visit family in what’s been called the largest annual human migration. In 2022’s Spring Festival travel rush, a little over 1 billion trips were believed to have been made, down from around 3 billion in pre-pandemic 2019.

China to Contribute 50% to Global Luxury Sales by 2030

Again, luxury retailers will be among the happiest to see the return of Chinese tourists, who have historically been the highest per-capita spenders on luxury goods. Chinese buyers often make most of their luxury purchases while in Europe, where they can shop tax-free using European rebates.

Over the past three years, European luxury retailers have had to rethink the shopping experience they offered, tailored in many ways to high-spending Chinese tourists. Many locations hired Mandarin-speaking staff, for instance, and prominently displayed products favored by Chinese travelers.

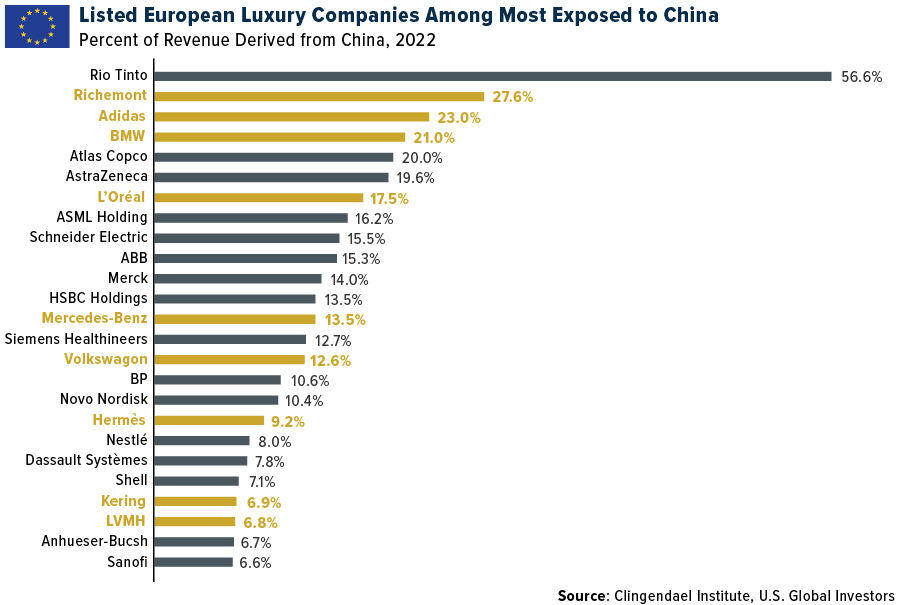

Take a look below. Of the 25 listed European companies with the greatest exposure to China, as many as nine could be classified as luxury goods makers. Switzerland-based Compagnie Financière Richemont ( CFRUY ), owner of Cartier, Piaget and other luxury brands, has the most exposure, with 27.6% of its revenues derived from China. This is followed by Adidas ( ADDYY ) at 23.0% of its revenues, and BMW ( BMWYY ) at 21.0%. LVMH (), the world’s biggest luxury conglomerate—its brands include Louis Vuitton, Christian Dior, Hennessy, Tiffany and Sephora—has relatively low exposure at 6.8% of revenues.

LVMH’s chief, Bernard Arnault, recently surpassed Elon Musk as the world’s richest man, valued at more than $164 billion. This marks the first time that a European topped the list of billionaires.

Some people believe that European companies should decrease their exposure to China for political reasons, but I don’t think luxury firms in particular have much of a choice. Consumers from the Asian country are forecast to become the world’s largest luxury market, accounting for roughly 40% of all sales globally by 2030, according to Bain & Company.