Twist Bioscience Raises $250 Million in Upsized Offering

Video source: YouTube, Twist Bioscience

Twist Bioscience TWST announced Friday the pricing of $250 million in gross proceeds from a follow-on offering of 4,545,454 shares of common stock at $55.00 per share.

The deal was increased in size from the planned $200 million, and the offering price represents a discount of 10.8% from Thursday's close of $61.64.

The company has a proprietary semiconductor-based synthetic DNA manufacturing process using a high-throughput silicon platform that enables Twist Bioscience to miniaturize the chemistry necessary for DNA synthesis.

This miniaturization enables the reduction of reaction volumes by a factor of 1,000,000, while increasing throughput by a factor of 1,000.

Twist Bioscience can synthesize 9,600 genes on a single silicon chip. Compare that to traditional DNA synthesis methods which can produce just a single gene in the same physical space.

Investment Thesis

Twist Bioscience went public in 2018, raising $70 million at a post-IPO valuation of $373 million at $14 per share. The stock breached $160 per share in January 2021 but has since lost over 60% of its value.

Even at the current depressed valuation, the company has increased its market valuation by a factor of 10 in a little over three years as a public company, and the demand for its broad platform of services continues to grow.

We think the most recent selloff since November 2021 is vastly overdone, and the stock appears to have found its footing off the January 2022 low.

-

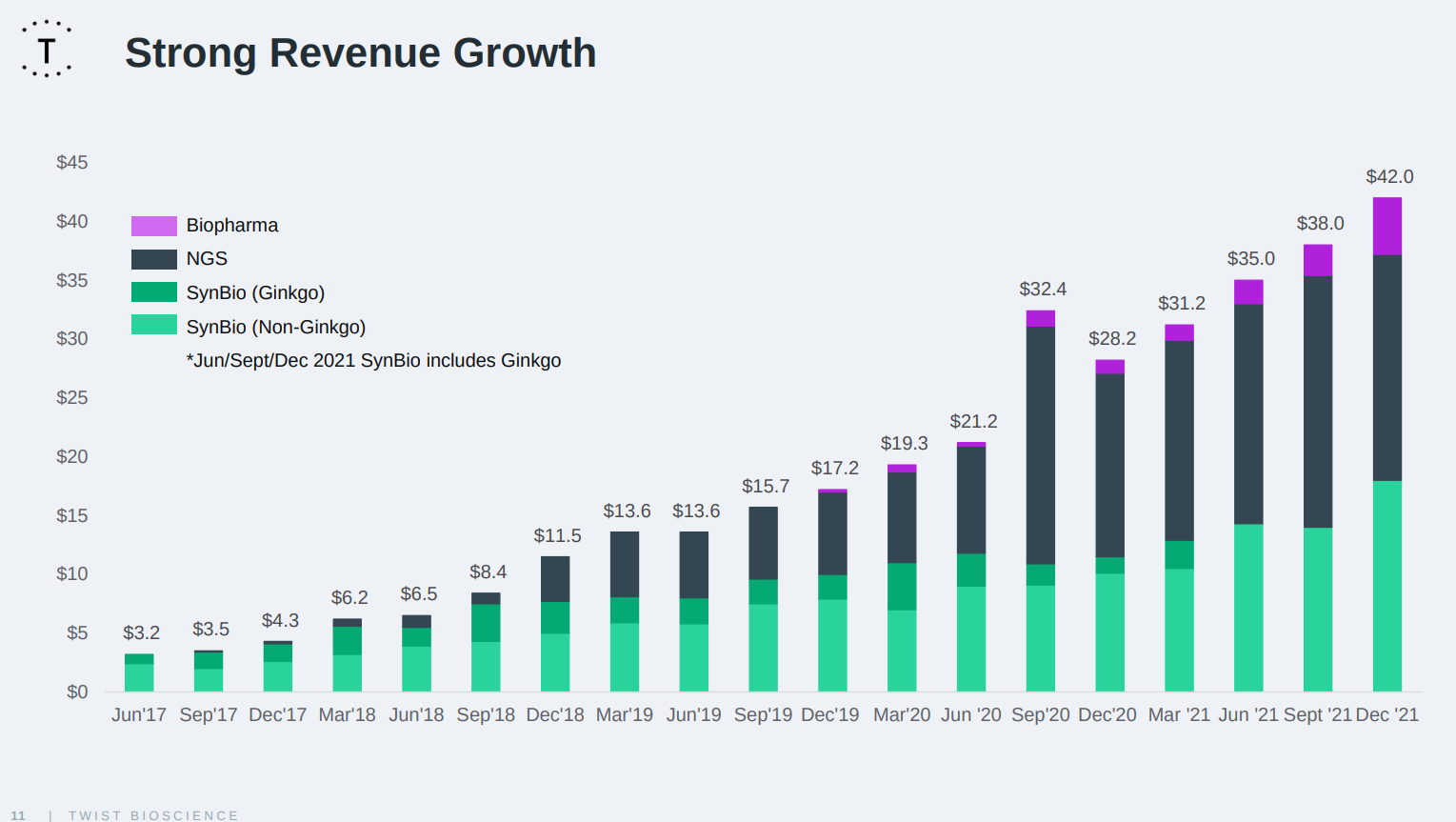

Strong track record of revenue growth.

- $146 million in 2021

- Company has guided the street to a range of $189 million to $198 million in 2022

- With gross margins of 35% to 37%

- Proprietry platform for writing DNA on silicon

- Large, growing markets

- Portfolio of high growth businesses

- Consistent track record of scientific innovation

_____

Source: Equities News