Saturday will be the 100th day of Trump’s presidency. Were these days positive for the gold market?

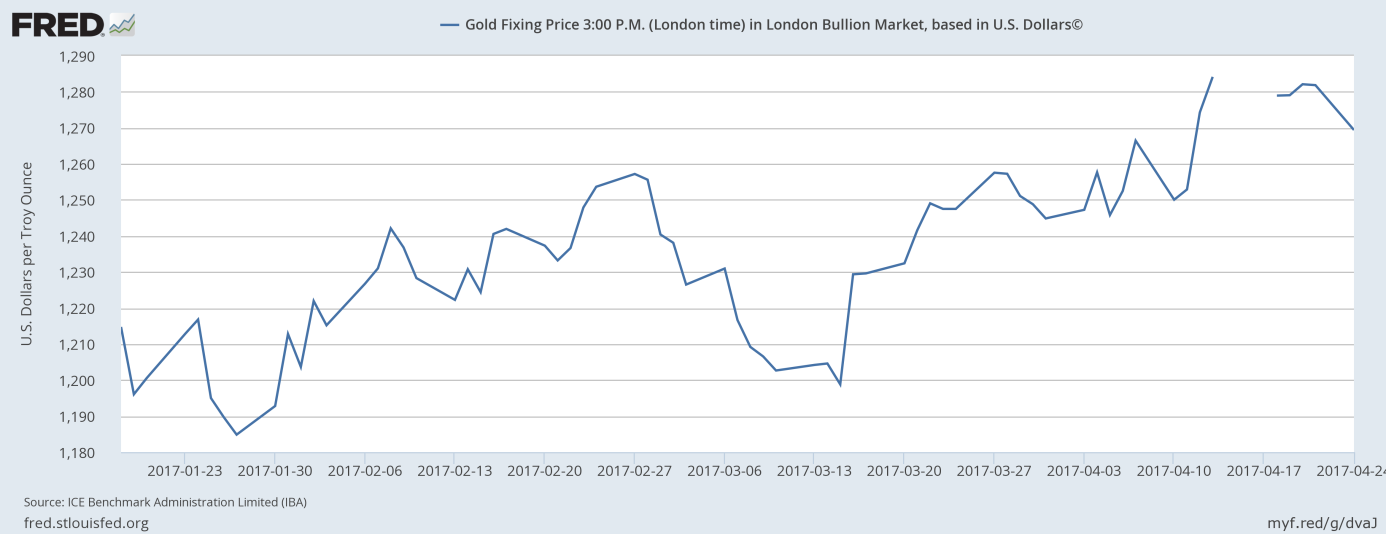

Well, that passed quickly. And the world has not collapsed, what a relief! But jokes aside, it’s been an eventful few months since the election, especially for precious metals. As one can see in the chart below, the price of gold gained about 5.6 percent over the first 100 days of Trump’s presidency.

Chart 1: The price of gold between Inauguration Day and April 24.

For sure, the waning expectations of a quick implementation of Trump’s pro-growth agenda and the uncertainty about Trump’s policies were important bullish drivers for gold prices. Indeed, the investors’ interest in gold has grown significantly since Trump’s inauguration. The comments from the new administration about the allegedly too strong U.S. dollar were also supportive for the yellow metal. Not to mention the recent Trump’s actions related to Syria and North Korea. However, gold’s performance shouldn’t be attributed entirely to Trump. Gold has been also sensitive to the Fed’s action and the broad macroeconomic outlook.

What can learn from these 100 days in the context of the gold market? Well, Trump has not fulfilled most of his promises. Surely, he nominated a Supreme Court justice, abandoned the TPP trade agreement and cancelled many of Obama’s regulations. However, he failed to repeal and replace Obamacare. And he actually reversed his stance on many issues – for example, he does not want to call China a ‘currency manipulator’ any longer (at least, until the next tweet). Hence, the key lesson is that Trump is inconsistent and often changes his mind – this is good for gold, as markets do not like surprises and unpredictability. On the other hand, it seems that the POTUS has softened his rhetoric on China and foreign trade, which reduces some uncertainty related to his presidency. And this is bad for the yellow metal. Anyway, perhaps the most important thing is that emotions about Trump’s presidency have been subsidizing, as the investors realize that he will not destroy, nor magically revive the U.S. economy. Hence, if the investors start to take him a little less seriously, the gold trade could become more about macroeconomics rather than politics. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview