The Quest for ‘Lost Cities’ Is Yielding Mineral Riches

Source: Streetwise Reports 11/19/2020

Aurania Resources’ large land package in Ecuador has never been explored with modern methods.

Historians know that there were seven Spanish colonial era gold mines in present-day Ecuador, but only five of them have been located. Dr. Keith Barron, chairman and CEO of Aurania Resources Ltd. (

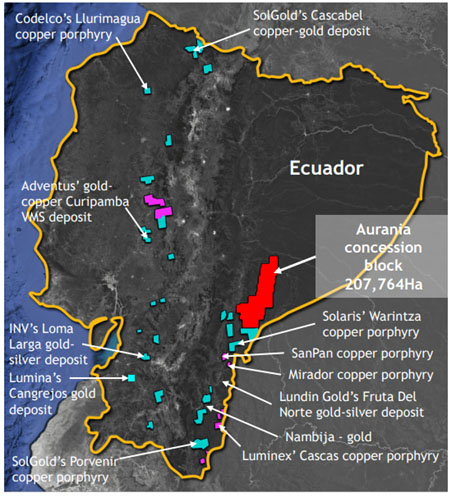

Aurania staked a large swath of land in Ecuador, a concession block 90 kilometers long and 10 to 20 kilometers wide, more than 207,000 hectares in total.

“We selected the areas that we thought were likely to contain the Lost Cities,” Dr. Keith Barron told Streetwise Reports, “but we haven’t found them yet. But we found a tremendous amount of other stuff. We’ve got 31 copper porphyry targets, 20 gold-silver epithermal-type targets, and a silver-lead-zinc mantos target?Tiria-Shimpia?that extends for 15 kilometers. Plus we’ve got a really remarkable copper and silver sediment on surface that extends for 23 kilometers. So we’ve got a real treasure box of riches.”

Aurania has been working for four years to delineate the property via mapping, sampling, soil sampling, and geochemical and geophysical surveys and has now begun to drill. Scout drilling on the Tsenken N2 copper-silver target commenced in September. The company airlifted a man-portable drill rig that has the ability to drill to 800 meters.

“The objective of ‘scout drilling’ a limited number of holes per target is to achieve discovery in a minimal amount of time, knowing that an eventual full investigation of all the targets will take substantial time and resources,” Dr. Barron explained.

In early November, Aurania reported that the Tsenken N2 drilling revealed “mineral alteration zoning typical of an iron oxide copper-gold (IOCG) system.” Dr. Barron said, “Our aim in the Tsenken North area is to define the large-scale mineral zoning so that we can home in on the core of the system where any copper-gold would be concentrated.” The company plans to undertake a Mobile Magnetotellurics (MMT) survey shortly.

Since the interview, Aurania has stated that native copper or chalcopyrite (copper sulfide) has been found in four of the first five drill holes at Tsenken N2 and N3.

At another area, Aurania announced in late September that soil sampling at Tiria-Shimpia has extended the areas of silver enrichment in soil there. “Soil sampling at the Tiria-Shimpia target has defined a large mineralized system that covers an area 75 square kilometers in extent?and is still open along trend?on the margin of a large, intensely magnetic feature that is interpreted to be a porphyry cluster,” the company reported.

Rock chip samples from boulders at Tiria-Shimpia sported grades as high as 710 grams per tonne (g/t) silver and 48% zinc, while outcrop samples returned grades as high as 356 g/t silver, 12.7% zinc and 11% lead.

These areas are just the tip of the iceberg on Aurania’s massive property. “We have many, many more targets that we have outlined to drill over the next six months or so,” Dr. Barron said. Part of the decision of where to drill will be guided by Covid precautions and protocols.

International interest in mining in Ecuador is heating up. “We’re on the continuation of the belt that goes from Fruta del Norte to the north, and 15 kilometers to the south of our southern boundary, Solaris Resources has just drilled a porphyry called Warintza and came up with a 1,010 meter intersection of high-grade copper. And so they now have a market cap of half a billion dollars. It came out of nowhere,” Dr. Barron noted.

Further south at the other end of the belt near the border with Peru, “SolGold just reported a 600-meter intersection of high-grade copper at a project called Porvenir; that’s looking really, really interesting,” Dr. Barron said. “And Fruta del Norte, which is the deposit that my former company found, unfortunately, I don’t own anymore, last quarter produced 94,000 ounces of gold for Lundin Gold, and it is already considering an expansion even though the mine only has been open since last November. So for the first time, we’re starting to get institutions looking at this area.”

BHP Billiton, Anglo-American and Newcrest are all active in Ecuador. “All the big boys are lining up and Ecuador is kind of the flavor of the month right now,” Dr. Barron said.

“Because this land package is so darn big, with four different types of targets and many different metals, our strategy is to JV with different companies over different metals, JV one area to a copper producer, another to a silver producer. That would be a good scenario for our shareholders. We’re the only ones with a big contiguous land package like this in the whole country,” Dr. Barron said.

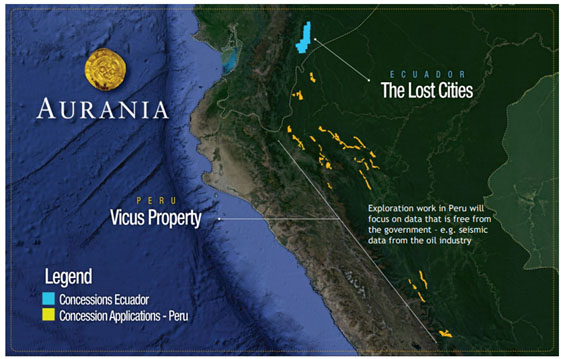

Aurania has also filed to stake 400,000 hectares in northern Peru. “We followed the copper bearing sequence to the Peru border and have selected the same age and types of rocks across the border in Peru,” Dr. Barron explained. “One junior already there has found copper and we decided to fill in the blanks between where they are and the border. After we did that, Barrick Gold ring-staked two of our packages.”

At the end of October, Aurania closed a CA$11.5 million public offering and currently has about CA$13 million in the treasury. The company has approximately 44 million shares outstanding, and approximately 50 million fully diluted. Insiders hold approximately 45% of all outstanding shares, of which the majority is held by Dr. Barron, who put up much of the early capital into the company. Dr. Barron doesn’t draw a salary and considers himself perfectly aligned with other shareholders.

Noble Capital Markets covers Aurania Resources and on November 5, analyst Mark Reichman wrote, “Aurania’s exploration program has affirmed the rich mineral potential of the Lost Cities project and yielded drilling targets for a variety of metals. The recent financing provides financial flexibility to pursue high priority targets which offer significant potential for discovery. We think the company’s drilling program will be closely monitored and could provide catalysts for the stock assuming favorable outcomes.” Noble has an Outperform rating and CA$4.00 target price on Aurania. The stock is currently trading at around CA$3.50.

Read what other experts are saying about:

- Aurania Resources Ltd.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Aurania Resources. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Additional disclosures:

Disclosures for Noble Capital Markets, Aurania Resources, November 5, 2020

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

The Company in this report is a participant in the Company Sponsored Research Program (“CSRP”); Noble receives compensation from the Company for such participation. No part of the CSRP compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed by the analyst in this research report.

Noble has arranged non-deal roadshow(s) with investors in the last 12 months.

Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) within the next 3 months.

Noble is not a market maker in the Company.

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Senior Equity Analyst focusing on Basic Materials & Mining. 20 years of experience in equity research. BA in Business Administration from Westminster College. MBA with a Finance concentration from the University of Missouri. MA in International Affairs from Washington University in St. Louis. Named WSJ ‘Best on the Street’ Analyst and Forbes/StarMine’s “Best Brokerage Analyst.” FINRA licenses 7, 24, 63, 87.

( Companies Mentioned:

)