The Great Labor Dilemma — How It Began and Where We Are Now

By Tradier Inc.

October 29, 2021

•3 min read

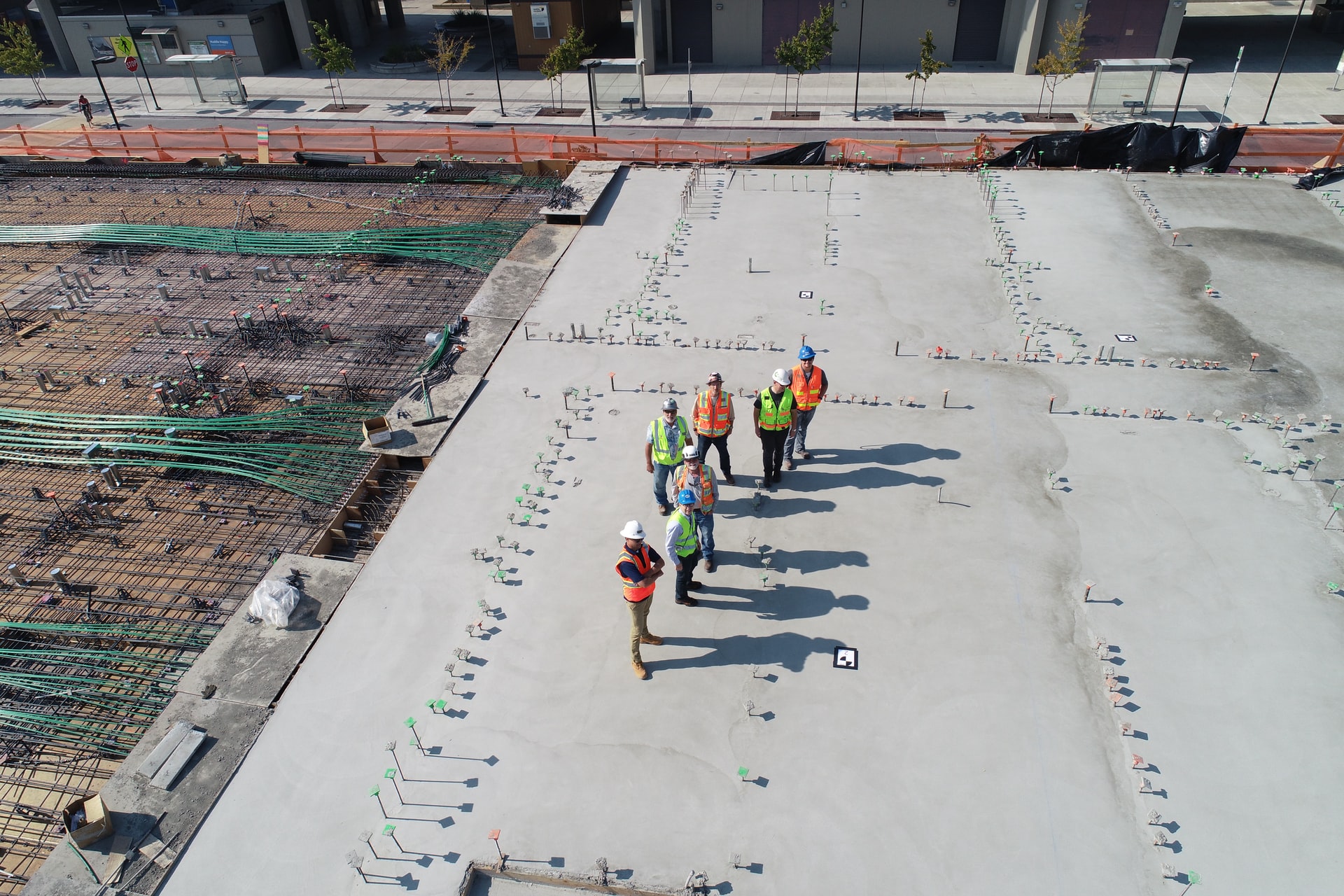

Image source: Scott Baker / Unsplash

In September, the US economy added 194,000 jobs, far below consensus analyst expectations of 500,000 jobs. The unemployment rate moved lower to 4.8% from 5.2% in August. Ironically, there are plenty of jobs available for workers, but companies across all sectors report challenging conditions for attracting workers.

The pandemic’s impact continues in the labor force

- Demand for workers is rising as economies reopen.

- Many workers are leaving the workforce. The “quits scale” rose to 4.3 million in August, a record high.

- The sectors most affected have been accommodation and food services, wholesale trade, and state and local government education.

It’s not just a US issue

- Employment shortages are not limited to the US.

- Brexit has exacerbated the UK labor force shortages as foreign workers have departed.

- Furlough schemes in the Eurozone have caused many workers to exit the labor market.

Impacting the supply chain

- The lack of sufficient workers affects the global supply chain with rising prices and demand for goods.

- The employment shortage has led to shorter hours and doing more with fewer employees for many retail and service businesses.

- A truck driver shortage increases the time for companies to bring their goods to markets.

Lots of job vacancies but filling them is a challenge

- There were 10.4 million unfilled job openings in August.

- Aging and retiring workers are not returning to the workforce in the aftermath of the pandemic.

- Border controls and immigration limits curtail the number of available workers.

- Demands for higher pay and flexible working arrangements are limiting the number of workers.

- Government subsidies and stimulus disbursements made staying home the same as working for lower-paid workers during the pandemic.

Wages will need to rise – More inflationary pressures

- Inflation has been increasing. The latest September CPI data rose 0.4%, pushing the year-over-year gain to 5.4%.

- Energy prices are soaring. Energy is a critical cost of goods sold input for all businesses.

- Rising wages will put upward pressure on inflation as companies pass along increased costs to consumers.

- Inflationary pressures will eventually lead to higher interest rates. Rising wages will weigh on corporate earnings.

The dilemma’s bottom line

- We could begin to see earnings pressure in the retail and restaurant sectors.

- Workers need to earn more to pay for essentials as inflation continues to rise.

- Inflation can become a vicious circle. Rising prices are the same as deteriorating currency values. The labor market shortage is another reason why inflationary pressure may not be all that “transitory.”

- Last weekend, Square’s (SQ) Jack Dorsey warned of impending hyperinflation, saying, “It will happen in the US soon, and so the world.”

Thanks for reading, and stay tuned for the next edition of the Tradier Rundown!

Click Here to see why active traders use Tradier Inc.

_____

Equities News Contributor: Tradier Inc

Source: Equities News

Trending Now

3

Investing Strategies

5

Investing Strategies

Read Next

Economic

Graduation rates for low-income students lag while their loan debt soars

The Conversation

Apr 18, 2024

Social

$30 trillion in U.S. wealth will transfer to younger women in the next 10 years

Steve Kerch

Apr 18, 2024

Private Investments

The Impact: Focusing private wealth on impact investing

Jeff Gitterman

Apr 17, 2024

Environment

Corporate climate plans are improving, but still ‘critically insufficient’

Grist

Apr 17, 2024

Education

Personalized cancer therapy can lead to faster treatments, better outcomes

The Conversation

Apr 16, 2024

Economic

GreenMoney: Investing in the future of water and sanitation

Green Money

Apr 16, 2024

The Latest

Economic

Graduation rates for low-income students lag while their loan debt soars

Apr 18, 2024

Social

$30 trillion in U.S. wealth will transfer to younger women in the next 10 years

Apr 18, 2024

Private Investments

The Impact: Focusing private wealth on impact investing

Apr 17, 2024

Environment

Corporate climate plans are improving, but still ‘critically insufficient’

Apr 17, 2024