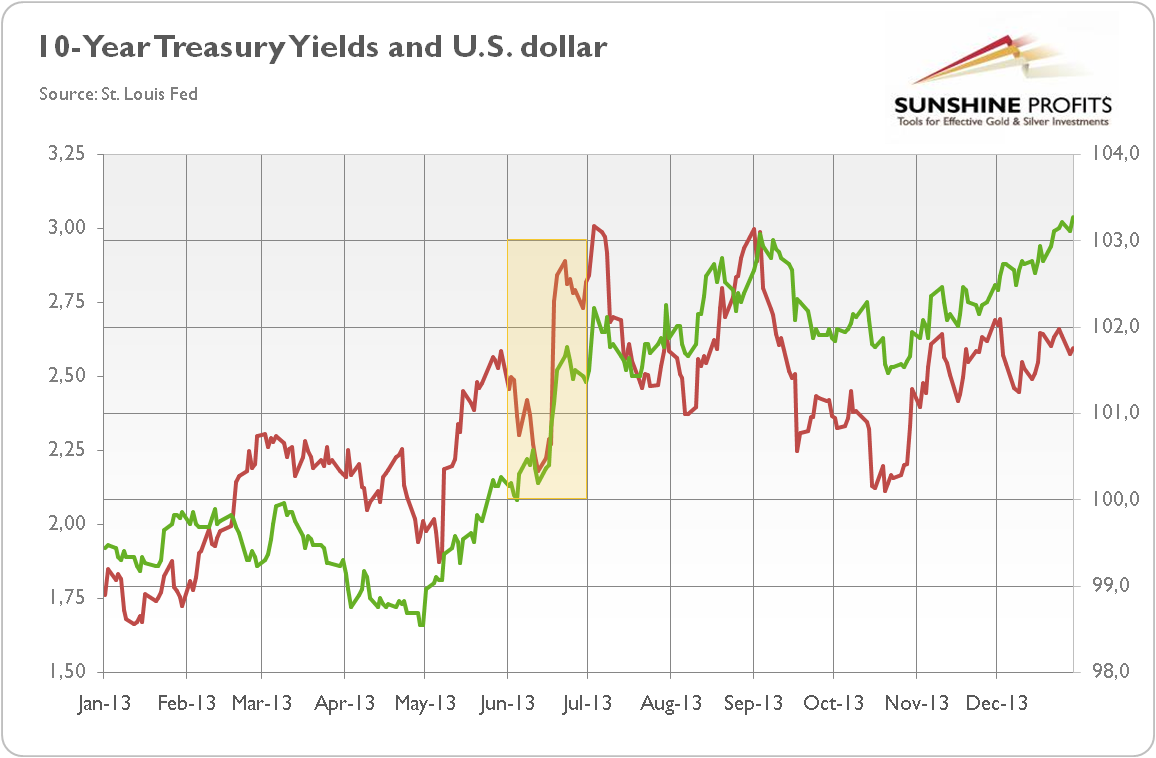

Chart 1: U.S. 10-Year Treasury Yields (green line, left axis) and the U.S. dollar’s strength (red line, right axis, a weighted broad U.S. dollar index) in 2013.

What happened? Well, Ben Bernanke announced that the Fed would gradually reduce the pace of asset purchases – the so-called tapering – and eventually it would end its quantitative easing program. He said:

If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear.

And then the global panic ensued. Investors feared that the economy will not stand on its own feet, with the reduced support from the U.S. central bank. The panic that broke out is called “taper tantrum”, as tapering, i.e., slowly reducing the amount of money the Fed puts into the economy, upset investors, who worried about the effects of a reduced monetary stimulus.

Taper Tantrum and Gold

How gold reacted to taper tantrum? As one can see in the next chart, the price of the yellow metal plunged after Bernanke’s press conference.

Chart 2: Gold prices (London P.M. Fix, in $) in 2013.

Why? Well, higher interest rates and stronger U.S. dollar dragged the gold prices down. Investors could be nervous about the effects, but generally traders took the Fed’s faith in recovery as a good omen. They also welcomed the gradual approach to the tightening of monetary policy.

Taper tantrum did not last long, but it forced the Fed to adopt even more gradual approach. And each time the Fed tightens its monetary policy, there are some fears about the replay of taper tantrum, especially in emerging markets, which were substantially hit by the higher yields, stronger greenback, and capital outflows.

We encourage you to learn more about the gold market – not only about the link between taper tantrum and the yellow metal, but also how to successfully use gold as an investment and how to profitably trade it. Great way to start is to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!