Gold is usually weak during the summer and it can create great times to enter the market at relatively lower prices, but this rule is far from being set in stone. In fact, summer doldrums is actually just a fancy name for seasonality. Giving it an additional name doesn’t make it more important.

The key thing about seasonality (based on our extensive research) is that it’s particularly useful when there is no strong trend or any other strong indications. In other words, seasonality is a gentle force that sets the overall tone for the trading patterns, but is unlikely to overcome other substantial market forces.

For instance, seasonality can be compared to average waves on a medium-sized lake and a strong up- or downtrend can be compared to a big wave generated by a speeding motorboat.

Here’s a real-life example: based on the last 30 years or so, gold has – on average – not done anything during April. It was the most boring month of the entire year. And yet, in 2013, we saw a $200+ decline in gold in just a few days – and it happened in April. Why didn’t seasonals prevent this? Because that’s not how they work.

Seasonality is the background force that is going to lead the prices if nothing else interferes. The problem with trading using seasonality is that it is quite rarely the case when nothing really happens and there are no strong indications for a move up or down.

Summer Doldrums in Gold and Silver

Gold and silver are no exception from the above rule as its price is driven by multiple factors of both: fundamental and technical nature. The fundamental factors drive gold prices and silver prices in the very long term, while technical factors play a more important role over the medium- and short terms. The seasonality will not interfere with the big, fundamentally-driven trends, and it can change the technical trends only to some extent. If there are strong indications that silver and gold are going to move higher or lower, the seasonality is not likely to change it.

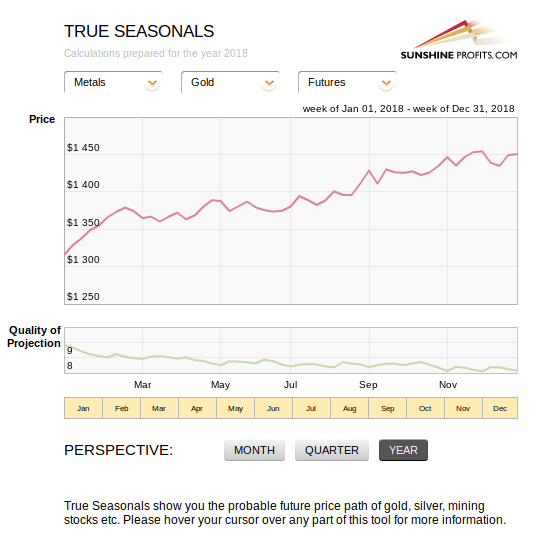

Let’s get back to the idea of summer doldrums in the precious metals market. Some people even go as far as to say “Sell in May and go away!”, suggesting to get out of the market in May and not come back until September. But is this really the case? Can one boil seasonality down to such a convenient sound bite? We have actually checked this for our investors. Take a look at the chart below displaying the annual seasonality of gold.

There’s a lot to process here but please, bear with us for a second. The most important part is the largest one with the red line reflecting the projected price of gold. This line shows how the price of gold has behaved on average throughout the year. In other words, it shows the seasonal tendencies of gold from an annual perspective. A short glance at this chart actually shows that there in fact seems to be some stagnation in May. So, preliminary analysis suggests that we can’t simply discard the notion of summer doldrums right off the bat.

If you are wondering, the above chart comes from one of our tools, True Seasonals. Using this tool, you can analyze not only gold but also silver, mining stocks and indices. If you are curious about a specific part of the year, you can use the tool to zoom in on a given quarter or even month. The tool also gives you a measure of the reliability of its projections. The green line shows the value of Quality of Projection – our internal measure designed to show you whether the indications of True Seasonals are strong or only optional.

Of course, seasonality is only one of the aspects of the precious metals market. At times, other factors can trump the influence of seasonal trends. A prominent example is the period following the 2011 top, when the market was tense precisely at the time of the summer doldrums. It is crucial to combine seasonality with other signals, like the ones we provide in our Gold & Silver Trading Alerts.

So, seasonality is not completely useless. Conversely, it’s quite useful, but one needs to be aware of the fact that it’s not the all-knowing crystal ball, but a tools that is most useful as a confirmation. If many techniques point to the same price move in the near term, and the seasonality confirms it, one might want to open a speculative position. But, if the seasonality points to something entirely different and these other techniques are not particularly strong, one might want to pass on this particular trade.

We hope you enjoyed the above definition. If you’d like to learn more about gold trading and see how we apply seasonal analysis to the precious metals market, we encourage you to sign up to our gold newsletter. It’s free and if you don’t like it, you can unsubscribe anytime. Sign up today.