Strong ADP Employment, ISM Manufacturing and Gold

This week was full of important data. How can the recent economic reports affect the gold market?

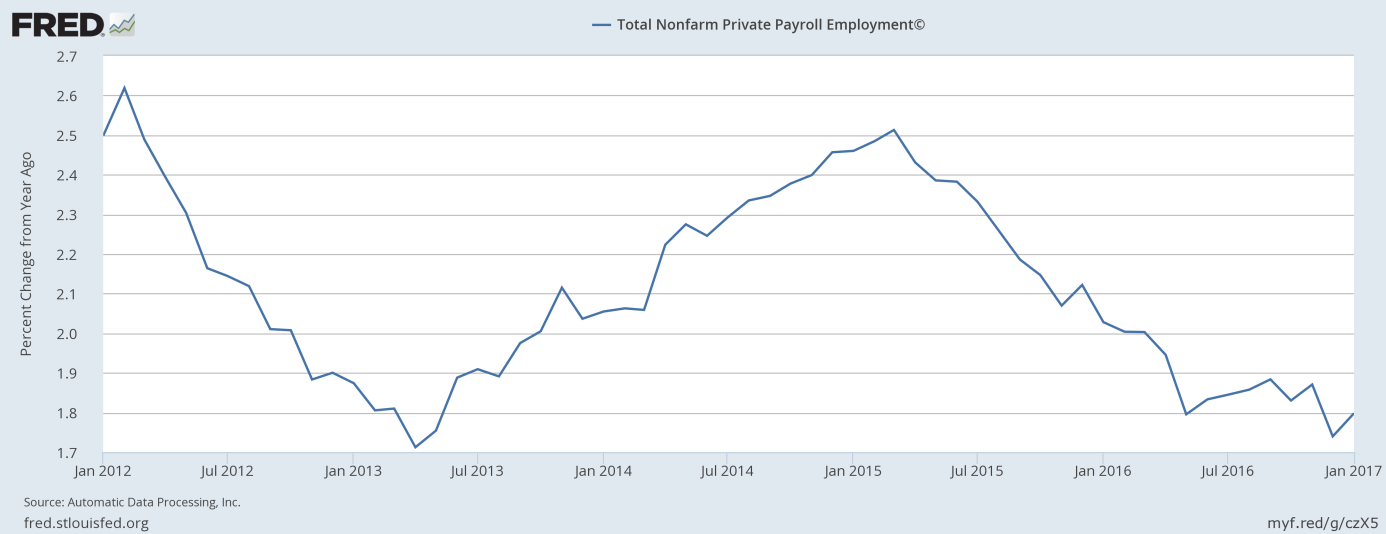

Let’s start with the ADP. The U.S. private sector added 246,000 jobs, well above expectations of 168,000 and much more than 153,000 in December. Actually, it was the fastest pace of job growth since June. One month does not tell us much, but the strong January number may signal some acceleration in the U.S. labor market. Indeed, there was a reversal in the slowdown in the annual pace of employment growth, as one see in the chart below.

Chart 1: Total nonfarm private payroll employment as percent change (year-over-year), January 2012 to January 2017.

We will know more after today’s release from the government. If the non-farm payrolls are similarly strong, it will strengthen the narrative that the U.S. economy is accelerating further, which should be detrimental to the gold market.

Let’s move on to the ISM Manufacturing Index, which climbed to 56 percent in January from 54.5 percent in December. It means that American manufacturers grew at the fastest pace since the end of 2014. Moreover, the Markit U.S. Manufacturing PMI also showed the strongest growth in almost two years – the index increased from 54.3 in December to 55.0 in January, signaling a strong start to 2017.

Summing up, the recent U.S. economic reports signal that the economy is accelerating. The manufacturing sector has started the year with strong momentum, while the labor market strengthened further. The brightened outlook should be negative for the yellow metal. Gold is supported now by Trump’s aggressive approach to international relations. However, if he eases his stance and focuses on pro-growth policies, gold prices may fell. The important Employment Situation report is due today, which may affect the price of gold. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview