Image source: Squarespace

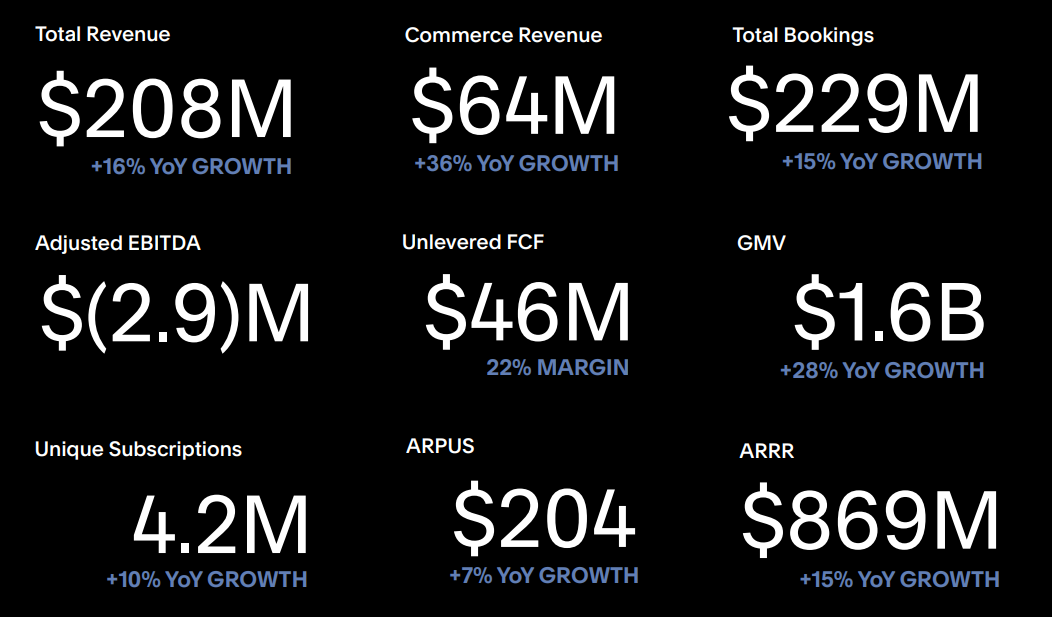

Squarespace ( SQSP ) posted record first quarter revenues on Thursday, with $207.8 million, up 16% over the same period last year. The street was looking for $204.7 million.

The website design and hosting company raised guidance slightly for the full year to a range of $867 million to $879 million, up $5 million at the bottom end of the range from previous guidance.

On the earnings conference call, CFO Marcela Martin, who's leaving the company at the end of July to become president of Buzzfeed ( BZFD ), said, "We reiterate our expectations for 2023 and 2024 with regards to revenue growth into the mid to high teens, crossing the $1 billion mark in revenues in 2023."

"We are quite pleased with our first quarter results, which exceeded our guidance in multiple ways," said founder and CEO Anthony Casalena on the call.

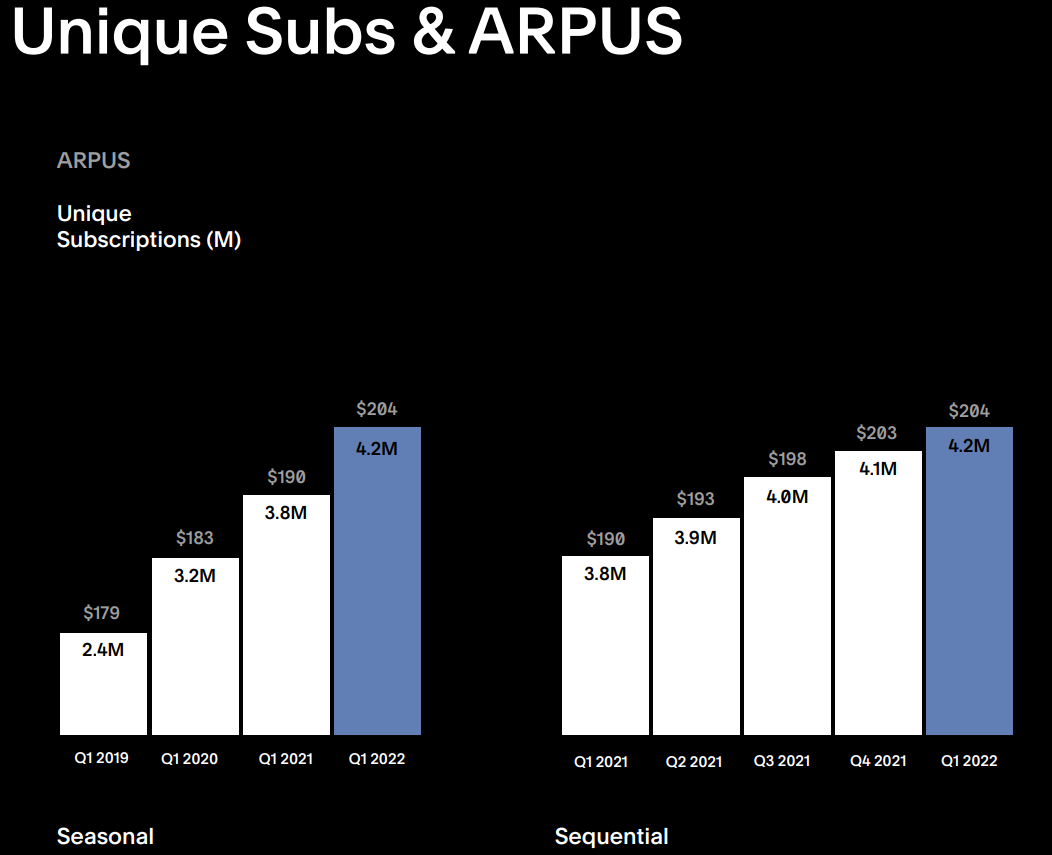

"We currently support 4.2 million unique subscriptions across our product categories," continued Casalena, "representing significant traction among the audience of entrepreneurs and creators we provide tools for."

Image source: Squarespace

Investment thesis

Squarespace went public a year ago in May 2021, via direct listing on the NYSE at a market valuation of about $7 billion. While the company saved money on investment banking fees, one could argue that it didn't do itself any favors by avoiding the traditional IPO process of bookbuilding and raising capital to assess institutional demand.

The stock peaked in June 2021 at $64.71, but had declined 78% through Wednesday's close of $14.44. Shares popped on Thursday after the quarterly report to close at $21.44, for a market cap of about $2 billion.

While we think that Thursday's pop was overdone and would expect a short-term pullback, we find the long-term prospects of the company to be attractive:

- Company's addressable market is very large. Company estimates put the "creator economy" at $100 billion.

- Positive trends in revenue and subscriber growth

- Strong free cash flow of $46 million in Q1

- CEO Casalena noted on the conference call, "One highlight coming up this summer I'd like to tease are some fundamental enhancements to our core content management system or CMS which will enhance Squarespace's core usability and expressability to a wide range of users. We'll be talking about that over the next few weeks. As always, we continue to operate Squarespace by balancing our strong cash flow with sustainable growth."

- Concurrent with the Q1 report, Squarespace announced a $200 million share repurchase program.

- The 4,2 million subscriptions represent 10% year-over-year growth, and the average revenue per unique subscription rose to $204.

We note, of course, that the company has a long road before it's profitable, and we'll be watching for who steps in as the new CFO, but on balance we have reasons for optimism.

_____

Source: Equities News