The idea of summer doldrums stands out. It ties the changes in the activity of investors to the fluctuations in the silver market. The notion could be summarized in the following way. People generally tend to relax more during the summer. School is out, the weather encourages outdoor activities, and so this is the period when people typically plan their holidays. And when silver investors and traders go on holidays, they do not always keep track of the market as much as during the other seasons and might not trade as frequently.

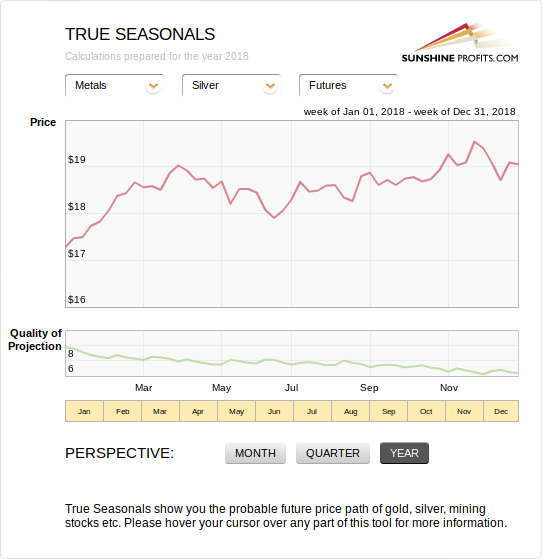

This would in turn mean that, overall, there is less trading in the silver market and, because of that, prices do not swing as vigorously. In consequence, the silver market would become less volatile. Some people even go as far as to say “Sell in May and go away!”, suggesting to get out of the market in May and not come back until September as nothing interesting is supposed to happen in the meanwhile. But is this really the case? Can one boil seasonality down to such a simple approach? We have actually checked this for you. Take a look at the chart below displaying the annual seasonality of silver.

There’s a lot to take in here but please, bear with us for a second. The most important part is the largest one with the red line reflecting the projected price of silver. This line shows how the price of silver has behaved on average throughout the year. In other words, it shows the seasonal tendencies of silver from an annual perspective. A short glance at this chart actually shows that there in fact seems to be some depreciation in May. So, preliminary analysis suggests that we can’t simply discard the notion of summer doldrums right off the bat. At the same time, you see that “Sell in May and go away!” is not the whole story as May is, on average, the month when the declines culminate, not when they start.

If you are wondering, the above chart comes from one of our tools, True Seasonals. Using this tool, you can analyze not only silver but also gold, mining stocks and indices. If you are curious about a specific part of the year, you can use the tool to zoom in on a given quarter or even month. The tool also gives you a measure of the reliability of its projections. The green line shows the value of Quality of Projection – our internal measure designed to show you whether the indications of True Seasonals are strong or only optional.

Hang on a sec, surely there’s more that influences the price of silver than only the part of the year we are in? You would be right to ask that question. Some precious metals investors and traders have been mystified by the trading activity around the expiration of futures and options. In particular, silver has been numerously singled out as the metal to observe in the days right before the expiration dates of derivatives. These dates do not always fall on the same day of the month and are typically not considered in seasonality analyses. Luckily, we have worked to include this factor in True Seasonals. So, when you are peering over the charts of True Seasonals, the influence of the expiration of derivatives is automatically taken into account for your convenience. And you can choose whether you would like to focus on the influence of precious metals futures, precious metals options or, maybe, stock options.

Of course, seasonality is only one of the aspects of the precious metals market. At times, other factors can trump the influence of seasonal trends. A prominent example are the months after the April 2011 top, when the market was extremely tense precisely at the time of the summer doldrums. It is crucial to combine seasonality with other signals, like the ones we provide in our Gold & Silver Trading Alerts.

Whenever you feel like you want to dig deeper into seasonality and look at specific parts of the year for a wide array of assets, check out True Seasonals. You can analyze the market thanks to more detailed charts which we update for you.

We encourage you to learn more about the precious metals market – not only about silver seasonality, but also how to successfully use gold as an investment and how to profitably trade it. A great way to start is to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!