Market manipulation, also called price manipulation, can be defined broadly as a purposeful effort to control prices. This sort of manipulation exists in financial markets as traders try to influence the markets. It may be responsible for some short-term aberrations in asset prices, including the price of silver. However, there is another, more specific definition. According to the Securities and Exchange Commission, manipulation is intentional conduct designed to deceive investors by controlling or artificially affecting the market for a security… This includes rigging quotes, prices or trades to create a false or deceptive picture of the demand for an asset. A popular belief within the precious metals investing community is that gold is manipulated and the same goes for silver (generally downwards, in what is described as price suppression).

Are Silver Prices Manipulated?

More specifically, many silver investors believe that the market for silver is systematically manipulated. There are many variations of this theory: some say that precious metals are under the thumb of central bankers, while others blame big banks and their use of derivatives (‘naked’ shorts) and high-frequency trading for the declines in the price of silver. There are also worries about the discrepancy between paper silver and physical silver, the fairness of London trading, declining inventories at Comex and the leasing of silver. At first glance, this theory makes sense, especially that the silver market is much smaller than the gold market, so it is easier to influence it, while a few financial institutions have already been fined for influencing or manipulating silver prices.

Moreover, it is commonly known that in the 1960s the U.S. government kept the price of silver frozen at $1.29 per ounce. Additionally, in the 1970s, the Hunt brothers for some time attempted to corner the market in silver (whether they purposely intended to manipulate the market or not, their actions pushed the silver prices upward, not downward).

Long-term Cycles in Silver

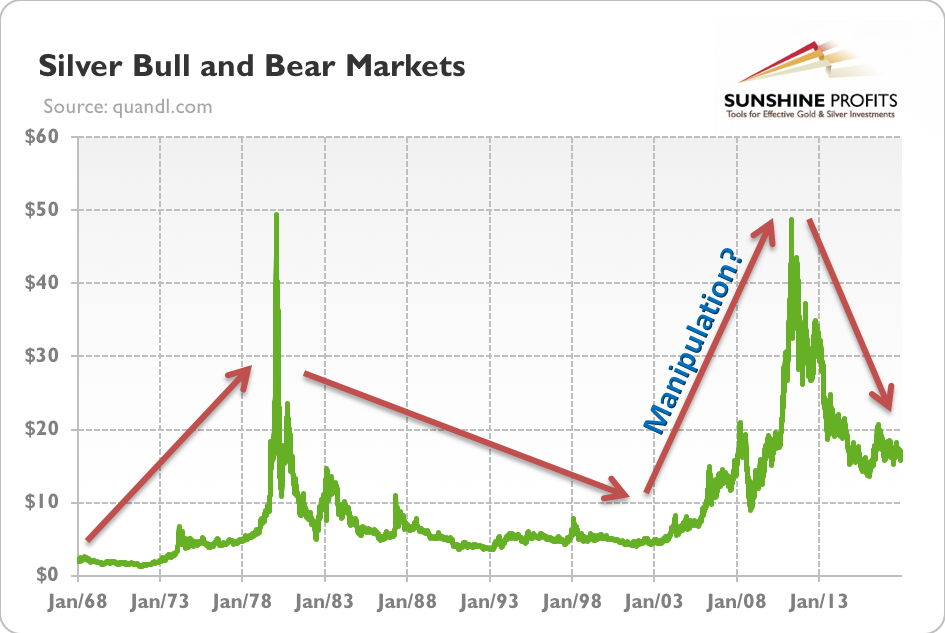

However, academic research did not find any clear evidence of silver price suppression. Moreover, when we look at the long-term behavior of silver prices (see the chart below), we see clear cyclical patterns, not a permanent downward trend (or even a flat line).

Chart 1: Silver bull and bear markets (from April 1968 to January 2016, London PM Fix).

Therefore, from the long-term perspective, and especially looking at the 2000s, it is hard to understand the accusation of manipulation in the silver market. The cries of “suppression” are extremely selective. When the price of silver is decreasing, then this is the obvious effect of evil conspirators, but when the price of silver was rising in the 2000s, then there was no manipulation and the true market forces were at work. The influence on prices should only be short-lived, as low prices cure low prices. Hence, any attempts to systematically suppress silver prices would be counterproductive, since the reduction in the price of silver would trigger a market reaction in the form of higher demand and upward pressure on the price.

Hunt Brothers and Silver Thursday

As a reminder, the Hunt brothers accumulated silver for a decade, but they were estimated to hold ‘only’ one third of the entire world supply of silver (without counting the significant amount held by governments). Moreover, their attempt to corner the market failed, as the price of silver plunged on March 27, 1980 (the so-called Silver Thursday), causing losses of over a billion dollars for the Hunt brothers.

Naked Silver Short Selling

Many people accuse bullion banks of naked short selling of silver in order to drive down the price. What is naked silver short selling? Let’s start with silver short selling, which is the sale of bullion that is not currently owned by the seller (usually borrowed) and the subsequent repurchase of the metal. The idea is to take advantage of the price decline, as it enables to repurchase the white metal at a lower price.

And we say that short selling is naked when silver short selling occurs without first borrowing it, or at least ensuring that the precious metal can be borrowed. So the short-seller can sometimes fail to deliver silver to the buyer.

The impact of naked shorts is, thus, controversial. The popular story says that the Fed uses bullion banks as its agents to put on naked silver shorts on Comex to drive down the price of silver. It protects the U.S. dollar’s value and enables banks to repurchase silver at lower prices.

However, if short sellers on Comex were really as uncovered as it is claimed, there would be a huge ‘short squeeze’ and the price of silver would rise. Therefore, any manipulation using naked shorts would be short-lived. If banks had massive short positions in the silver market, they would have to buy large numbers of futures contracts to cover their position and buy the physical metal to deliver it or roll their positions, buying expiring contracts and selling the next one out. In all cases the short-term impact of selling the futures contract would be reversed as banks would have to unwind their positions (investors should also not forget that for each seller of a futures contract there must be a buyer). Thus, the practice of naked silver short selling, existing or not, cannot explain the long-term bear markets in silver.

Goldman Sachs and Silver

Goldman Sachs was founded in New York in 1869 by Marcus Goldman (later, his son-in-law, Samuel Sachs joined the company). It is one of the largest investments banks in the world. It is well known for its political connections – its former executives often work in the government. For many people, Goldman Sachs is a villain, responsible for financial crises and the suppression of precious metals prices. Surely, the bank is large and powerful, so it may sometimes take advantage of its position, but the gold and silver markets are relatively liquid, so it could be practically impossible to exert lasting downward pressure on them. Actually, Goldman Sachs should sometimes intervene in the precious metals market – it is an LBMA market maker, after all!

JP Morgan Chase and Silver

JP Morgan is an investment bank headquartered in New York. It’s the largest bank in the United States and one of the biggest in the world. Together with Goldman Sachs, JP Morgan Chase is considered to be a ‘bad dude’, a kind of greedy manipulator. In particular, many precious metals analysts don’t like the bank, as it is accused of selling uncovered shorts on Comex. However, these analysts seem to not understand what bullion banks are. They don’t bet on price moves. Instead, they take the opposite side of the trade with speculators. As a reminder, JP Morgan is an LBMA market maker and it’s additionally responsible (with other banks) for clearing silver transactions, so it must engage in the silver market. But it doesn’t mean that it’s able to permanently suppress silver prices.

Conclusions

The bottom line is that despite many variations of the theory of manipulation in the silver market, their supporters hardly offer any proof. Just as with other asset classes, there are both bull markets, when the price of silver goes up, as well as bear markets, when the price goes down. Bear markets do not imply that there is deliberate suppression of the price of silver. This is normal market behavior resulting from changes in the silver market’s fundamentals. Indeed, the fundamental factors, such as the U.S. dollar, real interest rates, risk-aversion, industrial demand or the situation in the gold and base metals markets, do a very good job of explaining the behavior of silver prices in the long term.

We encourage you to learn more about silver – not only whether it is manipulated, but also how to successfully use silver as an investment and how to profitably trade it. A great way to start is to sign up for our gold & silver newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.