Shipping Companies Flush With Cash, With Some Splashing Jumbo Employee Bonuses

Image source: Ian Taylor / Unsplash

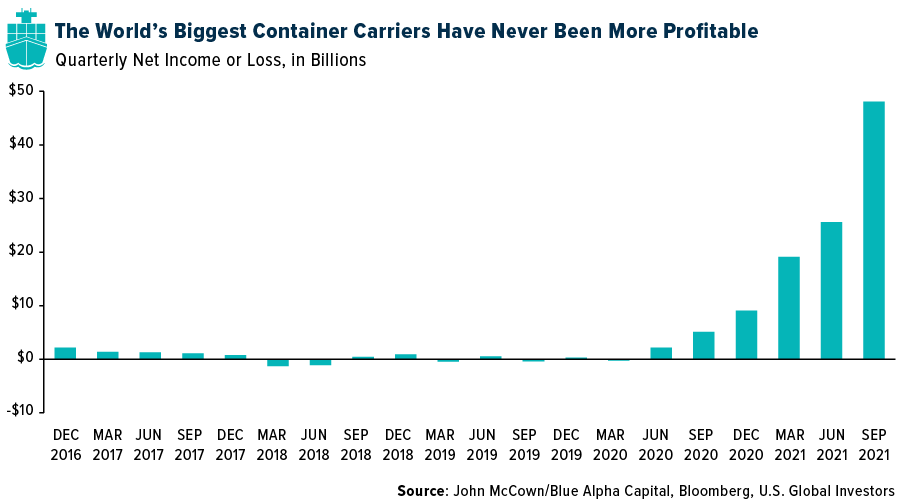

A “boatload” of news last week suggests that the shipping industry continues to look very attractive from an investing point of view. For starters, global cargo carriers are estimated to have recorded $150 billion in profits in 2021, the first time they’ve collectively reached that figure in a single year.

Indeed, net income has never been bigger, and it’s not even close. Denmark’s A.P. Moller-Maersk (AMKBY), known simply as Maersk, is expected to report an annual profit that meets or exceeds the combined profits from the past nine years. The world’s second largest carrier, having recently been dethroned by Geneva-based Mediterranean Shipping Company (MSC), sailed up an impressive 72% in 2021 in Copenhagen trading.

To give you an idea of just how cash-flush shipping companies are right now, employees of Chinese state-owned COSCO Shipping (CICOY), one of our favorite industry names, were paid a jaw-dropping year-end bonus that was 30 times their monthly salary, according to Caixin Global. Taiwanese company Evergreen Marine reportedly doled out a bonus that was as high as 40 times workers’ monthly pay.

Rates Likely to Remain Elevated

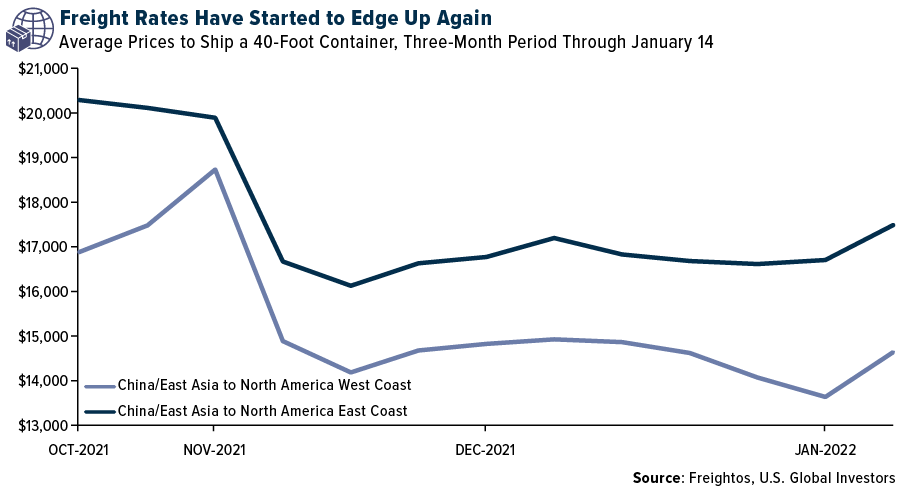

The reason for all of this, of course, is record-high freight rates. Last year, as Covid forced households around the world to shift a lot of their discretionary spending from experiences to goods, the rate to ship a 40-foot container rose to as much as $20,000 in some cases, compared to less than $2,000 in 2019.

Although rates have come off their highs, they’ve lately begun to turn up again as the more transmissible Omicron variant has led to new lockdowns around the world. That includes in China, which CLSA points out has a zero-tolerance approach to controlling the spread of Covid. “Global supply chain pressures are likely to persist, therefore, for much of this year,” CLSA analysts wrote in a note to clients dated January 20.

That thought was echoed by Peter Sand, chief analyst at ocean and air freight benchmarking platform Xeneta. In his weekly update, Sand said he believed that average shipping rates in 2022 “will be higher than ever before,” thanks to companies’ strong pricing power and ability to negotiate long-term rates.

Ports of L.A. and Long Beach Moved a Record Number of Containers

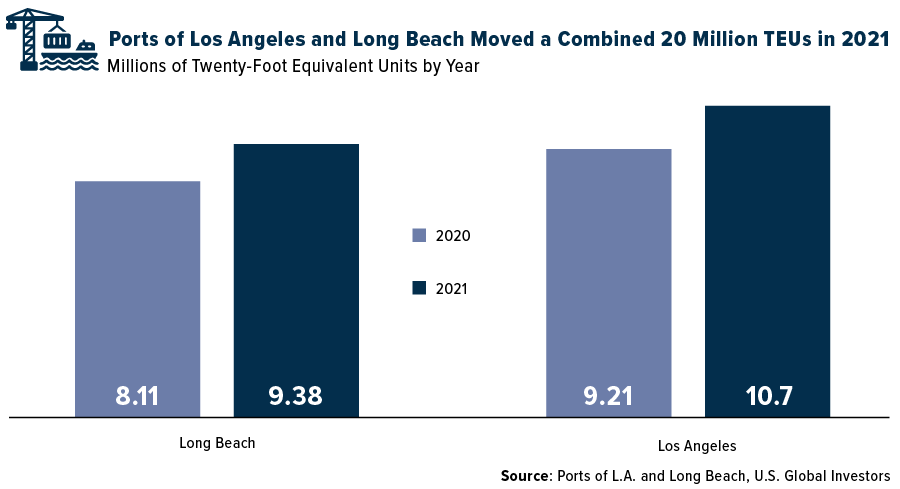

In the past several months, you may have run into some empty store shelves, but it’s not due to a lack of effort. The Ports of Los Angeles and Long Beach released their shipping statistics for calendar year 2021, showing that they’ve never before moved so many containers in a single year. Long Beach handled a record 9.38 million 20-foot equiavlent units (TEUs), a 16% jump in volume from 2020 numbers, while Los Angeles reported moving 10.7 million TEUs, also an increase of 16% from the previous year. Collectively, the two ports, which represent over 25% of North America’s total inbound container trade, handled an unheard-of 20 million TEUs.

It’s not just sea freight, though. Air freight companies had a phenomenal 2021. FedEx, another name we really like, reported record profit and record revenue of $84 billion last year, largely due to greater volumes. FedEx Express, one of the world’s largest cargo airlines, handled an average of 3.28 million packages per day domestically in 2021, up from 2.90 million packages per day in 2019.

Can Trade Continue to Grow at this Level?

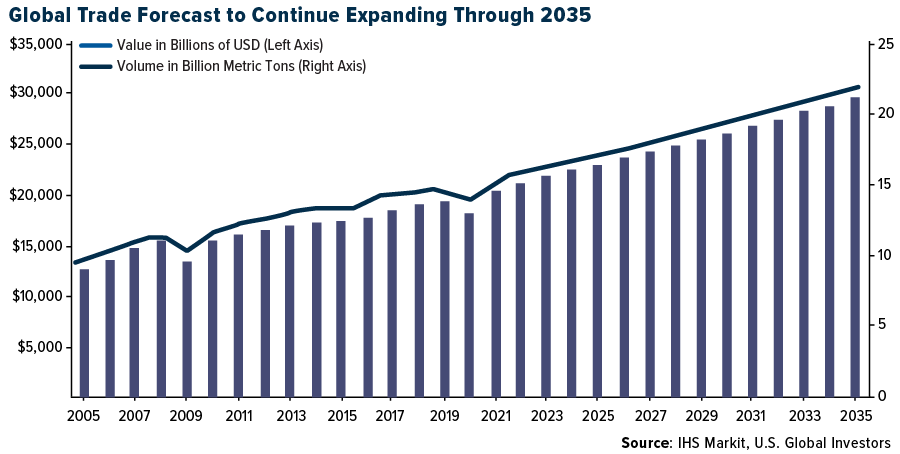

In many ways, last year was an anomaly, and we can’t expect growth in trade volumes to continue at the same high rate indefinitely. But by all accounts, we can reasonably expect them to grow year-over-year as more and more people join the middle class and seek to buy the things associated with such a lifestyle.

According to long-term forecasts by IHS Markit, the real value of traded goods could approach $30 trillion by 2035, up from just over $20 trillion today. Barring another global event like a war, pandemic or economic downturn, volume could exceed 20 billion metric tons, compared to 15.8 billion metric tons today, IHS Markit says.

To be transported all over the world, these future goods will need ships and cargo jets, not to mention ports, a few operators of which are publicly traded. As Americans, we don’t think of airports and seaports as being investable companies, but a few of them are in other countries, including the Philippines’ International Container Terminal Services (ICTEF), New Zealand’s Napier Ports Holding and the U.K.’s PD Ports and Global Ports Holding.

Frank Holmes is CEO and Chief Investment Officer of US Global Investors.

_____

Equities News Contributor: Frank Holmes

Source: Equities News