Yesterday, the minutes of the ECB’s September meeting were released. What do they say about the ECB stance and what do they mean for the gold market?

After a short trip to Japan, we return to Europe. On Thursday, the European Central Bank issued the minutes from its September meeting. They were considered by the markets as dovish. This is because they showed that the officials were worried about the appreciation of the euro. Peter Praet, an executive board member and chief economist at the ECB, even called for “close monitoring” of the exchange rate.

Another important issue discussed during the meeting and revealed in the minutes, was a trade-off between different options for extending the asset buying. The asset purchases will expire in December, so the ECB will have to decide whether it should extend the program for longer but combined with a greater reduction in monthly volumes or whether it should adopt a shorter extension but with larger purchases. On Monday, Praet said that the relatively calm market conditions could encourage the ECB to extend its asset purchase program for a relatively longer period but with reduced monthly spending. Given Praet’s position in the ECB, it suggests that the bank is likely to choose the “lower but longer” scenario. It also implies that the timing of any interest rate hike is further postponed.

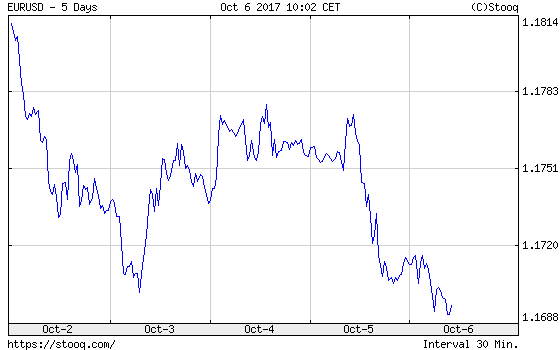

The minutes were, thus, dovish, which is not good news for the gold market. A more dovish ECB implies a weaker euro and a stronger greenback – the gold’s Nemesis. Indeed, the euro depreciated yesterday, as the chart below shows.

Chart 1: EUR/USD exchange rate over the last five days.

Anyway, markets expect that the ECB will cut its purchase volumes by a third to €40 billion a month until the middle of next year. Hence, if the bank slows the pace of buying more abruptly than the investors expect, while keeping the program for longer, the euro will depreciate even further. This is because a longer period will dampen the expectations on interest rates. It would be a negative scenario for the gold market. Will that happen? We will see as soon as October 26. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview