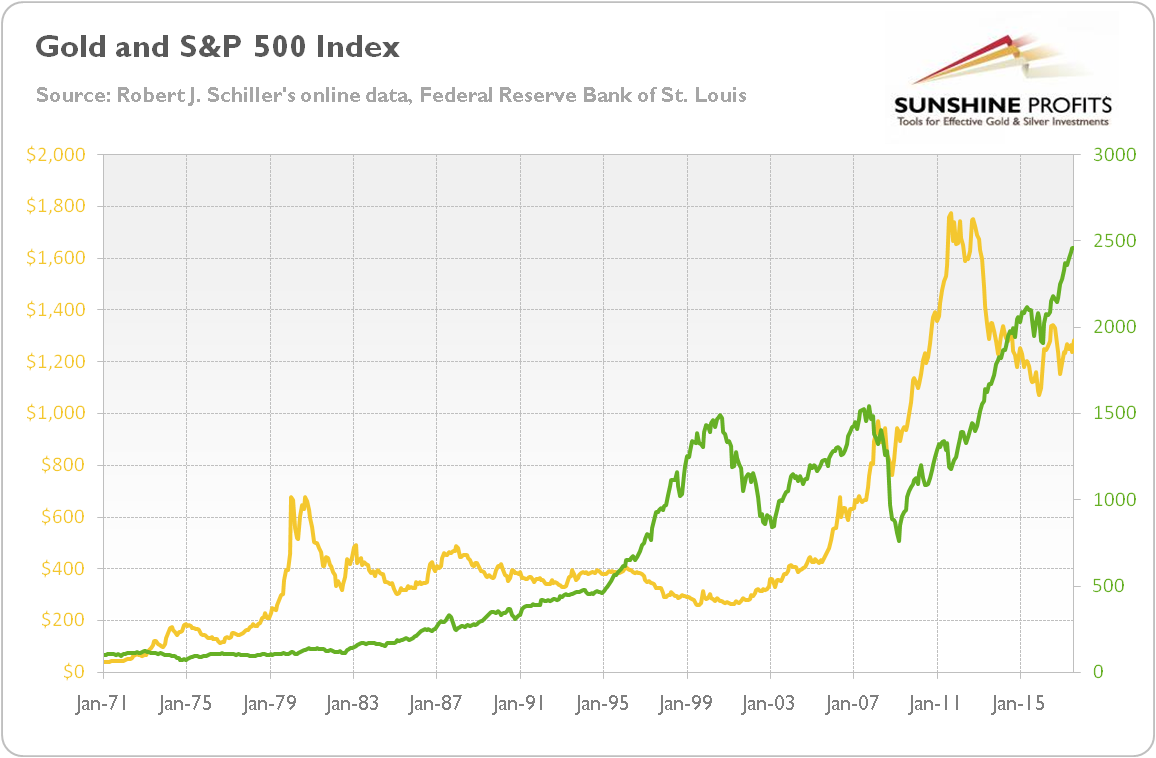

S&P 500 and Gold

The relationship between gold and S&P is widely debated. The standard view is that these two markets are negatively linked: when the stocks go up, the yellow metal dives, and vice versa. This is indeed often the case, as gold is a safe haven, so when traders go into defensive mode, they may prefer gold to relatively risky stocks. Clearly, as the chart below shows, there were many periods when stocks and gold were moving in opposite directions. This is why gold is also a good portfolio diversifier, as it provides a hedge against the S&P 500 Index. Hence, it might be a good idea to add some gold to an equity investment portfolio.

Chart 1: Gold prices (yellow line, left axis) and S&P 500 Index (green line, right axis) from 1971 to 2017.

However, the chart, which presents the price of gold and the S&P 500 Index, also shows periods of co-movement (think about the 2000s). It means that the gold-stock relationship changes over time, depending on external conditions, especially on macroeconomic factors. Hence, although there is often a shift of funds from equities to the gold market in times of stock crashes, the link between the S&P 500 and gold is complex and dependent on external macroeconomic factors.

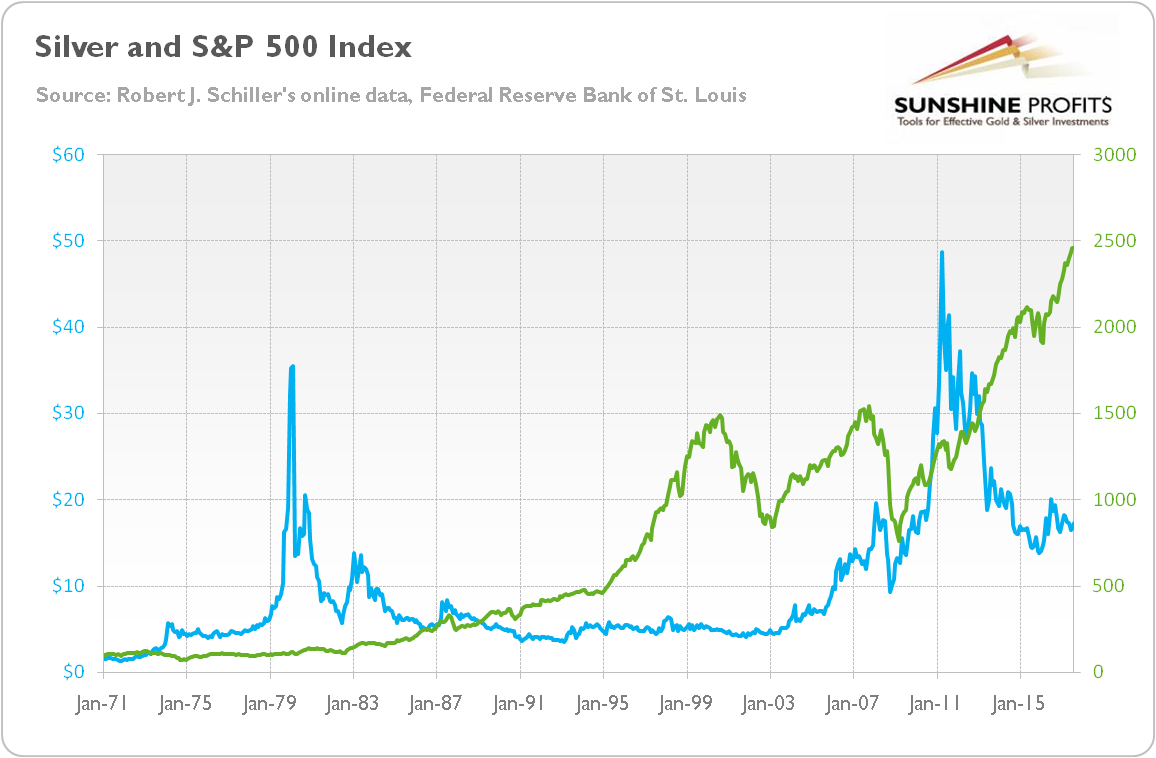

S&P 500 and Silver

As one can see in the chart below, there is no clear correlation between the price of silver and the S&P 500 Index. Although both asset classes moved in tandem during most of the 2000s, there were also periods of negative correlation or independent behavior, for example due to different specific developments in the silver market (see: Silver Thursday).

Chart 2: Silver prices (blue line, left axis) and S&P 500 Index (green line, right axis) from 1971 to 2017.

Hence, as silver prices are very closely linked to gold prices, this metal also serves as a safe-haven asset and a portfolio diversifier, as it might hedge the S&P 500.

We encourage you to learn more about the precious metals market – not only about the link between the S&P 500 Index and gold and silver, but also how to successfully use both silver and gold as an investments and how to profitably trade them. A great way to start is to sign up for our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.