In a price extension, the usual course of action is to identify a recent move from one specific level to another. This could be a move from a bottom to a top, from a top to a bottom, from a resistance level to a support level or the other way around, and so on.

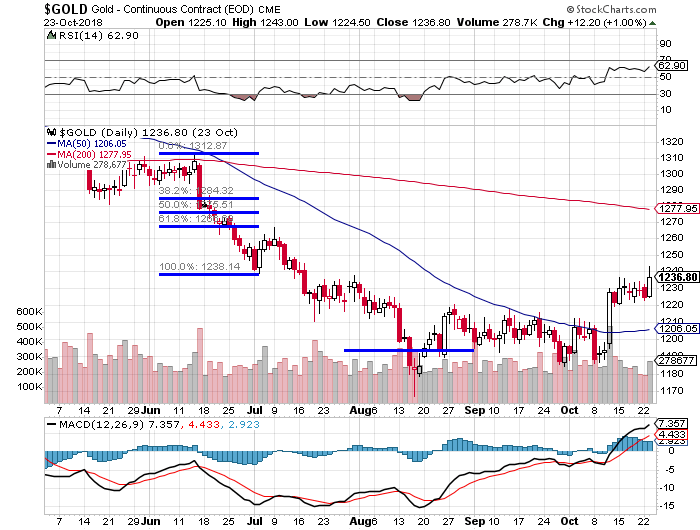

Imagine gold is in downtrend and after a temporary correction. If you expect the yellow metal to continue the trend down, you might be interested in how low it could go. Sometimes, important past tops and bottoms are far away or not applicable to the current situation. You could then use the magnitude of the most recent move down to get a bearing on how the next move down could potentially look like. An example of such an approach is shown on the chart below, where we see daily gold prices in 2018.

First of all, let’s focus on the June move down. Gold depreciated from above $1,310 to below $1,240. Suppose you are after this move and you’re seeing a short-term rebound in the first week of July. At the same time, you still believe the trend is down and gold is to depreciate further. You could then set your reference points to the beginning of the June decline and the early-July rebound. By measuring the move move between these level you would get Fibonacci retracements (five horizontal lines on the left) and a decline of roughly $70. Now, you could extend this decline by drawing further Fibonacci retracements. In this specific case, if you extended the retracements beyond 100% and drew the 161.8% retracement, you would get the $1,193 level (single horizontal line below and to the right of the Fibonacci retracements). This level could be interpreted as a target for a potential further move down following the early-July rebound.

And, in fact, a move down occurred, which took gold to the price extension and beyond it. The bottom was not perfectly in line with the price extension but it might be tricky to expect gold to move exactly to this level. It rather works on a near-to-basis. Also, notice how exiting a short position in the proximity of the extension would have been a quite good idea as it would have shielded traders from a quite volatile rebound.

We hope you have enjoyed reading the above definition. If you’d like to learn more about price extensions, and about gold’s most recent price swings and their implications, we invite you to sign up for our gold newsletter. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today.