Well, it depends on the region, mine and company (e.g., whether it is a junior or a senior company). However, investors should remember that palladium comes mainly from Russia and South Africa (together, these countries account for about 80 percent of the mining supply), so the global production costs are significantly shaped by the developments in these countries.

What does make up the cost of palladium production? First of all, the mining company has to discover mineable palladium deposits, conduct exploratory drilling and extensive geochemical analysis. Later, the company has to buy an exploration license and meet environmental and other regulations. Then, it can establish the site, buy all the equipment and physically extract the palladium ore. And after the mine is tapped out, the mining company may be required to rehabilitate the site to pre-mining conditions. As one can see, the palladium production costs go well beyond the mere act of pulling the metal from the ground.

This is why we have different notions of palladium production costs. Traditionally, the industry used cash cost, which focused only on the mining and processing costs incurred. But in 2013, the WGC published a guidance note on all-in sustaining costs and all-in costs metrics. The former concept is an extension of the existing “cash cost” metrics and incorporates costs related to sustaining production, while the latter notion includes all additional costs that reflect the varying costs of producing palladium over the lifecycle of a mine.

Palladium Production Costs and Palladium Prices

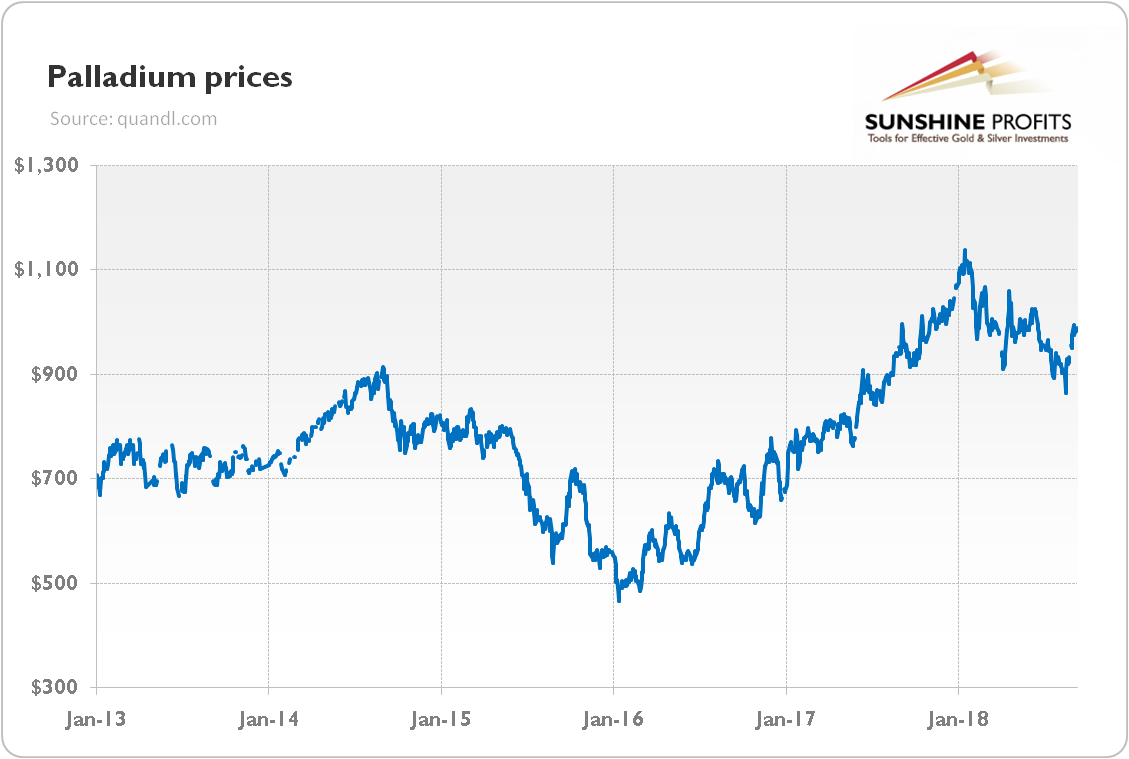

And what is the link between the palladium production costs and the price of palladium? Well, the data is scarce, but all-in sustaining costs for North American Palladium, one of the leading palladium producer, were about $720 in 2017. The current palladium price is about $990 per ounce (as of September 2018), as one can see in the chart below.

Chart 1: Palladium prices (London A.M. Fix in $) from 2013 to September 2018.

It means that the price of palladium is importantly above the production costs. The implication is that, contrary to platinum, the palladium mining is profitable right now. And the profit margins may rise further, with efficiency increases in Russian mining industry and supply lagging demand (which create upward pressure on prices). Another obvious advice is to invest in palladium mining companies that do well in keeping all-in sustaining costs low.

We encourage you to learn more about the precious metals market – not only about the link between palladium production costs and the price of the metal, but also how to successfully use palladium as an investment and how to profitably trade it. Great way to start is to sign up for our Gold & Silver trading Alerts. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Related terms:

-

Juniors

Juniors (also known as junior mining stocks) are low cap (with market capitalization usually under 500 million), and thinly traded (daily volume usually under 700,000) exploration companies searching for new deposits of precious metals. Junior mining companies strive to acquire properties that are believed to have a big probability of including large resource deposits.

Read more

-

Mining Stocks

There are many ways to gain exposure to movements in the commodities, including precious metals. One of them is mining stocks, i.e. shares in mining companies.Mining stocks can be divided into two broad categories: seniors and juniors. The former are stocks of a considerably large commodity producing mining companies with an established position and relatively large market capitalization, while the latter are stocks of smaller mining companies with little capital and short history. For these reasons, juniors are more risky than seniors.

Read more

-

Senior Mining Stocks

Senior Mining Stocks (a.k.a. Seniors) are stocks of a considerably large commodity (e.g. gold) producing mining companies with an established position and relatively large market capitalization. Senior stocks are usually perceived as being less risky than junior stocks (stocks of my smaller mining companies) – they are more liquid and their prices are typically subject to less volatility.

Read more

-

World Gold Council (WGC)

The World Gold Council (WGC) is the market development organization for the gold industry, based in London. It is a non-profit association of the world’s leading gold producers, set up to provide industry leadership and stimulate the demand for gold. For example, the WGC is the creator of the first gold ETF.

Read more