North American Construction Group Beats Earnings Estimates, Nears Pre-Pandemic Trajectory

Image source: North American Construction Group

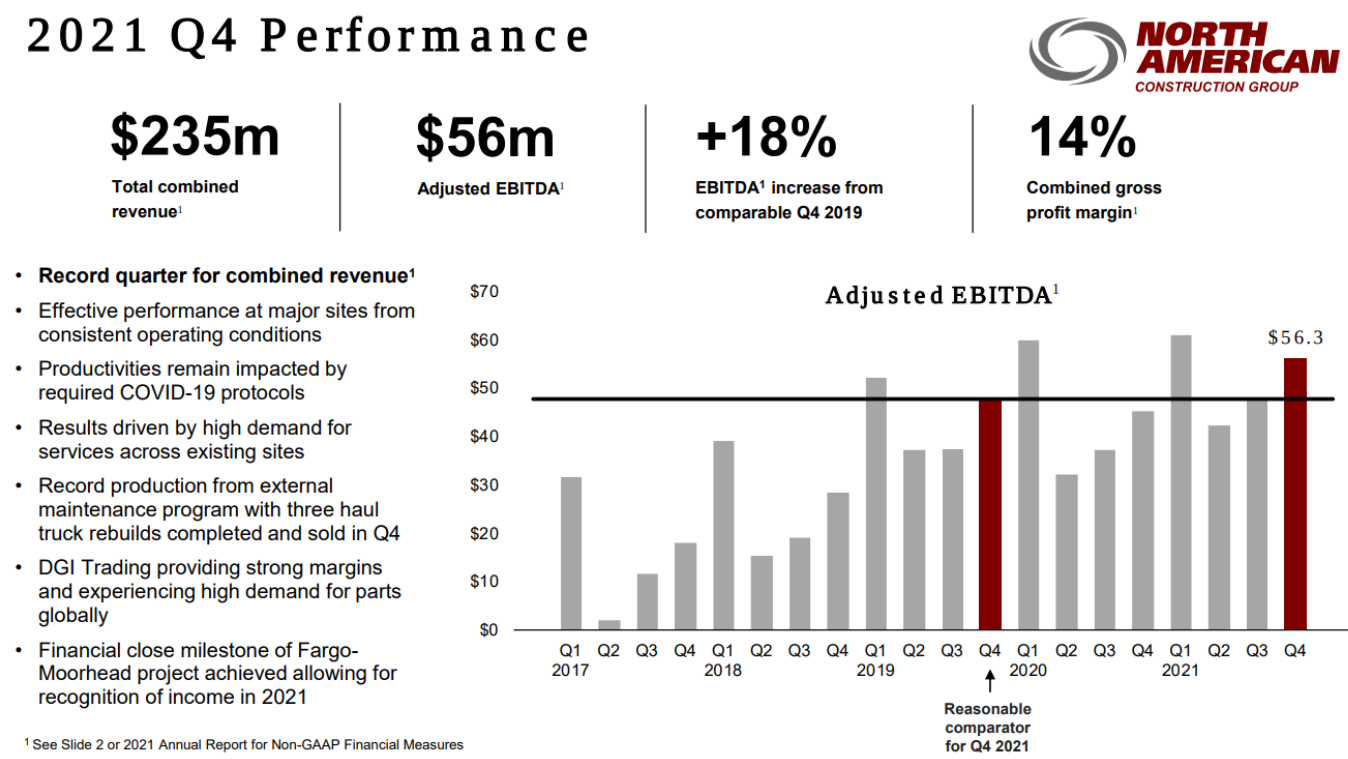

North American Construction Group (NACG) NOA reported fourth quarter earnings Wednesday ahead of estimates, completing a strong second half of 2021.

The Alberta, Canada-based provider of heavy civil construction and mining contractor services posted net income of C$15.3 million (US$12.1 million) in Q4 2021, up 53% from the C$10.0 million in Q4 2020, or C$0.59 (US$0.47) per share on an adjusted basis. The street was looking for US$0.45 per share.

Image source: North American Construction Group Q4 2021 earnings presentation, Feb. 17, 2022.

Revenues for the fourth quarter came in at a record C$181.0 million (US$143.6 million), in line with estimates, up 33% from C$136.1 million in the prior year's quarter.

NACG reported adjusted EBITDA of C$56.3 million (US$44.7 million) in Q4 2021, up from C$45.2 million in Q4 2020.

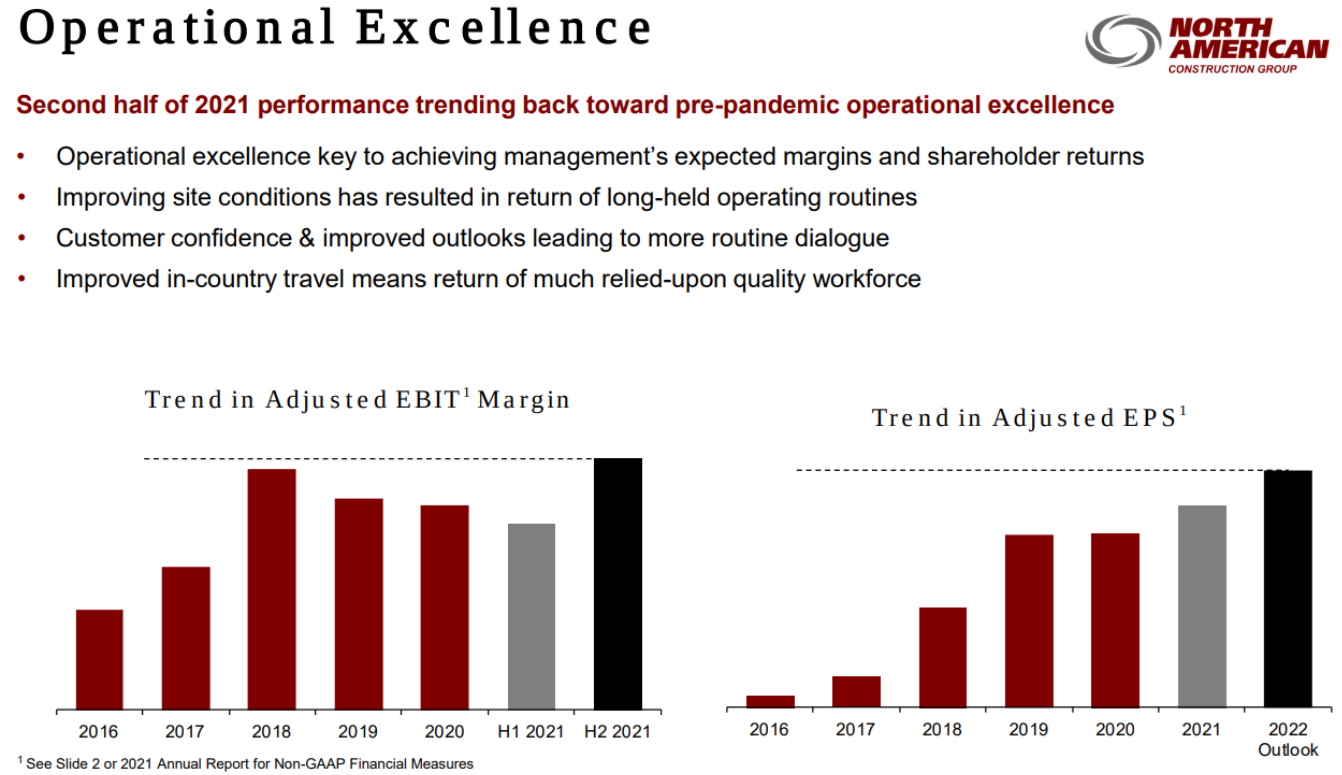

Trending to pre-pandemic operational strength

On the company's conference call on Thursday morning, CFO Jason Veenstra pointed to consistency in equipment utilization as a key driver for NACG's success. The company enjoyed increased fleet utilization as the winter season demand enabled full deployment of the fleet. Further, the planned maintenance that adversely impacted Q3 utilization paved the way for increased utilization and availability in Q4.

CEO Joe Lambert highlighted that the company's performance was trending back toward the highs it experienced before the COVID-19 pandemic hit.

Image source: North American Construction Group Q4 2021 earnings presentation, Feb. 17, 2022.

Investment thesis

Since its recent peak of $17.79 on Oct. 29, 2021, NACG stock traded down to $13.31 when the market swooned in November and December before rebounding over the past couple of weeks. The stock popped 4.1% on Thursday on the heels of the earnings announcement, but the company is still only valued at $447 million, which feels low given its operational trajectory and outlook for 2022.

- Demonstrated ability to achieve operational improvements in challenging supply chain and labor environment.

- Ended 2021 with the highest order backlog in the company's history.

- Company has thrived being a low cost provider in a cyclical commodity business.

- Strong free cash flow, projected to be in the range of C$95 million to C$115 million in 2022.

- Board doubled the dividend rate to C$0.32 per year from C$0.16.

_____

Source: Equities News