Modest Uptick in USD/JPY on Bank of Japan’s Dovish Turn

- BOJ’s Governor pledged to add stimulus if needed.

- Equities and yields marginally down, limiting the upside for USD/JPY.

The greenback is firmer Tuesday although with uneven strength across the FX board, although advancing evenly against its European rivals. The USD/JPY pair rose to 110.81, trading around this last. The JPY was hit overnight by comments from BOJ’s Governor Kuroda, who said that he would consider adding more stimulus to achieve the inflation target if needed, and/or if the yen’s moves impact the economy.

Equities traded with a soft tone in Asia, while European indexes follow suit, limiting the pair’s gains. US Treasury yields, which came back after a long weekend, are marginally lower also preventing USD/JPY from rallying further. Wall Street will also return after a long weekend, with the indexes marginally lower ahead of the opening amid the poor performance of overseas counterparts. The US calendar has nothing relevant to offer today, with a minor housing index schedule and the auction of short-term government bills.

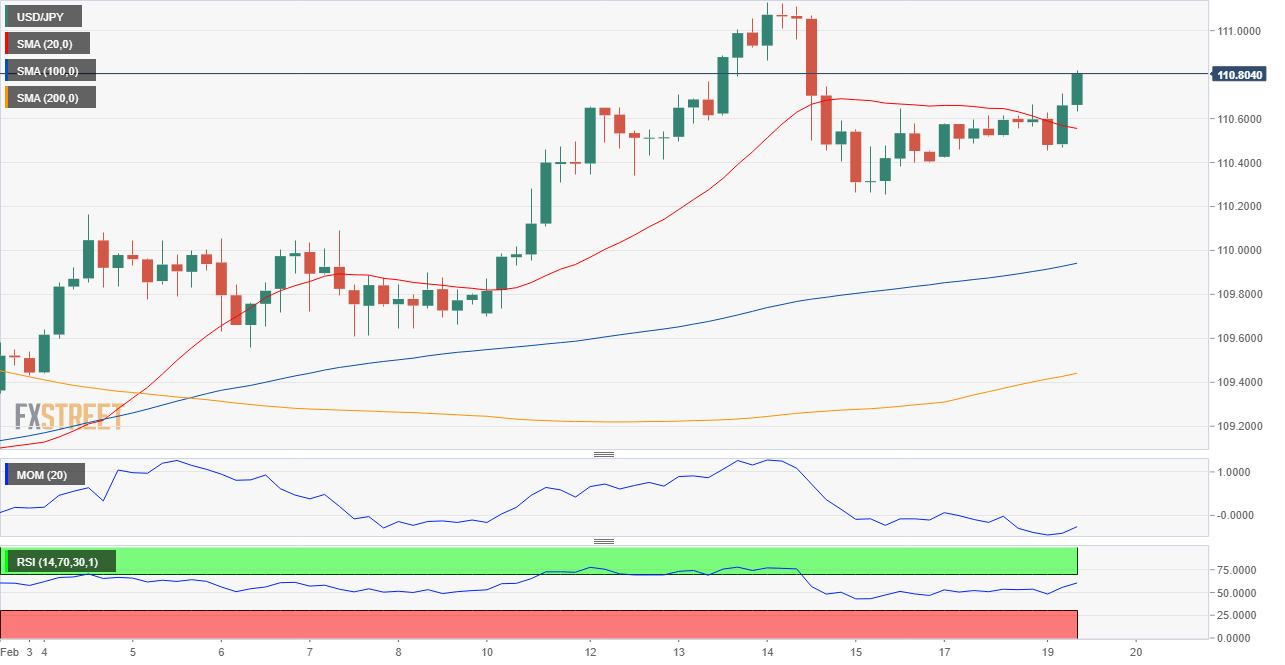

From a technical point of view, the pair is short-term bullish, given that its steady above the upper end of its previous range, and advancing above its 100 and 200 SMA in the 4 hours chart, where technical indicators hold near daily highs, partially losing their upward strength. The pair has topped for this year at 111.12, with a break above the level favoring an extension up to 111.44, Dec. 26 daily high.

Support levels: 110.50 110.10 109.80

Resistance levels: 110.80 111.10 111.45