Lessons From 15 Years of Short Selling: How to Find Great Shorts

In my two recent columns, 12 Reasons Not To Short and 10 Reasons to Short, I outlined the pros and cons of short selling and concluded that most people should avoid it altogether – but that it can make sense for certain investors. For them, I hope that by sharing some of my experiences and lessons learned from nearly two decades in the trenches, I can help my fellow short sellers both identify great shorts – the subject of this column – and avoid deadly ones – the subject of my next column.

While shorting is a brutally tough business, I think that the increasing level of overvaluation, complacency, hype and even fraud in our markets make it a fantastic time to be looking at opportunities on the short side, which is why I’ve organized a conference in NYC on Thursday, May 3, The Art, Pain and Opportunity of Short Selling. This full-day event is the first of its kind dedicated solely to short selling and will feature some of the world’s top practitioners who will share their wisdom, lessons learned, and best, actionable short ideas. Featured speakers include David Einhorn, Carson Block, Sahm Adrangi, Soren Aandahl, Ben Axler (a list of all speakers, further information and registration is available at kaselearning.com; Seeking Alpha readers can get 10% off by using discount code SA10).

Short Collapsing Earnings

There are all sorts of ways to make money on the short side. Some investors favor shorting total frauds like those promoted by “boiler rooms” (the subject of the movie The Wolf of Wall Street) or the hundreds of Chinese companies that went public via reverse mergers, highlighted in the excellent new documentary, The China Hustle. Others prefer betting against stocks in overhyped sectors like cryptocurrencies, marijuana and alternative power. Still others like to short market darlings like Netflix (NFLX) and Tesla (TSLA), whose stock prices appear to be far ahead of the fundamentals.

I’ve tried all three of these approaches, with limited success. While the typical outcome is a stock falling 50-100%, I’ve also gotten destroyed on more occasions than I want to remember because once a stock becomes totally disconnected from reality, there’s almost no limit to how far it can soar. If a stock is trading at five times its intrinsic value, why can’t it trade at 10x…or 20x? I’ve seen it happen – and experienced it happening! – too many times…

In contrast, I’ve had quite a bit of success shorting stocks that are valued on a multiple of earnings – and the earnings collapse. “Well, duh,” you might be thinking, but sticking to this simple approach would have kept me (and countless other short sellers) out of stocks that crushed us like Salesforce.com (CRM), Tesla (my worst short ever, from $35 to $205) and Netflix (which doubled against me in 2010 before I covered and later went long it – very profitably – in 2012-13).

Allow me to give you examples of five great shorts in which the stocks closely followed earnings downward. (Earnings charts are from CapitalIQ and stock charts are from bigcharts.marketwatch.com).

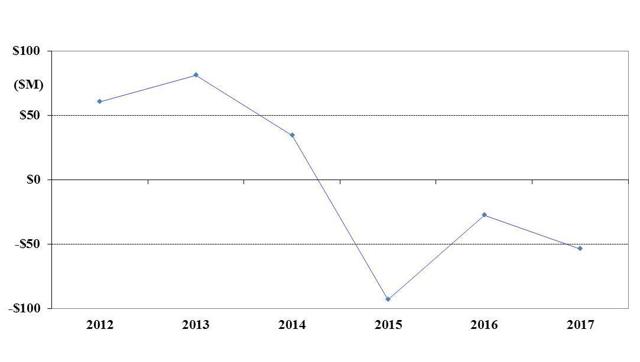

1) Here’s a chart of the operating earnings over the last six years of Lumber Liquidators (LL), my best short ever (see here (slides) and here(articles)):

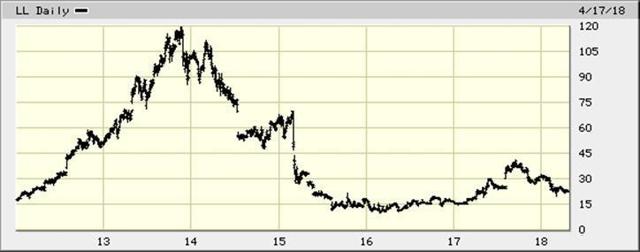

Not surprisingly, Lumber Liquidators’ stock tracked its earnings collapse:

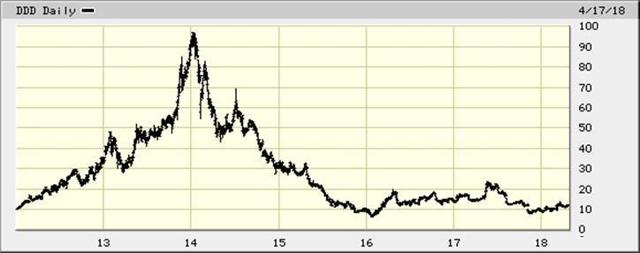

2) Here’s another stock I shorted very successfully, 3D Systems (DDD). Here are the operating earnings:

And here’s the stock chart, again tracking the earnings collapse:

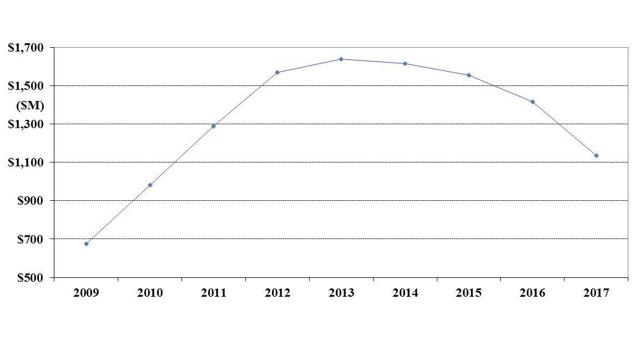

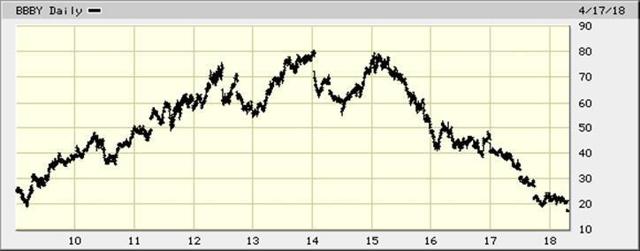

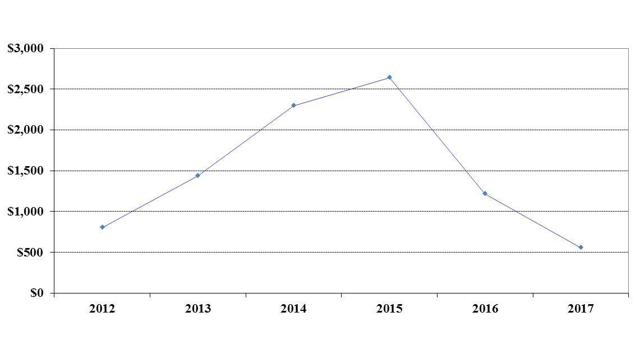

3) Here are the earnings of a rapidly failing retailer, Bed Bath & Beyond (BBBY):

And here is its stock price over the same period:

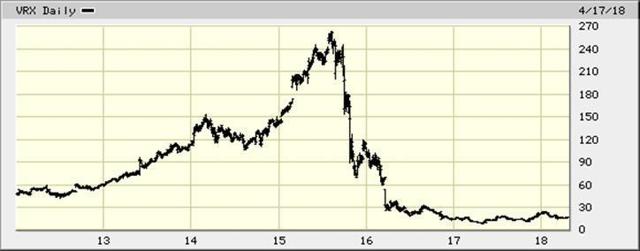

4) Here are the operating earnings of Valeant Pharmaceuticals (VRX), one of the most high-profile blow-ups ever:

And here’s Valeant’s stock chart:

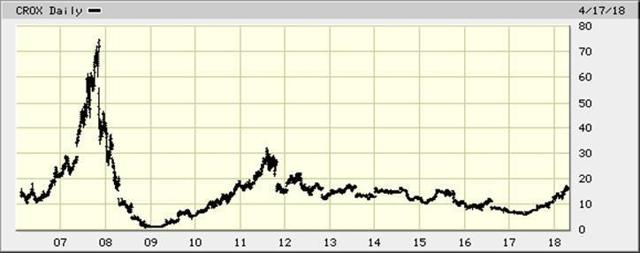

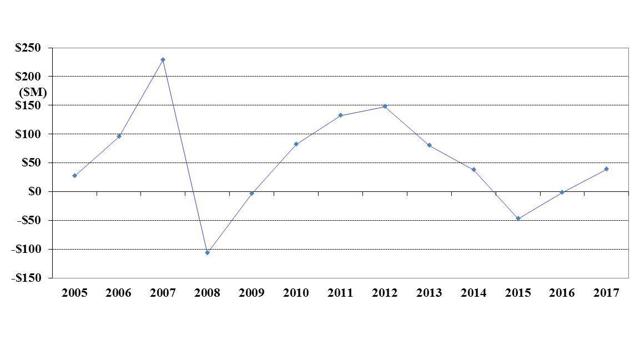

5) Lastly, Crocs’ (CROX) rubber shoes were a huge hit in 2007, driving earnings and the stock price through the roof – and, just as quickly, the fad passed and both earnings and the stock collapsed. Look at how closely Crocs’ stock price follows its earnings over the past 13 years. Here are operating earnings:

And here is the stock chart:

How to Find Collapsing Earnings

There are many reasons why a company’s earnings might collapse – the primary ones I tend to look for are:

1) Unsustainable or illegal business practices (e.g., Lumber Liquidators buying Chinese-made formaldehyde-tainting flooring; Valeant making endless acquisitions and jacking up prices of acquired drugs);

2) A business model made obsolete by technology (e.g., numerous retailers such as Bed Bath & Beyond, Staples (SPLS) and Barnes & Noble (BKS) getting crushed by Amazon (AMZN); Netflix’s DVD-by-mail business; Blockbuster video; newspapers);

3) Accounting fraud (e.g., Enron; WorldCom);

4) Legal/regulatory scrutiny (e.g., Lumber Liquidators; Valeant; Insys Therapeutics (INSY));

5) A wave of new competition (e.g., 3D Systems; will this happen to Tesla in the near future?);

6) The aftermath of one-time events (e.g., Hurricane Sandy (Oct. 2012) juiced Lumber Liquidators’ earnings);

7) Cyclical companies over-earning at the peak of a cycle or due to random industry events (e.g., Cooper Tire & Rubber (CTB) today I believe); and

8) Fads coming to an end (e.g., Crocs).

Conclusion

Shorting is an extremely difficult and dangerous business, but the risks can be mitigated by focusing on stocks for which the odds are low of getting run over, which in my experience tend to be those valued on a multiple of earnings – and earnings decline sharply.