Tae Kim of CNBC reports, David Tepper says the bull market is in the late innings and he’s sold some stock holdings:

David Tepper, manager of $14 billion in assets, is more uncertain about the stock market due to President Donald Trump’s trade war with China.

“If we do the tariffs on China that’s going to make it a little bit tough on the market,” the co-founder of Appaloosa Management said Thursday on CNBC’s “Halftime Report.”

“It is a little tricky at this point of time. … It’s a late inning game.”

He said stocks could drop 5 percent to 20 percent if trade tensions between the world’s two largest economies increase.

The investor said he is now about 25 percent exposed to the stock market. Tepper called the market “fairly valued” if the U.S. doesn’t impose more tariffs on Chinese goods.

“I’ve taken down my exposure [to equities],” he said. “I’m just not sure what’s going to happen with these tariffs. … Our whole book we probably took down 30 percent at some point, the equity part.”

Last Friday, Trump said he was “ready to go” on tariffs for another $267 billion in Chinese goods, which would be on top of the proposed tariffs on $200 billion in goods already being considered.

The public comment period on the $200 billion tariff plan expired Thursday. The world’s two largest economies have already applied tariffs to $50 billion of each other’s goods.

In January, Tepper was more optimistic about stocks. He told CNBC that month the bull market still had room to grow, citing Trump’s tax cuts and equity valuations.

Akin Oyedele of Business Insider also reports, ‘It’s a late-innings game:’ Hedge fund billionaire David Tepper says he’s dumped some stocks, and warns of a bear market if Trump’s trade war worsens:

David Tepper, the billionaire hedge fund manager of Appaloosa Management, said Thursday that his firm had reduced its holdings of US stocks.

“If you ask me what inning we’re in, I think it’s a late-innings game,” Tepper, who manages about $14 billion in assets, told CNBC of the nine-year bull market in stocks.

At issue is the ongoing trade dispute between the US and China. The Trump administration has threatened to place tariffs on all Chinese products entering the country. A $200 billion round of duties that could be announced imminently, and Trump threatened last week to impose import taxes on another $267 billion worth of products.

Additional tariffs would “make it a little bit tough on the market,” Tepper said, adding that stocks could drop between 5% and 20% if the trade war worsens.

“To me, the market is fair-valued if you don’t have tariffs on China,” Tepper told CNBC. “But if you do have tariffs on China, the question is how high will the dollar go, and then where will earnings be in that case.”

Tepper said he had reduced his exposure to US stocks, although he remained long the market. He estimated his fund had around 25% exposure to the S&P 500 after reducing it by about 30%, which has been the wrong move “because the market has been very hot.”

He said he remained bullish on Facebook because the stock was still cheap.

From inception in 1993, Tepper’s hedge fund generated gross annual returns of more than 30 percent, according to a source familiar with the firm’s returns.

The billionaire investor is also the owner of the National Football League’s Carolina Panthers.

Earlier this week, I went over why Bridgewater’s founder Ray Dalio thinks we are in the 7th inning of the economic cycle, stating the following:

[…] is Ray right, are we in the seventh inning of the economic cycle? Nobody really knows but if you ask me, we are closer to the ninth inning as the cycle has already peaked according to leading economic indicators and global PMIs.

People focusing on inflation and employment are focusing on lagging and coincident economic indicators which is typical at this point of the cycle.

So whether we are in the 7th or 9th inning, it doesn’t matter because I agree with Ray, as time goes by, the risks are rising and investors need to position themselves defensively now to prepare for the eventual slowdown.

It’s important to understand why risks are rising. As the Fed raises rates, it reduces global liquidity, spreads start to widen, the US dollar gains and financial conditions become more restrictive. The lagged effects of rising rates is starting to hit risk assets, especially emerging market stocks and bonds.

So, on the one hand, the US economy is roaring according to employment indicators but on the other, emerging markets are getting whacked hard and the risks are if the Fed continues raising rates, it will precipitate an emerging markets crisis which is deflationary.

Can we avoid a hard landing? Sure, if the Fed stops raising rates and pays more attention to what is going on outside the US, we can avoid a hard landing.

My fear, however, is the Fed is already determined to continue raising rates based on lagging and coincident economic indicators and just keeping an eye on what’s going on in emerging markets.

This is where a policy error can happen because if the Fed overdoes it and raises rates too much, it will trigger a crisis in emerging markets, and we will need to prepare for a deflationary wave.

Now we have another hedge fund titan, David Tepper, telling us it’s late innings for stocks. Is he right?

Calling the economy is a little easier for me than calling stocks and I’ll explain why. Stocks move based on a lot of factors including liquidity.

Even though the Fed and other central banks are raising rates, removing global liquidity, there’s still plenty of juice to drive stocks and other risk assets higher.

So, yes, I agree with Tepper, we are in the late innings for stocks which are a leading indicator of the economy, but it’s at this stage of the market where risks are high for parabolic moves.

In fact, the whole tech bubble went parabolic a year after the Fed started raising rates and it lasted a lot longer than skeptics thought, decimating many value managers.

Value managers are lagging far behind growth managers again this year, which is normal. In a video clip this week, Francois Trahan and Michael Kantrowitz of Cornerstone Macro went over the structural shifts explaining why growth will continue to outperform value, highlighting these points:

- Structural Shift In Growth/Value Complicates Historical Comparisons

- Scarcity Breeds Premium: It’s Becoming Harder To Find Structural Growers

- Growth Has Beaten Value in 2018 DESPITE Historical Valuation Spread

- Beware Of Value: Low PE Stocks Used To Be Low Beta, Now Higher Beta

- Valuation In Context: S&P500 Is Now Growthier Relative To Its History

I highly recommend you subscribe to their research, it is excellent.

According to Francois, the rally in growth stocks is “textbook at this stage” where investors are defensive and it’s normal to see breadth narrowing.

However, he too is telling investors to start focusing on defensive sectors because the lagged effects of interest rate hikes will eventually hit all risk assets.

But if you drill down on markets, you see crazy things happening at stock levels. For example, look at shares of Tilray (TLRY), a company that engages in the research, cultivation, processing, and distribution of medical cannabis (click on image):

As you can see, animal spirits are alive and well, especially in pot stocks but as I stated on StockTwits last night, momos are driving this game and a lot of retail investors are going to get burned badly buying these stocks, especially after a parabolic move.

Other stocks that caught my eye? Look at shares of Advanced Micro Devices (

AMD is one of the best-performing chip stocks which is great news for Vanguard, BlackRock and Fidelity, the top institutional holders, but also for top hedge funds like Renaissance Technologies and Balyasny which increased their stake significantly in the second quarter (click on image):

You’ll recall when I went over top funds’ activity in Q2 2018, I went over another semiconductor stock:

When I went over Q1 activity, I went through a lot of stuff, like why I wasn’t so convinced with David Tepper’s decision to increase his holdings of Micron Technology (

MU ). It turns out I was right:

Still, Tepper significantly increased his stake in Micron again in Q2 and is the fifth largest institutional holder of the stock.

Maybe there is a bounce to be played here but I wouldn’t buy and hold it, that’s for sure.

Shares of Micron Technology (

It’s a tough market and even hedge fund gurus can get their stock picks wrong.

Still, as I stated last week in my comment on the confounding market, you can’t throw in the towel on semiconductor stocks but you need to pay attention to them:

[…] semi stocks (

SMH ) are getting knocked off their perch and some market watchers think it’s the canary in the coal mine.Looking at the 5-year chart, I’m not worried yet, but definitely keeping a close eye on semis as I do believe they can get hit more if global growth continues to deteriorate.

Lastly, on global growth, Colby Smith of the Financial Times reports, The EM rout is not made in America:

As Turkey, Argentina and South Africa have come under pressure in recent months, many market watchers have blamed the Federal Reserve’s tightening timeline. Yes, higher US interest rates do raise the cost of borrowing and put upward pressure on the dollar. But what’s really driving emerging market pain has less to do with the Fed and more to do with domestic fundamentals and the global business cycle.

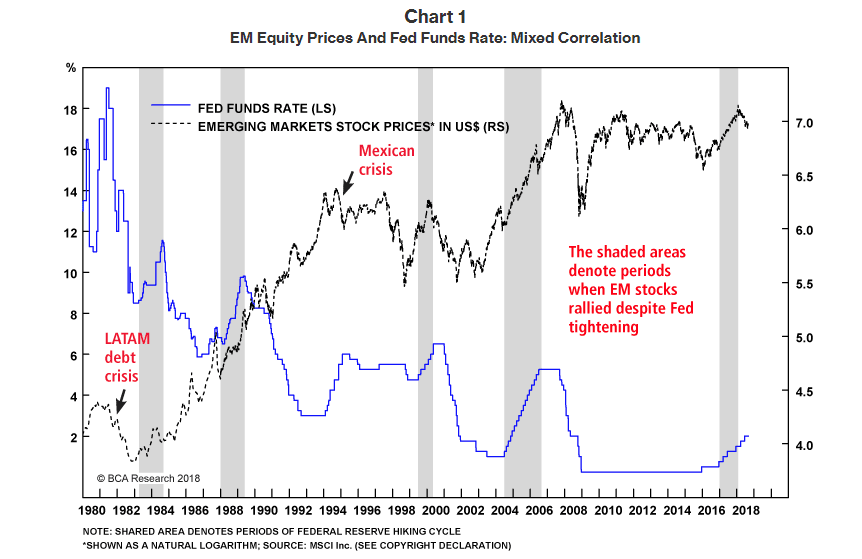

According to BCA Research, the correlation between EM risk assets and the fed funds rate is not that tight. In fact, there have only been two episodes since 1980 when emerging markets cratered as US interest rates ticked higher. And during both —the 1982 Latin American debt crisis and the 1994 Mexican Tequila crisis—the combination of high external debt, substantial current account deficits and pegged exchange rates laid the foundation for an unravelling. As indicated by the shaded grey areas, EM stocks and currencies have been more likely to perform well as the Fed tightened monetary policy:

What distinguishes these periods from 1992 and 1994 is basic domestic fundamentals. In other words, if an emerging market is on sound financial footing, the Fed’s policy stance has minimal impact. During the debt crisis of 1997-8, imports grew in the US and Europe, Treasuries yields fell and equities in the US were in a bull market. Here’s how the S&P 500 moved with stock prices across Asia stocks between 1993 and 2000:

Most emerging-market economies thrived. The ones that didn’t had bigger external imbalances.

The hardest-hit emerging economies today share many of the same weak fundamentals that have sunk developing markets in the past: dual deficits, runaway inflation and a heavy reliance on external funding. But beyond domestic fundamentals, what drives emerging markets if not the Fed?

China.

Displacing the US, China has become the main export destination for many emerging market countries — Brazil, South Africa, Malaysia and the Philippines. The relationship has become so pronounced that China’s import growth correlates closely with the export growth for many emerging economies. While this does not imply causation, TS Lombard points out that it illustrates just how synchronised global trade has become with Asia’s biggest buyer:

That linkage has become more problematic as China’s growth slows. In August, the Caixin manufacturing PMI index fell to a 14-month low as new orders dried up. And as China attempts to delever, constrained credit growth has curbed investment in capital-intensive infrastructure projects. Emerging markets and G10 economies are already beginning to feel pinched. Here’s a chart from Citi showing China’s weight on the rest of the world:

Unfortunately for emerging markets, the world’s second-largest economy is unlikely to see a reprieve anytime soon. The US is finalising plans for another round of tariffs on $200bn of Chinese imports. And this week, President Trump warned that additional levies on the remaining $267bn could come soon after that.

This is what worries David Tepper, an all-out trade war with the US can hit China and emerging markets’ exports hard.

And even though emerging market stocks (

I’d also be very careful with that BCA chart showing a weak correlation between EM risk assets and the fed funds rate. We weren’t on the precipice of a full-blown trade war back then and China wasn’t the main driver of emerging markets’ export growth.

Keep your eyes peeled on the US dollar (

There has been a bit of a pullback in both, giving emerging market risk assets some breathing room, but if all hell breaks loose, I expect the US dollar and US long bonds to rally concurrently, which isn’t the norm but when global investors are scared, they flock to US assets (which is why US stocks have outperformed global stocks so much this year).

Below, Appaloosa Management’s David Tepper said that tariffs on China were a “blunt” move for the Trump administration, but that maybe it was the right move because it is for the “future of our country”. He also said the stock market may endure a little pain with tariffs on China, but that the markets will eventually adjust.

It remains to be seen just how painful the adjustment will be and that in my opinion depends on how much the Fed tightens given what is going on in emerging markets.