J.P. Morgan’s Executive Director Shares Her Secret for Investing in Emerging Markets

At the Strategic Investment Conference 2018, Gabriela Santos, Executive Director at J.P. Morgan Asset Management, compared the potential of the US and international markets in terms of equity returns.

J.P. Morgan projects 5.5% annualized for US equities over the next 10 years. Meanwhile, Japan is projected to return 6% and emerging markets (EM) around 8%. But that’s assuming today as a starting point.

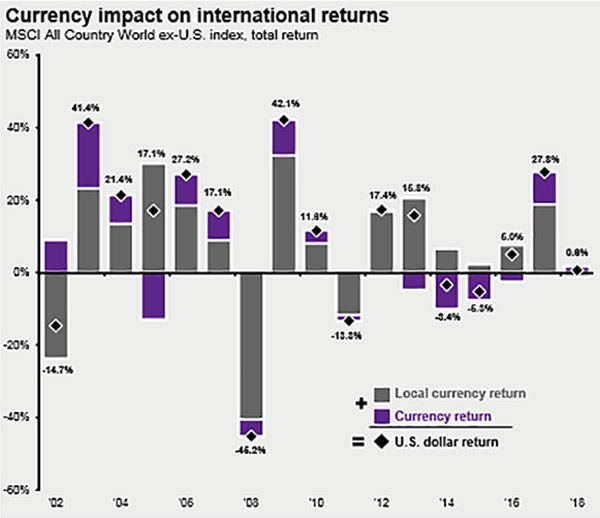

Santos stressed that the entry point and currency can make a huge difference on returns, so they can vary a lot. The chart below that she shared during her speech illustrates the currency impact on international market returns.

Source: Mauldin Economics

Source: Mauldin Economics

For instance, a weak dollar may help US investors who hold foreign stocks. Likewise, the depreciation of another market’s currency could hurt US investors. But the aggregate effect can vary.

Emerging Markets Show Promise

Gabriela Santos then turned to emerging markets. She showed a chart of what she calls her EM “growth alpha,” the difference between the outlook for developed markets (DM) growth and EM growth.

When it’s shrinking, it’s a terrible time to invest in EMs. When it’s growing, it’s a good time to buy EMs.

Santos noted that we need stability in several areas such as currencies and commodities to reach the full EM outperformance.

Most people think of EMs as being markets and economies in Asia. And that is partially true. But there are regions beyond Asia that will outperform—in particular, Latin America.

Santos argued that Latin America today has the best starting point in terms of growth. She thinks that this year, the region will finally return to its earnings potential.

In 2016, the seed of future growth was planted and now is time to harvest the returns.

Get Live Updates from the Strategic Investment Conference 2018

Learn from 25 top financial experts, best-selling authors, and investment professionals as they discuss their best investment ideas and predictions for the economy, financial markets, and geopolitical relations. Tune in to the SIC 2018 live blog now!