However, another Keynes’ book titled “The General Theory of Unemployment, Interest, and Money” became one of the most influential economics books in history, presumably because of its lack of clarity (as the scoffers say). The book is the bible of Keynesian economics, as it allegedly explains why the unemployment may persist in the free market economy. According to Keynes, the key to reducing unemployment is to increase government spending and to run a budget deficit. It goes without saying that governments, which always look for excuses to increase spending, wholeheartedly accepted Keynes’s views. Actually, the governments bastardized Keynes’s arguments, as he proposed running fiscal deficits only during bad times (and surpluses during good times) – while they run deficits practically all the time.

Keynes and Gold

What was the Keynes’ impact on gold? Well, there was hardly any direct influence, as Keynes died in 1946, several years before the price of gold started to freely fluctuate. However, Keynes’ indirect impact was enormous.

Firstly, as the leader of the British delegation, Keynes played a prominent role at the Bretton Woods Conference in 1944 that established the Bretton Woods system. As the system was inherently unstable, it eventually collapsed in 1971, which made gold prices rally.

Secondly, Keynes has revolutionized economics (although Hayek, one of the Keynes’ most prominent critics, would say that he actually stopped or even reversed the development of the discipline), challenging the neoclassical economics and the laisser-faire approach which dominated until the Great Depression. As Keynesian economists advocate the active use of fiscal policy, gold may benefit from Keynes’ great influence in economics and policymaking. The example may be the rise in gold prices after the Keynesian economic policies undertaken in response to the Great Recession by President Obama.

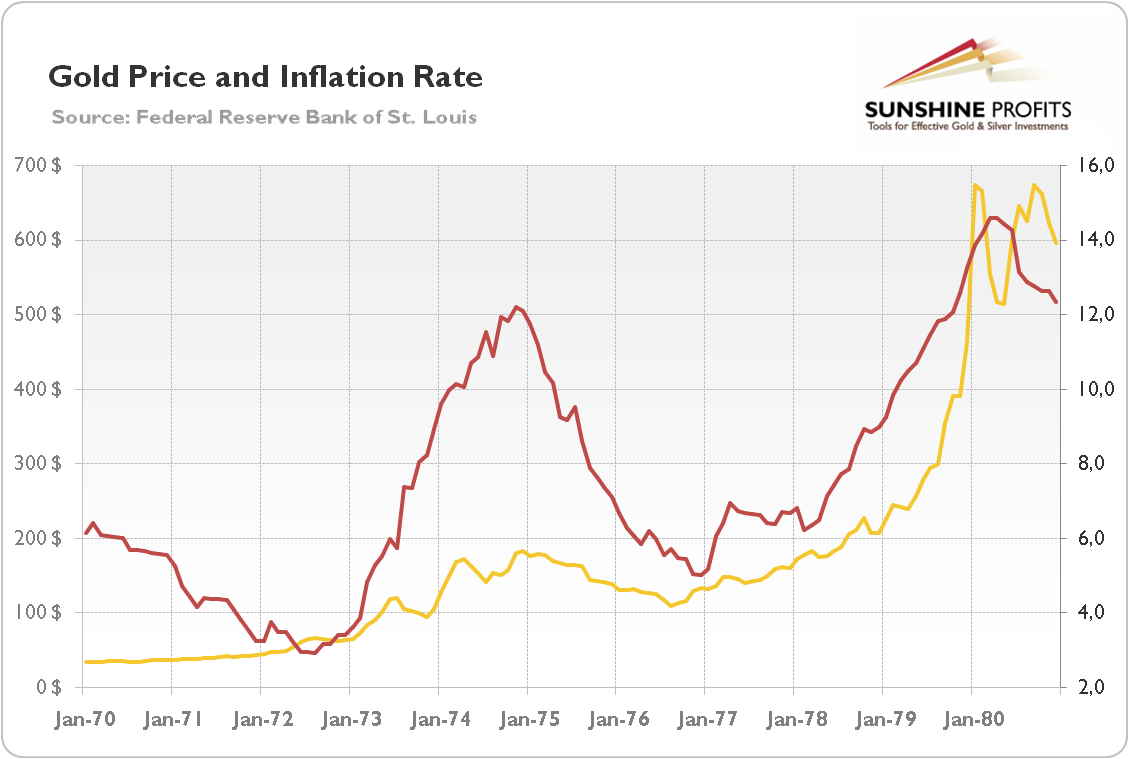

But the best example is perhaps the 1970s, where the gold prices rallied during stagflation (see the chart below), which was totally ignored by the Keynesian economists, as they naively believed in the Philips curve, i.e., in negative relationship between the unemployment and inflation.

Chart 1: Gold prices (London P.M. Fix, in $, monthly averages) during the stagflation from the 1970s.

Thirdly, Keynes believed that gold was the “barbarous relic”. Some investors mistakenly think that he advised against investing in the yellow metal, but Keynes referred to the gold standard. He meant that governments did not follow the rules of the gold standard, as they did not want the restriction imposed by such system. So in the 1920s, when Keynes coined his famous term, the gold standard was practically dead – it was killed by the governments. So Keynes simply described the reality when he wrote: “In truth, the gold standard is already a barbarous relic.”

We encourage you to learn more about the gold market – not only about the link between John Maynard Keynes and the yellow metal, but also how to successfully use gold as an investment and how to profitably trade it. Great way to start is to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!