Is Gold a Hedge against Trump’s Impeachment?

Gold is showing impressive resilience to an unfavorable macroeconomic environment. Does it mean that investors are buying gold as a hedge against the risk of Trump’s impeachment?

As we repeated, the macroeconomic outlook seems to be rather bearish for the yellow metal. The pickup in real interest rates and the U.S. dollar are usually negative drivers in the precious metals market, but gold has shined this year so far. One of the reasons for such a development is the uncertainty about Trump’s policies. After his conciliatory acceptance speech in November, the price of gold plunged. However, the subsequent aggressive diplomacy, chaotic decisions and conflicts with the press boosted gold prices. There is also a risk that the “investors’ anticipation of a boost to earnings from a cut in corporate taxes or more expansionary fiscal policy (…) might not materialize”, as was pointed out in the recent FOMC minutes. Some analysts even suggest that gold has been pricing in Trump’s impeachment. Is that true?

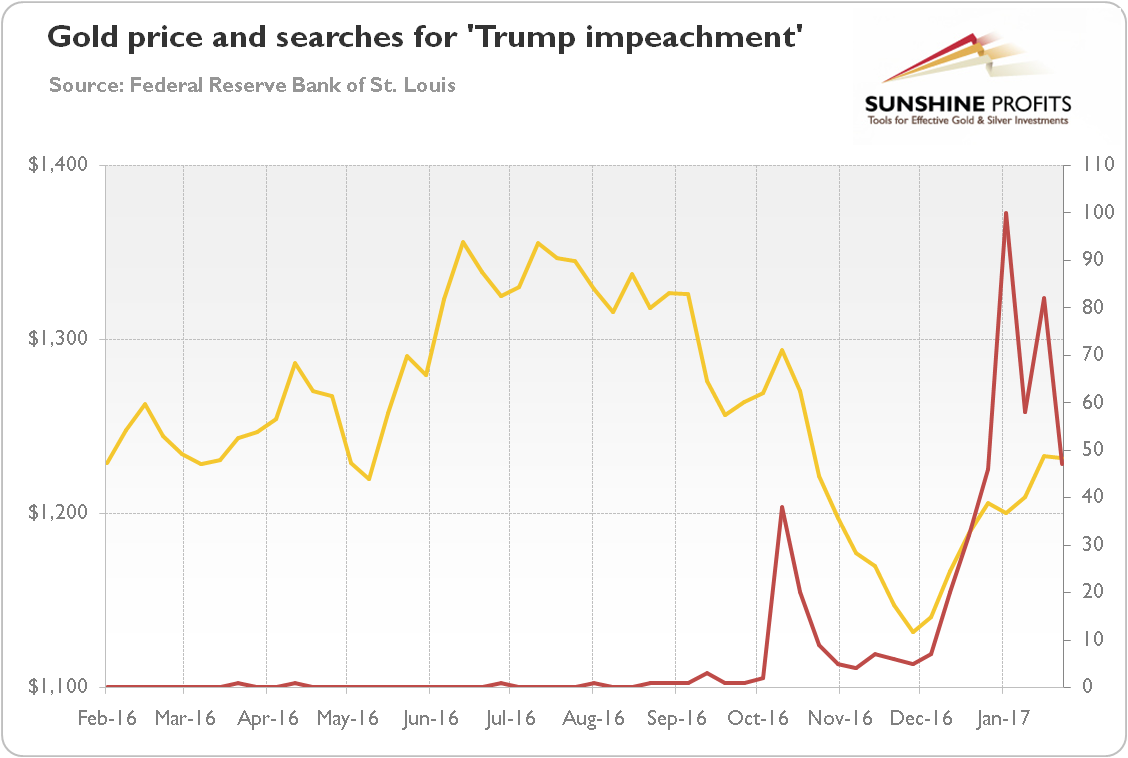

Well, indeed, the worldwide Google searches for the term ‘Trump impeachment’ skyrocketed in January, as one can see in the chart below.

Chart 1: The price of gold (yellow line, left axis, London P.M. Fix, weekly averages) and Google searches for ‘Trump impeachment’ (red line, right axis) over the last 12 months.

The rise clearly coincided with the jump in gold prices. However, the correlation is far from being perfect. The searches peaked at the end of January, while the price of gold continued its rally. However, the surge in searches for “Trump impeachment” reflects the general uncertainty about the new administration, which is supporting the shiny metal. One of the risks associated with Trump is that he could be impeached, because of his alleged ties to Russia and possible conflicts of interest with his businesses. That risk is very low, as the Congress is dominated by Republicans (but do they really want Trump as president?). However, investors tend to overweight very low probability events, which may partially explain the recent rally in gold prices.

The bottom line is that the yellow metal seems to be diverted from its fundamentals due to political uncertainty about the new administration. Markets are now hyper-focused on Trump. The worries about his actions are growing, replacing the previous euphoria. Investors are worried about Trump’s aversion to a strong greenback and that he may not deliver the tax cuts, because of an impeachment, for example. Hence, it seems that unless Trump softens his stance or investors get used to it, gold will be supported. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview