How to Deal with Headwinds for Commodities and International Stocks

Global economies outpaced growth expectations in 2017, resulting in rising interest rates worldwide as bonds became less attractive. As foreign long-term yields closed the gap with U.S. yields, the dollar weakened against a basket of foreign currencies, says Joon Choi.

During this 13-month period from January 2017 to January 2018, PowerShares DB US Dollar Index Bullish Fund (UUP) actually had a correction of 13% (its first correction since 2011). However, the dollar has rallied in the past two weeks. In this article, I want to discuss how to prepare for a potentially much stronger dollar.

Dollar Breaks Out

I have been monitoring the U.S. dollar for the last couple of months and it seems to have broken out a few weeks ago.

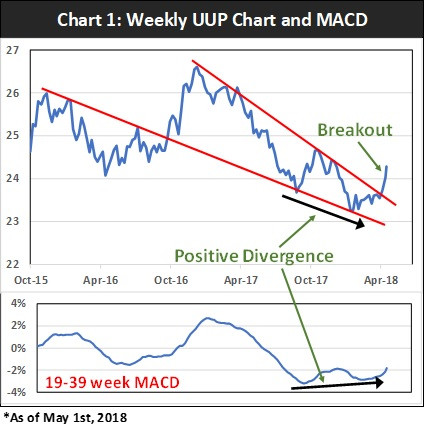

The weekly UUP chart had been trading in a downward wedge over the past year which was a bullish sign for the dollar as sharp reversals usually take place after such a formation (Chart 1). In addition, the 19-39 week MACD of UUP made a higher low, leading to a positive divergence well before the breakout in recent weeks.

UUP Target Price

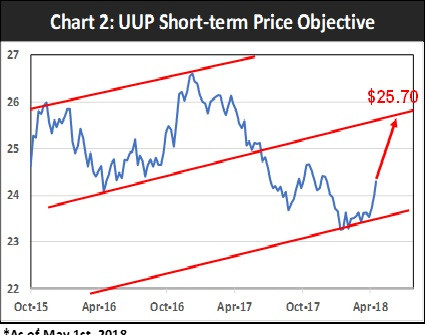

I believe the dollar will continue to trend up, albeit not straight up, similar to recent weeks.

The short-term price objective of UUP is $25.70 which will take the ETF up to the upper trading channel.

This move may take a few months and there is a possibility that the dollar may strengthen further beyond the target price.

Recommendation

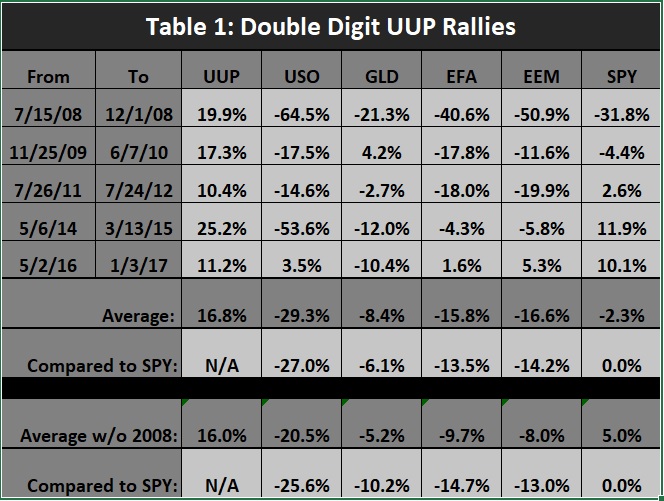

UUP has rebounded 5% from the three-year low in early February and the positive divergence formation between the price and its MACD may be an indication that further dollar strength is on the horizon.So, I analyzed the five periods when UUP rose more than 10% in the past 10 years.

Commodities such as oil, United States Oil Fund (USO) and gold, SPDR Gold Shares (GLD), did not fare well as their average losses were 29.3% and 8.4% (Table 1).

International ETFs such as iShares MSCI EAFE Index Fund (EFA) and iShares MSCI Emerging Markets Index Fund (EEM) also underperformed during strong dollar rallies; they lost 15.8% and 16.6% respectively while SPY only lost 2.3%.

I calculated the average gains without the 2008 figures since the large losses incurred in this period could distort the figures.

The four ETFs above still underperformed SPDR S&P 500 ETF Trust (SPY) by at least 5.2% and as much as 20.5%.

Conclusion

The U.S. dollar may be on the brink of a major rally if the bullish formation in the UUP weekly chart signals a trend reversal of multi-year weakness in the currency.

The five most recent periods of double digit UUP rallies suggest that you should be invested in SPY instead of international stocks and commodities. Therefore, it may be prudent to stick with SPY for the next several months.

Joon Choi is senior portfolio manager, research analyst at Signalert Asset Management.

Subscribe to investment newsletter Systems and Forecasts here

About MoneyShow.com: Founded in 1981, MoneyShow is a privately held financial media company headquartered in Sarasota, Florida. As a global network of investing and trading education, MoneyShow presents an extensive agenda of live and online events that attract over 75,000 investors, traders and financial advisors around the world.