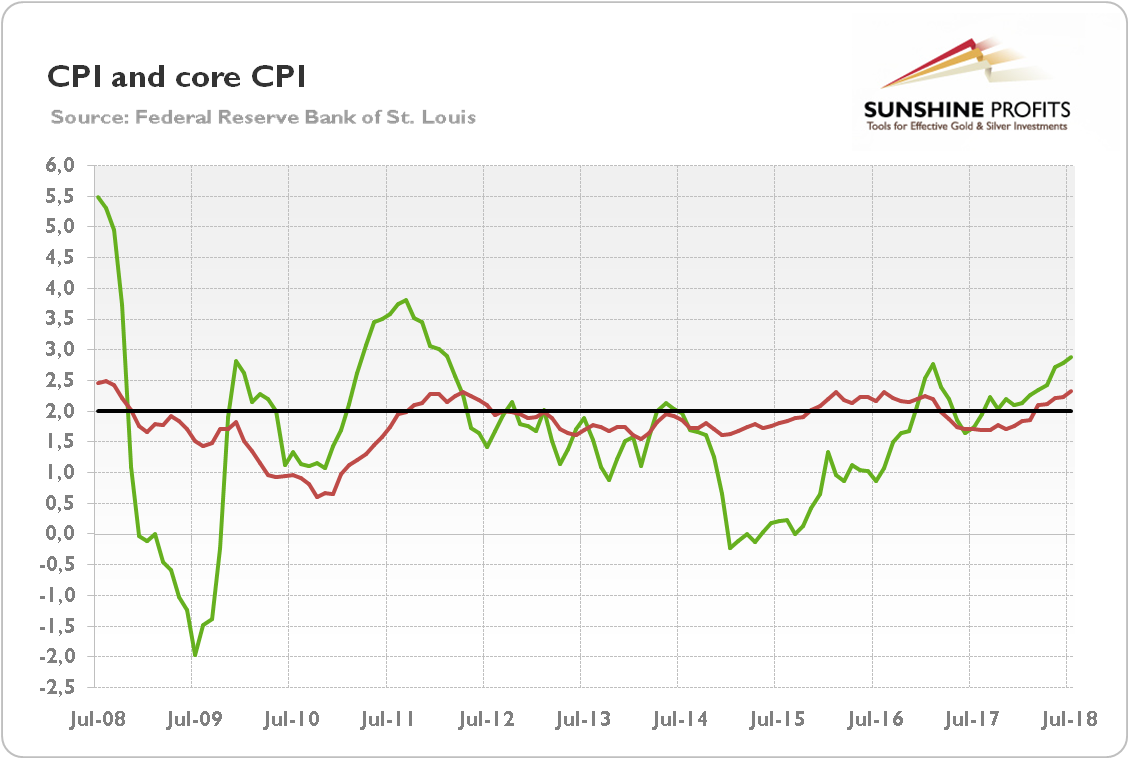

Annual core CPI jumped 2.4 percent, the fastest pace since September 2008. Is it the peak – or just the beginning of inflation? And what does it mean for the gold market?

What Happened?

On Friday, the BLS released its latest report on inflation. It showed that the Consumer Price Index increased 0.2 percent in July, following a 0.1 percent uptick in June. The core index, which excludes food and energy, rose 0.2 percent for the third month in a row. Over the last 12 months, the CPI rose 2.9 percent, the same as in the previous month. But the core CPI accelerated and jumped 2.4 percent. This was the largest annual increase since September 2008, as one can see in the chart below.

Chart 1: U.S. CPI (green line, annual % change) and core CPI (red line, annual % change) from July 2008 to July 2018.

This indicates that inflationary pressures strengthened in July. Interestingly, monthly inflation remained unchanged despite that 0.5 percent fall in energy prices. The 0.3 percent rise in the shelter index, which is a dominant component of the CPI, offset the decline in the energy index. This is also why the core index accelerated.

Although some people see rising inflation as a sign of a healthy economy, it is worth noting that it undermines the consumers’ purchasing power. Indeed, real wages have stagnated recently.

Have We Seen the Peak?

After the core CPI accelerated to the fastest pace of growth since September 2008, some experts started to worry about rising prices, while other claimed that it was likely that we had just seen the peak in inflation. Who is right?

Well, take a look at producer prices. On an annual basis, the PPI jumped 3.3 percent in July, the highest level since 2011. Importantly, the tariffs on Chinese goods should support the price pressure in the coming months. Hence, a further increase in inflation wouldn’t surprise us, but it should be temporary and moderate, unless we see a full-blown trade war. If we avoid such a conflict, trade patterns should adjust to the new reality and then new capacity would spring up in new places, keeping prices under control.

Implications for Gold

What does it all mean for the Fed’s policy and the precious metals market? Well, the Fed should become more hawkish in the face of rising inflation, shouldn’t it? Not necessarily. Investors should remember that the inflation target of the U.S. central bank is symmetric. On the one hand, it means that the Fed is symmetrically concerned about too low and too high inflation. But it also implies that the FOMC members will not overreact to deviations from the target, no matter whether to the downside or the upside, at least as long the medium-run path of inflation converges to the target. As Charles Evans has recently said in an interview:

Inflation moving up to, say, 2.25% would not be troubling at all, and even 2.5% as long as that is expected not to accelerate, could well be consistent with symmetry of our 2% objective.

He also stated that:

We don’t have to win the war on inflation over again because we did that in a very difficult costly and arduous fashion in the eighties and into the nineties.

Thus, the Fed should remain on track to gradually raise interest rates. It tolerated – read: it was unable to do something about it – subdued inflation rate for years, so it shouldn’t overreact to the CPI rate above the target, at least unless the overshooting becomes really big. As a reminder, the Fed expects that the PCE inflation will be 2.1 percent this year. In June, that index rose to 2.2 percent, not very far above the Fed’s forecast.

Hence, we would not expect a rally in gold prices. The yellow metal needs high and accelerating inflation, not slowly creeping inflationary pressures. Without runaway inflation, the sideways trend may remain in force. And if we get higher interest rates, as they should finally return to more normal levels, it may transform into a more bearish pattern. The current Fed tightening is unusually gradual, while the unemployment rate is very low. More hikes are possible. The combination of higher rates, as the Fed’s actions could finally transmit into higher long-term yields, and moderate inflation is nothing but negative for gold prices. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor