GBP/USD: Skating on Thin Ice

- GBP/USD is trading on lower ground as the dust settles from a critical poll.

- Political developments on both sides of the Atlantic are set to move cable.

- Black Friday’s technical chart is painting a mixed picture.

A meltdown may be an exaggerated term for cable’s retreat from the highs – but that is what has physically happened in Channel 4’s studios in the climate debate. Prime Minister Boris Johnson had refused to take part in the panel of party leaders, and the broadcaster placed an ice sculpture reading “Conservatives” in his place.

The controversy tops the campaign agenda 13 days ahead of the elections, but traders are more focused on opinion polls and their interpretation. YouGov’s Multilevel Regression and Post-stratification (MRP) has been making more waves. The topline numbers showed a landslide victory for the Conservatives—a market-friendly outcome—and the pound shot higher on Thursday.

However, a closer look has shown that many seats are up for grabs and a small shift may result in Johnson falling short of a majority. Labour leader Jeremy Corbyn is fighting back and the opposition has a better ground game according to analysts. Investors fear Corbyn’s radical economic policies.

New opinion polls today and over the weekend will be of interest as well as statements from politicians in all parties. A polling tracker from Britain Elects shows a 12.8-point lead for the Tories.

Outside the elections

GfK’s Consumer Confidence measure has shown that Brits’ sentiment is at the lowest level since 2010, in the wake of the financial crisis. The data has failed to move sterling, which is focused on the elections. However, it may come to haunt the pound after December 12.

Currency movements have been subdued as US traders enjoyed their Thanksgiving holiday and perhaps shopped on Black Friday instead of participating in an abbreviated trading session. Markets have been leaning lower as the row between the US and China over Hong Kong remains unresolved.

Trump, who made a surprise visit to Afghanistan, angered Beijing by signing a bill supporting the pro-democracy movement in the city-state into law. Trade talks continue ahead of the administration’s self-imposed deadline to slap new tariffs on China on December 15.

Overall, UK politics is set to dominate trading.

GBP/USD Technical Analysis

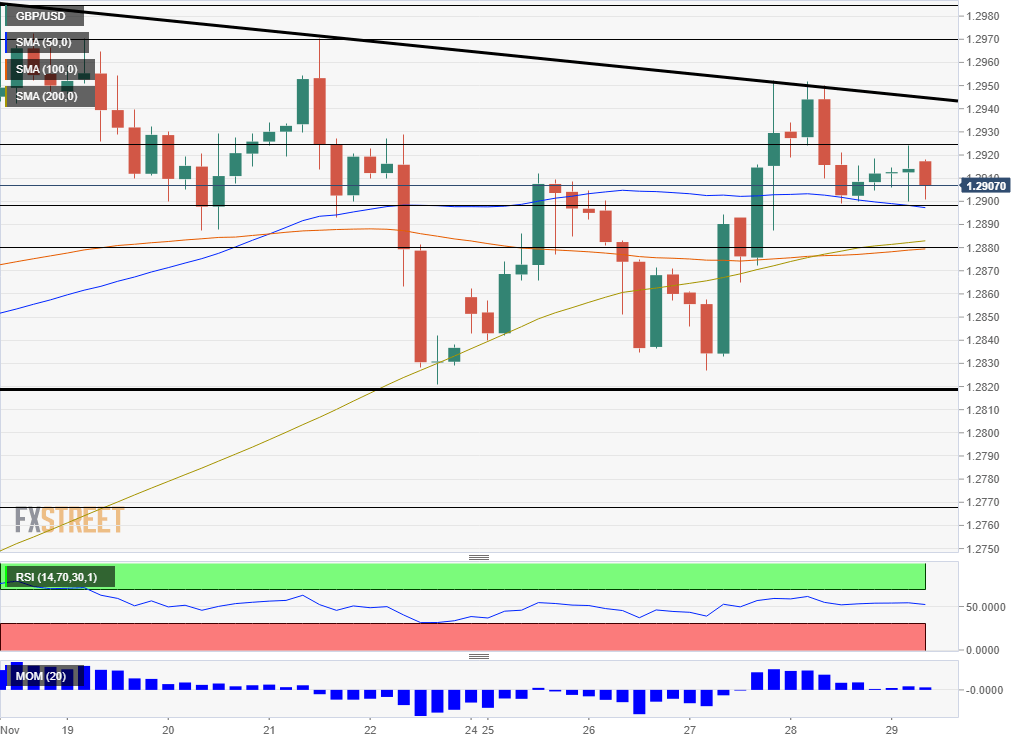

Pound/dollar has been rejected at the downtrend resistance line and is clinging onto the 50 Simple Moving Average on the four-hour chart. Upside momentum has waned. Overall, the bullishness has faded away and the picture is mixed.

Support awaits at 1.2895, which provided support early in the day and converges with the 50 SMA. It is closely followed by 1.2880, which is the confluence of the 100 and 200 SMAs. Next, we find 1.2820, a stubborn support line.

Resistance awaits at 1.2925, the daily high, followed by 1.2940, which is where the downtrend resistance line meets the price. Next, 1.2970 was a swing high and 1.2985 is November’s high point.

_____

Equities Contributor: FXStreet

Source: Equities News