GBP/USD: Falling Amid Speculation of New Elections

- GBP/USD has been falling amid speculation of new elections.

- Fears of a hard Brexit and the intensifying trade war are set to weigh.

- Monday’s technical picture looks favorable for sellers.

UK PM Boris Johnson said he only wants to fulfill a campaign promise – but political analysts have been suspecting that his decision to inject £1.8 billion in the National Health Service (NHS) is a political move ahead of fresh elections. Johnson’ s previous cabinet appointments and statements were also seen as moves toward holding a snap vote – and uncertainty weighs on the pound.

Moreover, the PM’s senior adviser Dominic Cummings – considered as the “mastermind” behind the Vote Leave campaign – has said that the government may bypass parliament and head to a no-deal Brexit. The staunch Brexit supporter’s quotes in The Telegraph have weighed on sentiment.

And from one 2016 event – Brexit – we swiftly move to another ramification of that year’s other political shocker – the election of Donald Trump as President of the US. After Trump surprised markets by new tariffs on Chinese goods, the world’s second-largest economy is striking back. China let its currency fall with one dollar now buying over seven yuan – a line that was considered politically sensitive. Moreover, there are reports that Beijing will halt buying of US agricultural goods. Trade tensions have push money into the safety of US bonds – thus making the greenback less attractive. The battle continues.

On the other hand, sterling received a boost from Markit’s upbeat services purchasing managers’ index. The indicator came out at 51.4 points, reflecting a pickup in growth. Nevertheless, it remains at low levels.

Later today, the US ISM Non-Manufacturing PMI is due to show an improvement in America’s largest sector. However, FXStreet’s Surprise Index is pointing to a potential disappointment.

Overall, politics are dominating the scene, with brief periods of impact from services sector figures.

GBP/USD Technical Analysis

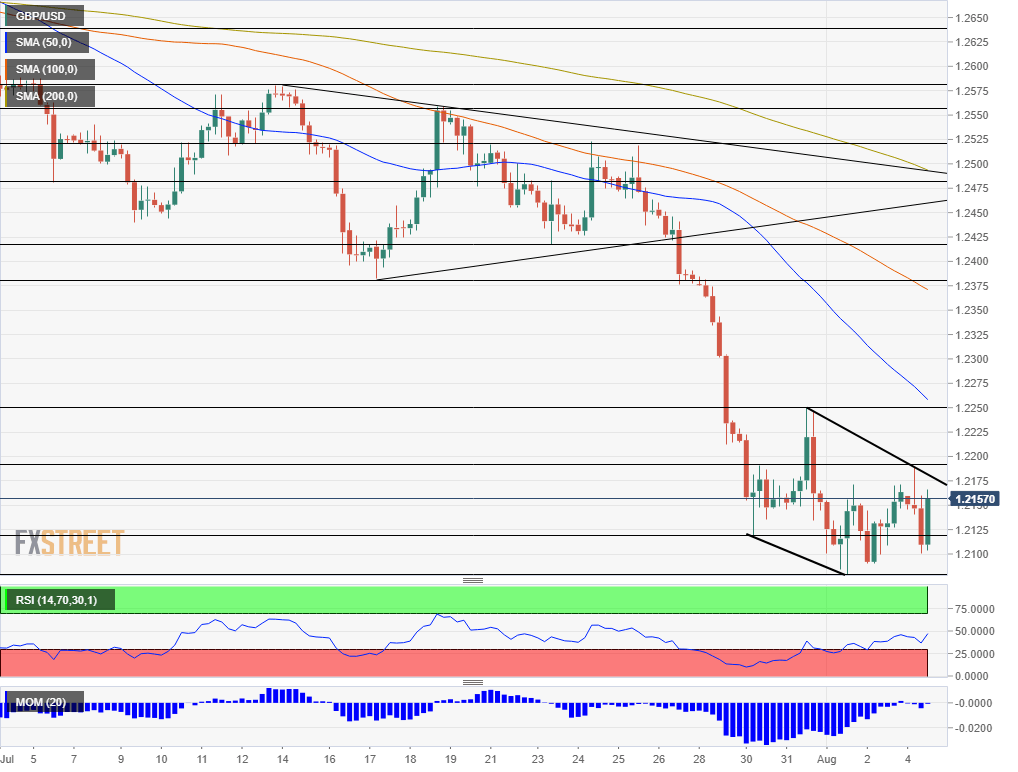

GBP/USD is trading within a downtrend channel in the past few days and it remains below the 50, 100, and 200 Simple Moving Averages. On the other hand, downside momentum is waning.

All in all, the technical picture is moderately bearish.

Some support awaits at 1.2120 which was the initial post-crash low last week. Further down, the fresh 2019 trough of 1.2075 is the next line to watch. Lower, 1.1985 and 1.1866 are eyed.

Looking up, 1.2185 is the daily high. It is then followed by last week’s post-crash recovery attempt of 1.2250. The next resistance line is only at 1.2380.

Equities Contributor: FXStreet

Source: Equities News