GBP/USD: Boris Johnson’s Big Lead, Trade Hopes, Improve Outlook

- GBP/USD has been recovering amid upbeat polling for the Conservatives.

- Trade and election headlines will likely set the tone for cable.

- Monday’s four-hour chart is reflecting weakness.

Nightmare on Downing Street on Friday the 13th? These have been Prime Minister Boris Johnson’s most colorful words over the weekend, in an otherwise quiet launch to his Conservative Party’s manifesto — and it seems to work for him.

GBP/USD has been recovering from the drop it suffered on Friday, with investors seeming to prefer an outright majority for the market-friendly policies of the center-right party and a clear path on Brexit.

The current PM has probably learned the lesson from his predecessor, Theresa May, who lost the party’s majority partly thanks to the infamous “dementia tax.” Johnson’s electoral program is featuring neither earth-shattering promises nor blunders.

The strategy seems to be paying off as opinion polls continue showing double-digit leads for the Tories against Labour, which trails behind despite radical promises in its own manifesto. Labour leader Jeremy Corbyn’s upbeat performance in the televised debate with Johnson also has been insufficient. Britain Elects’ polling tracker shows a 12.8% advantage with one poll reflecting a whopping 19-point gap in favor of the ruling party.

With 17 days to go until Brits go to the polls and only one day before registration to vote closes, politicians will be on the campaign trail. Statements, gaffes and new surveys will all move the pound.

Trade deal coming?

Politics are also set to dominate the dollar side of GBP/USD. China has announced it will slap heavier penalties on companies that violate Intellectual Property (IP) rules, which in turn will become stricter. IP theft has been one of the thorniest topics in US-China negotiations, and markets see Beijing’s move as an olive branch.

Moreover, optimistic comments about striking a deal have been in abundance. The upbeat risk-on mood is boosting sentiment and pushing the safe-haven US dollar down.

Trump has so far refrained from signing a bill that supports pro-democracy protests in Hong Kong. The city-state’s political woes have also played into trade talks between the world’s largest economies.

Hong Kong citizens voiced their support for change in local elections over the weekend, by overwhelmingly backing anti-establishment candidates in a peaceful event. The relative calm is also boosting sentiment.

Overall, British politics and trade talks are positive for the pound so far.

GBP/USD Technical Analysis

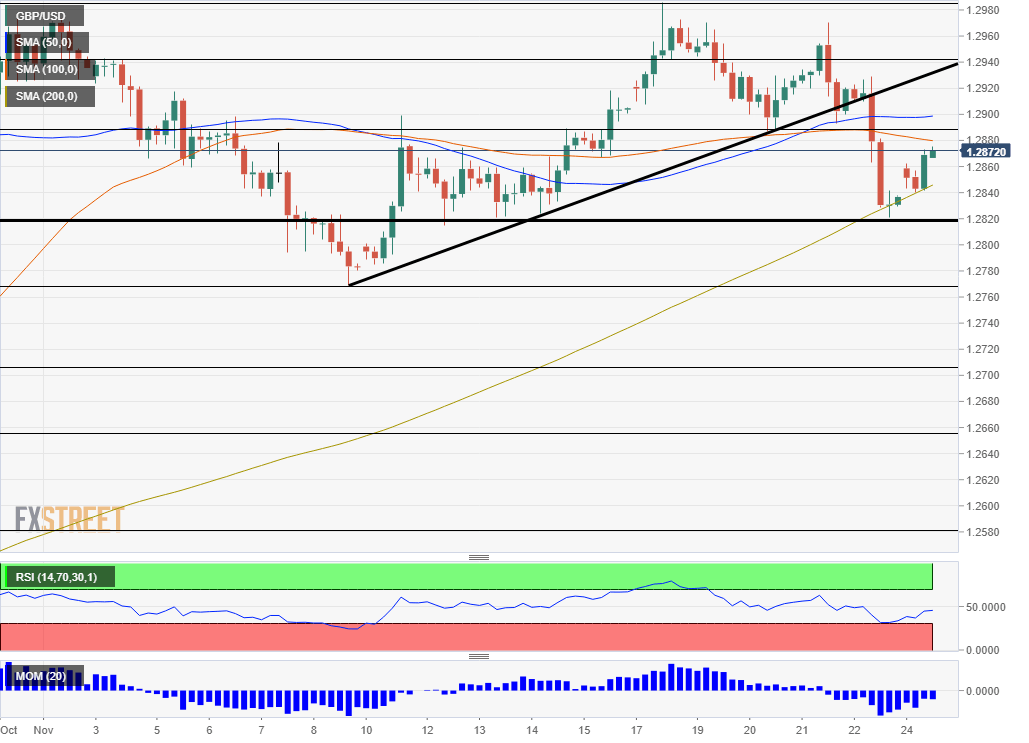

Sterling has broken below the uptrend support line that has been accompanying it since early November – a bearish sign. It is also suffering from downside momentum on the four-hour chart. However, the pound managed to cling onto the mid-November cushion of 1.2820 and to rise above the 200 Simple Moving Average. The bears are in the lead, but not by much.

Below 1.2820, the next support line to watch is 1.2760, November’s low. Further down, 1.2705 and 1.2655 were both stepping stones on the way up.

Resistance awaits at 1.2890, which provided support last week, and also nearly converges with the 50 and 100 SMAs. It is followed by 1.2940, which held cable down in early November, and then by the November high of 1.2985.

_____

Equities Contributor: FXStreet

Source: Equities News