EUR/USD: Weak German Industrial Output Limits Trade War Gains

Image: BMW

- EUR/USD has been consolidating its previous gains as dark clouds gather.

- Weak German industrial output limits any gains related to the US-Sino trade wars.

- Wednesday’s technical chart is pointing to limited gains.

Schadenfreude– the German word for pleasure from others’ misfortunes – is hitting back at Germany and the euro. German industrial output has dropped by 1.5% in June and 5.2% year on year – significantly worse than expected. The euro zone’s locomotive is showing another sign of derailment just one day after factory orders beat expectations. The fresh data has been weighing on the common currency.

EUR/USD was previously supported by another intensification in the US-Sino trade war. Beijing has fixed the yuan at a lower value – with USD/CNY just below 7.00 – keeping up the tensions in the trade wars. While China is wary of a rapid fall in the exchange rate – a move that could trigger massive capital outflows – it seems keen to retaliate against the upcoming US tariffs.

In the US, White House economic adviser Larry Kudlow has expressed hope that trade talks would resume in September as planned. On the other hand, Vice President Mike Pence has signaled openness to slap sanctions on China due to violations of human rights in the Xinjiang region – upping the ante once again.

The greenback’s decline earlier this week came alongside the fall in US bond yields – which reflect an imminent rate cut by the Federal Reserve. However, the central bank may be less responsive than markets wish. James Bullard, President of the Saint Louis branch of the Fed, has said that the bank should not respond to every move in the trade war. Bullard is known as a dove – supporting looser monetary policy – and his surprising comments have helped the dollar stabilize. Later today, his colleague Charles Evans, President of the Federal Reserve Bank of Chicago, is due to speak.

A light calendar later today implies further developments in tensions between the world’s largest economies, and speculation about the prospects of the euro-zone economy are set to drive markets.

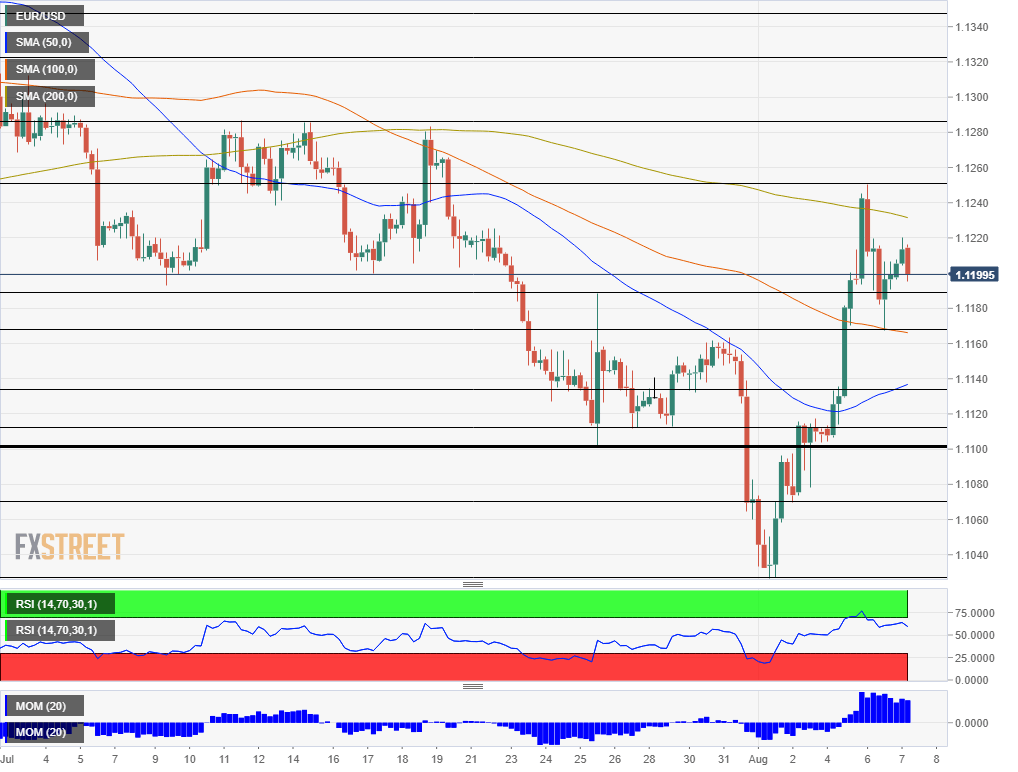

EUR/USD Technical Analysis

EUR/USD is enjoying upside momentum on the four-hour chart and traded above the 50 and 100 Simple Moving Averages – bullish signs. However, the currency pair failed to break above the 200 SMA. The technical picture is mostly positive.

Resistance awaits at this week’s peak of 1.1250. Next up we find the triple-top of 1.1285 which dates back to mid-July. It is followed by 1.1325 that held EUR/USD down early last month, and then by 1.1345.

Some support awaits at 1.1190, which was a swing high in late July. Next, we find 1.1165 that was a low point on Tuesday and 1.1135 which provided some support last week. 1.1110 and 1.1101 are next.

Equities Contributor: FXStreet

Source: Equities News