EUR/USD: May Bounce From Oversold Conditions

- EUR/USD has been struggling to recover after upbeat US retail sales sent it down.

- ECB officials’ concerns have also added to downside pressures.

- Monday’s four-hour chart portrays oversold conditions that may result in a bounce.

EUR/USD has been trying to lick its wounds and recover from two blows – so far with little success – and trades around 1.1200.

The first downside pressure came from the upbeat US retail sales report. Consumers in the world’s largest economy spent more than expected in May, with the all-important retail sales control group rising by 0.5%. Moreover, last month’s robust data came on top of upwards revision for April. GDP growth forecasts for the second quarter have been revised upward by official and private forecasters alike – consumption is critical to the US economy.

More importantly, the upbeat data triggers a revision of the dovish expectations for Wednesday’s Federal Reserve decision. Markets foresee a rate cut coming as soon as July, but the Fed is unlikely to rush to stimulate an economy which is seemingly firing on all engines.

The dollar’s reaction to the figures was slow and persistent, sending EUR/USD to 1.1200 at the end of a turbulent week.

And then came the European Central Bank.

ECB Vice President Luis de Guindos has said that the Frankfurt-based institution will act as inflation expectations are deteriorating. Benoit Coeure – another bank official which is usually restrained in his language – has said that market signs are “bleak” and that “risk may materialize.”

Both ECB members spoke at the eve of the bank’s annual conference at Sintra, Portugal. President Mario Draghi will deliver opening remarks later today and may touch on monetary policy. He has recently expressed concern that markets are pricing in more than a slowdown – but perhaps a change in the post-war order.

Speculation about both central banks will likely set the tone today.

EUR/USD Technical Analysis

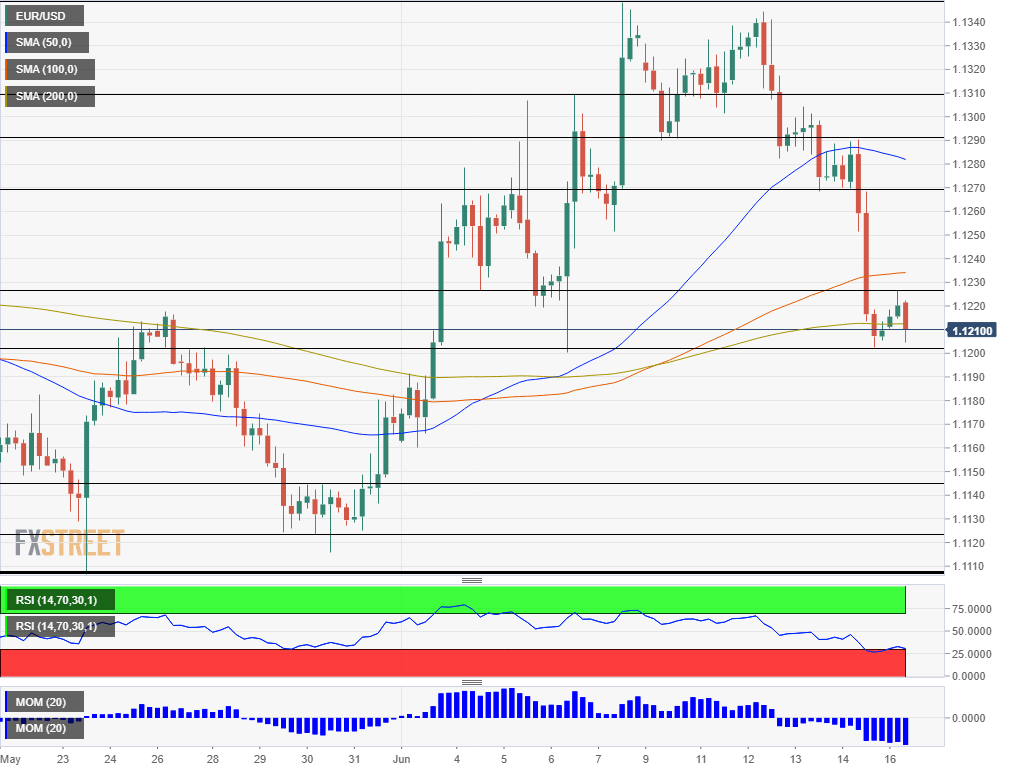

EUR/USD is entering oversold conditions according to the Relative Strength Index on the four-hour chart – which is just below 30 at the time of writing. The dip implies a chance of a corrective rebound – at least in the short term.

Other technical indicators are bearish. The pair slipped below the 200 Simple Moving Average after losing the 100 SMA on Friday.

Initial support awaits at the round 1.1200 level which was the low point late last week. 1.1145 capped EUR/USD when it was trading at lower in late May and now turns into support. 1.1125 was a support line around that time and the 2019 low of 1.1107 is next down the line.

Looking up, 1.1225 is the daily high and the first line of resistance. 1.1270 provided support before the recent downturn and caps the pair now. 1.1290 and 1.1310 are next.