EUR/USD: How Trade Wars Move the Pair

- EUR/USD has been rising amid a rise in Fed rate cut expectations.

- The US-Sino trade war continues topping the agenda.

- Tuesday’s technical chart is pointing to further, yet limited gains.

“Currency manipulator” is the label that the US has slapped on China for the first time since 1994 – but probably for the wrong reasons. The Treasury’s declaration late on Monday came in response to the world’s second-largest economy’s decision earlier that day. China allowed market forces to push the yuan to 11-year lows, with USD/CNY topping 7.00 – a move that was seen as an escalation in the trade wars and triggered a massive sell-off in equity markets.

And early today, China has responded by manipulating its currency – to the direction the US wants it to go – up. It is essential to note that while a weaker currency helps exporters and mitigates some of the effects of US tariffs, a free-fall of the yuan may trigger capital outflows that may endanger the economy. China’s fresh revaluation of the CNY – partially intended for its own protection – has helped stabilize markets.

Back to Monday, global stocks were free-falling, with the benchmark S&P suffering a 3% loss – the worst so far this year. The money flowed into bonds, and the lower yields reflected higher chances of the Fed cutting its interest rates in September. Fed Governor Lael Brainard has said that she is “monitoring the situation closely” – words that were interpreted as opening the door to reducing rates.

The drop of bond yields has weighed on the US dollar and sent EUR/USD to 1.1250 – the highest level since mid-July. China’s fresh revaluation has pushed yields higher and enabled the greenback to recover and euro/dollar to pare some of its gains.

The world’s most popular currency pair is mostly dependent on trade wars and their reflection in US bond yields, but traders should also note incoming European data – which has surprised for a change. German factory orders have risen by 2.5% in June – better than expected – and providing hope that Europe’s locomotive will exit its slump.

Later today, Fed officials James Bullard and Charles Evans will speak – both are doves. If they open the door to more cuts, the greenback may drop – but the fall may be limited as they will repeat their known positions. If they show no hurry for an imminent move – the dollar may extend its recovery.

Overall, US-Sino trade relations will likely dominate trading today.

EUR/USD Technical Analysis

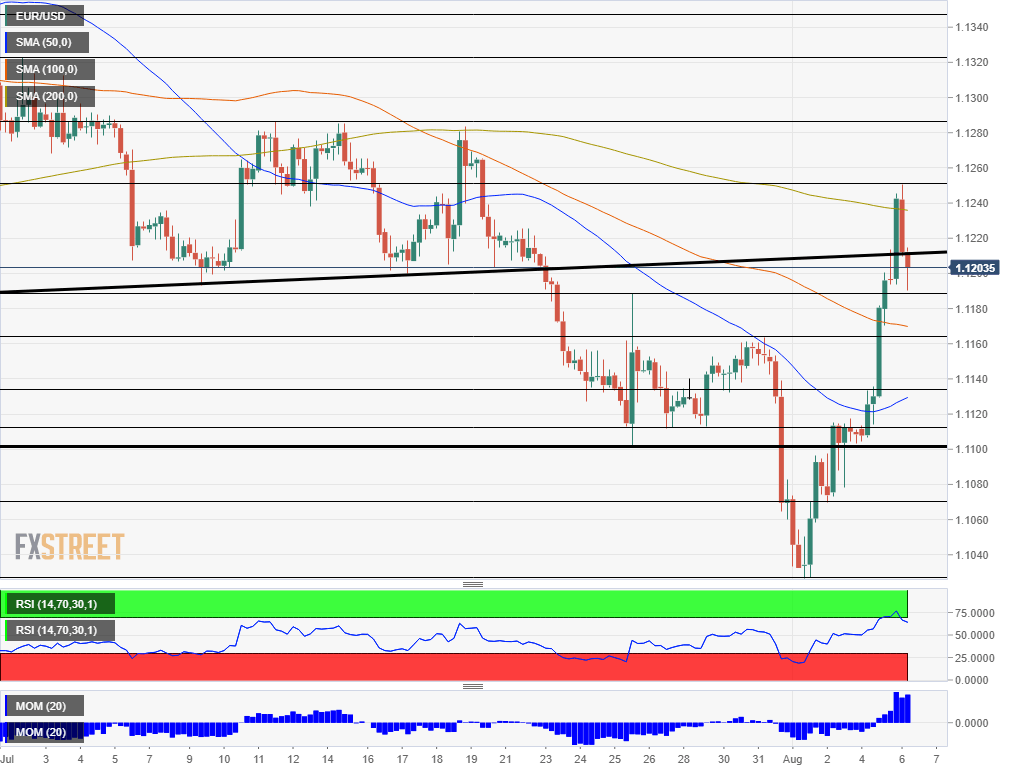

The surge in EUR/USD has temporarily sent the Relative Strength Index above 70 – indicating overbought conditions. However, the RSI dropped below that level – allowing for more gains. Momentum has turned positive and the pair trades above the 50 and 200 Simple Moving Averages.

All in all, the chart suggests the pair may resume its rise but may be halted by entering overbought territory again.

Resistance awaits at 1.1250 which was Monday’s high. It is followed by 1.1290 that capped EUR/USD three times in mid-July. Further up, 1.1320 was a swing high in early July.

Looking down, 1.1190 was a swing high in late July and now turns into support. 1.1165 capped it late last week, and 1.1135 provided temporary support around the same time. Lower, 1.1110, 1.1101, 1.1170, and 1.1027 – the 2019 low – provide a dense net of support on the way down.

Equities Contributor: FXStreet

Source: Equities News