EUR/USD: Hopeful for a Recovery After Setting Higher Lows

- EUR/USD has been attempting to recover after Friday’s US jobs report sent it down.

- Speculation about action from central banks is set to dominate price action today.

- Monday’s technical chart shows a series of higher lows – a lone bullish sign amid a bearish trend.

The Federal Reserve has 224,000 good reasons to ignore Trump and remain patient on interest rate cuts. The US economy gained that number of jobs in June – far above the 160,000 that was expected and the 120,000 that was feared.

The US labor market seems robust enough to prevent the Fed from slashing interest rates by 50 basis points at the end of this month or embarking on a long cycle of cuts. Some analysts even doubt the central bank will move forward with a single “insurance” cut.

Chair Jerome Powell will testify on Capitol Hill on Wednesday and Thursday, and markets are highly anticipating his comments. Trump has criticized the Fed for its tight monetary policy, saying, “It does not know what it is doing.” He has nominated two monetary policy doves to the bank’s Board of Governors. Christopher Waller, executive vice president at the Federal Reserve Bank of St. Louis, and Judy Shelton, who advised Trump in his campaign and previously supported a return to the gold standard – an unconventional pick.

Powell has remained fiercely independent, shrugging off the president’s criticism.

The greenback has reacted positively to the employment report, and EUR/USD has yet to recover. German industrial output has marginally missed expectations with an increase of 0.3% in May, but the euro zone’s largest economy enjoyed a broader than expected trade balance surprise of 18.7 billion euros. The mixed data has failed to cheer the common currency.

Euro traders are concerned about the next steps by the European Central Bank. The Frankfurt-based institution is set to introduce monetary stimulus amid falling inflation and trade concerns. ECB member Francois Villeroy de Galhau has reiterated the bank’s readiness to act over the weekend.

With few events scheduled on the economic calendar, markets will focus on speculation regarding the next policy moves.

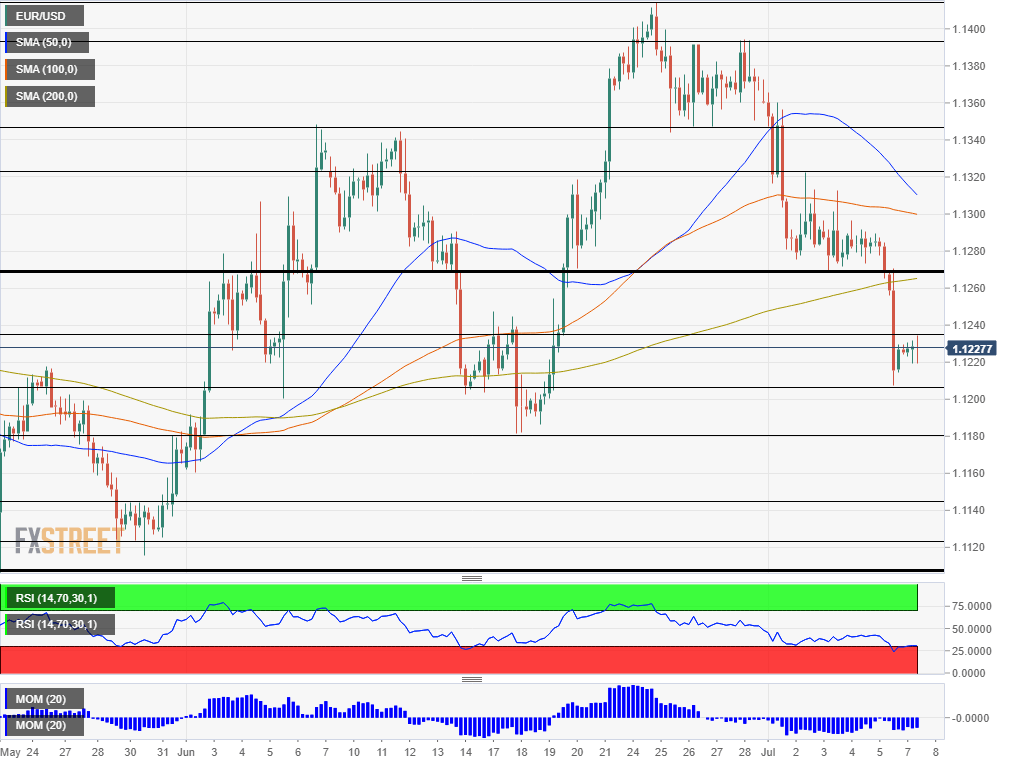

EUR/USD Technical Analysis – Higher Lows

The green arrows on the four-hour chart show higher lows – a bullish sign for EUR/USD. On the other hand, downside momentum persists and the currency pair trades below the 50, 100, and 200 Simple Moving Averages. Moreover, the Relative Strength Index (RSI) has risen above 30 –exiting oversold conditions – and indicating more drops ahead.

Support awaits at 1.1205, which was the low point on Friday. It is followed by 1.1180 that was the trough in mid-June. Further down, 1.1145 capped EUR/USD in late May and it is followed by 1.1125 and 1.1107.

Looking up, 1.1270 provided support in early July. Next up we find 1.1320 which capped it in both early July and mid-June. It is followed by 1.1350 which provided support in late June.

Equities Contributor: FXStreet

Source: Equities News