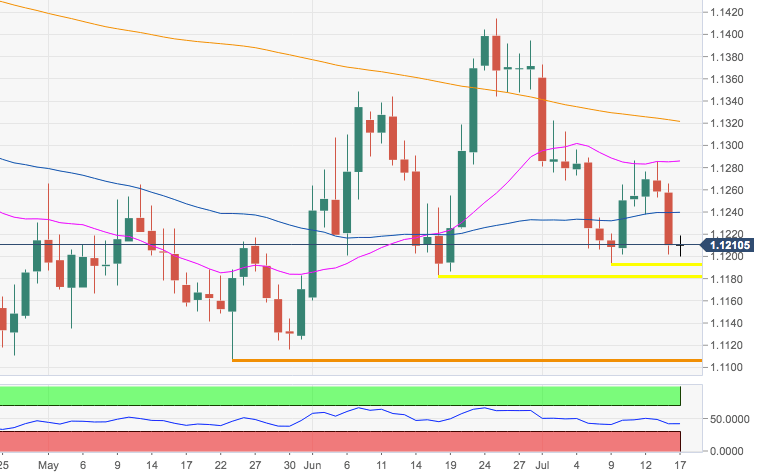

EUR/USD Forecast: Downside Pressure Persists

- The 1.1200 region holds the downside for the time being.

- EUR/USD remains under pressure and initially targets 1.1181/76.

- Economic slowdown in the bloc, ECB easing seen behind the sell off.

Recent disappointing prints from the German ZEW survey noted the slowdown in the euro area remains everything but abated. Poor results in the bloc have been giving at the same time extra ammunition to the ECB to embark on another wave of accommodative policy, including lower rates, a restart of the QE programme and changes in its forward guidance. That said, EUR is expected to remain under scrutiny and there is the tangible chance of a visit to 2019 lows near 1.1100 if the selling pressure intensifies.

Collaborating with the downside, the US economy remains in good shape despite stagnant inflation and omnipresent concerns over the US-China trade dispute and global growth. Although an “insurance cut” of 25 bps by the Federal Reserve later this month looks like a “done deal” at the moment, speculations of a larger cut, say 50 bps, appear to have lost some traction.

Later today, the final inflation figures in Euroland for the month of June are unlikely to have much influence, whereas the release of the Fed’s Beige Book later in the US session should shed further light on the late performance of the economy.

Technically speaking, EUR/USD needs to recover to the area of recent tops around 1.1280/90, where the 21-day SMA also converges, to mitigate immediate downside pressure. Further up lies the critical 200-day SMA at 1.1320, deemed as the last defense for a visit to monthly peaks near 1.1420. However, a deeper pullback looms large in the horizon and the pair could slip back to, initially, 1.1181 ahead of 1.1176.

Equities Contributor: FXStreet

Source: Equities News