The Morgan Stanley Capital International Emerging Markets Index lists 24 countries representing 10 percent of world market capitalization. They are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Russia, Qatar, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The classifications differ, but all of them include BRIC countries, i.e. Brazil, Russia, India and China. The two last countries are home to 40 percent of the world’s labor force and population, which make them real emerging market powerhouses.

Emerging Markets and Gold

What are the links between the emerging markets and gold? First, the emerging countries are gaining importance, so they should exert stronger impact on the gold market in the future. Having said that, investors should remember that major gold trading marketplaces are in advanced economies and they still dominate the process of gold prices discovery.

Second, emerging markets are more volatile. The institutions are weaker, while economic policies are more populist, which make these countries more vulnerable to economic crises. It should theoretically support the safe-haven demand for gold. However, investors should remember that these countries are heavily indebted in US dollars. It makes them vulnerable to sharp and sudden appreciation of the greenback. In other words, the emerging markets usually fall into troubles when the US dollar strengthens. In such environment, the price of gold is not likely to rise.

The bottom line is that gold is not strongly linked to the emerging markets. They are still less important for traders than advanced countries. Gold is mainly a bet against the US dollar, so it reacts strongly to the developments in the US or its main peers, such as the European Union or Japan, but shrugs off what is happening in Russia or Brazil.

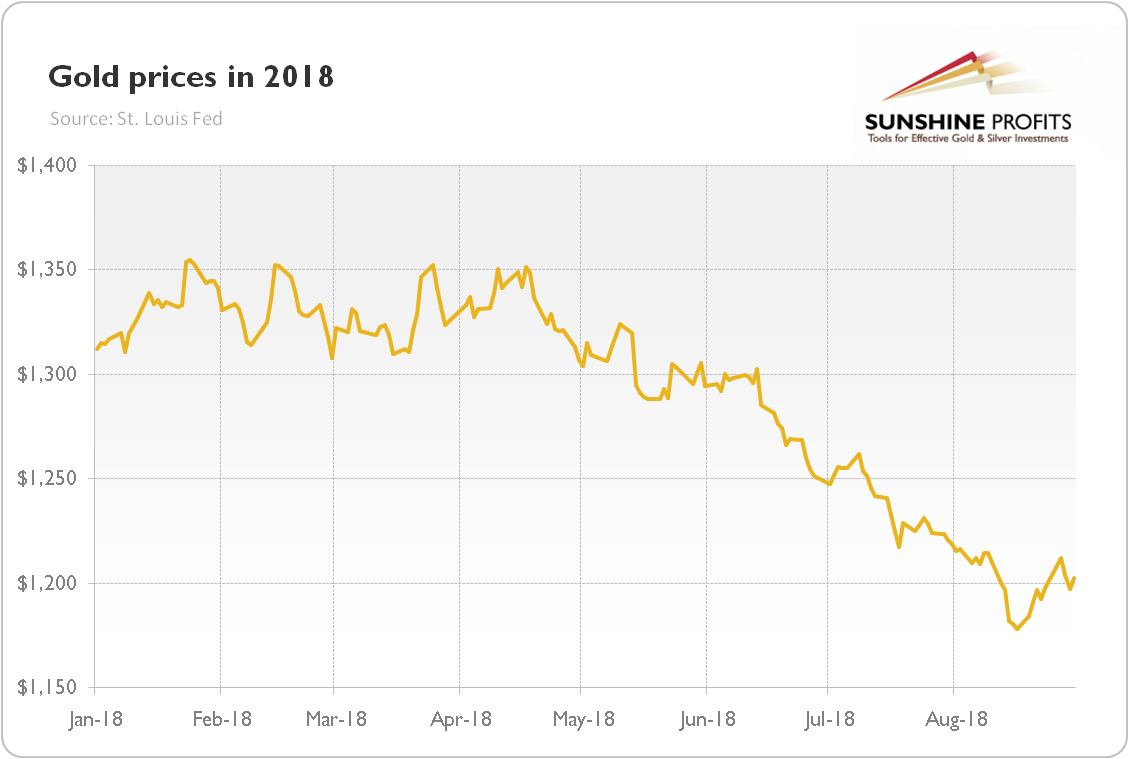

The best example may be 2018. The Turkish lira and the Argentina’s peso lost about one third and about half of their respective values against the greenback from January to August. In the same period, which witnessed the turmoil in several emerging markets, the price of gold declined by about 8 percent, as one can see in the chart below.

Chart 1: Gold prices (London P.M. Fix, in $) from January to August 2018.

We encourage you to learn more about the gold market – not only about the link between emerging markets and the yellow metal, but also how to successfully use gold as an investment and how to profitably trade it. Great way to start is to sign up for our Gold & Silver trading Alerts. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Related terms:

-

BRIC

BRIC is the acronym for Brazil, Russia, India, and China. The term was specifically coined to refer to these fast-growing emerging economies and by implication, their mutual benefits by forming alliances with each other. The growth of the BRIC countries has implications for the gold market.

Read more

-

Gold as an Investment

Gold had served as money for thousands of years until 1971 when the gold standard was abandoned for a fiat currency system. Since that time, gold has been used as an investment. Gold is often classified as a commodity; however, it behaves more like a currency. The yellow metal is very weakly correlated with other commodities and is less used in the industry. Unlike national currencies, the yellow metal is not tied to any particular country. Gold is a global monetary asset and its price reflects the global sentiment, however, it is mostly influenced by the U.S. macroeconomic conditions.

Read more

-

Precious Metals

A precious metal is defined as a rare, naturally occurring chemical element that has high economic value and is chemically resistant. In the past, precious metals served as a currency. Now they are an investment or industrial commodity.

Read more