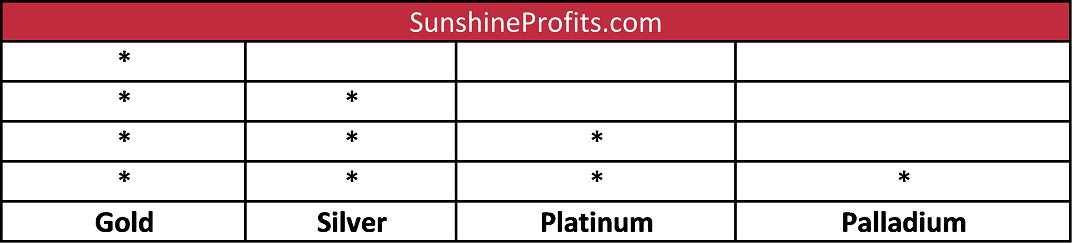

Let’s take an example. Assume that Sunshine Profits conducted a small poll among its Readers to find what precious metals investors prefer. This table shows the results: four people love gold, three adore silver, two like platinum and only one prefer palladium.

Table 1: Dot plot displaying the results of the hypothetical poll about the preferred metal among Sunshine Profits’ Readers.

As one can see, the dot plot was created by drawing a horizontal line with categories (to keep things simple, we made a table with categories put in columns) and a dot above the line for each investor who chose a particular precious metal.

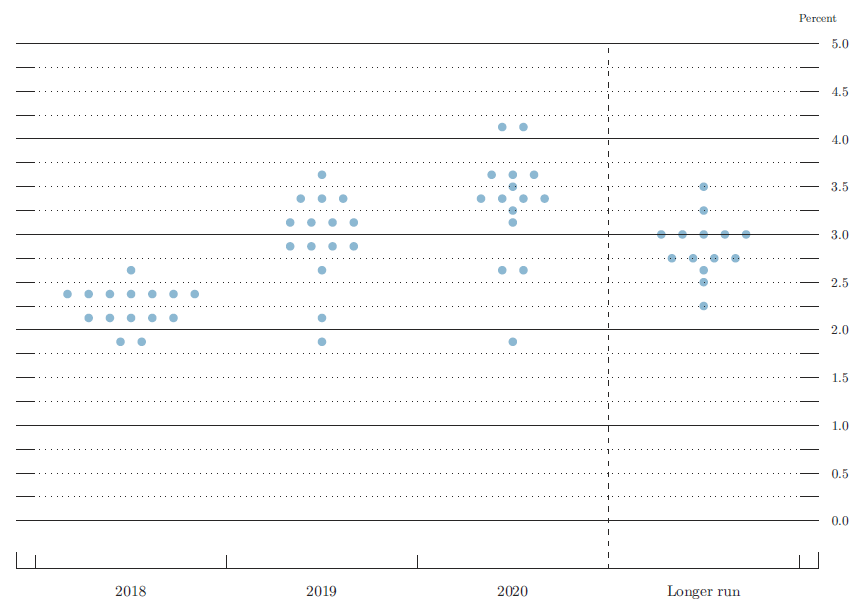

Probably the most watched dot plot in real life is the Fed dot plot, which displays the projections of the 12 members of the FOMC. Each dot represents a member’s view on where the federal funds rate should be at the particular dates and in the long run. Let’s look at the dot plot from the FOMC meeting in June 2018.

Figure 1: June 2018 Fed dot plot.

As one can see, that dot plot includes projections for 2018, 2019, 2020, and longer term. Each shaded circle indicates the value (rounded to the nearest ? percentage point) of an individual participant’s judgment of the midpoint of the appropriate target range for the federal funds rate at the end of the specified calendar year or over the longer run. The chart shows that two members believed that the midpoint of the target range of the fed funds rate should be at 1.875 percent, five participants chose 2.125, seven – 2.375, and one – 2.625. Hence, the median is 2.375 percent – and this is what markets take as the most probable value of the federal funds rate at the end of 2018.

Dot Plot and Gold

What is the link between the dot plot used by the Fed and gold? The dot plot – or, actually, the changes in the dot plot – show the shifts in the US central bank’s stance. Thus, the analysis of the dot plots over time enables investors to determine whether the FOMC is leaning toward looser or tighter monetary policy, which, then, affects the gold prices. The example may be December 2015, when the Fed finally hiked its interest rates. However, the upward move was accompanied with more dovish dot plots, so the gold prices started to rise soon after the FOMC historical meeting.

Nevertheless, investors should be careful not to read too much of the dot plot. The chart shows the projections of all participants, even those non-voting. And the dot plot carries no names, so there is no way to determine which dots belong to the most important members, such as the Fed Chair Jerome Powell. Finally, investors should remember that the dot plots show individual views of appropriate monetary policy, so they should not be taken as the targeted values.

We encourage you to learn more about the gold market – not only about the link between the dot plot and the yellow metal, but also how to successfully use gold as an investment and how to profitably trade it. Great way to start is to sign up for our Gold & Silver trading Alerts. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Related terms:

-

Fed

The Federal Reserve System, or sometimes referred to as “the Fed” is the central bank of the United States. The agency was created through the House Resolution 7883 by Rep. Carter Glass and it came into effect on December 23, 1913 after President Woodrow Wilson signed the Federal Reserve Act. The Fed is entrusted with the responsibility of ensuring that the country will have a safer, more stable, and flexible financial and monetary system.

Read more

-

Federal Funds Rate

The federal funds rate is an interest rate at which depository institutions lend balances (funds maintained at the Federal Reserve) to each other overnight. When one bank has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with excess cash, which is often referred to as liquidity, will lend to another bank that needs to quickly raise liquidity.

Read more

-

FOMC (The Federal Open Market Committee)

The Federal Open Market Committee (FOMC) is the policy making branch of the Federal Reserve Bank in the United States. It meets eight times a year to analyze the current market situation and make decisions based on its findings. The decisions made by the FOMC will have direct impact on the funds held by the Fed, causing ripple effects in the market. The decisions by this committee are eagerly awaited by the financial industry.

Read more

-

Gold as an Investment

Gold had served as money for thousands of years until 1971 when the gold standard was abandoned for a fiat currency system. Since that time, gold has been used as an investment. Gold is often classified as a commodity; however, it behaves more like a currency. The yellow metal is very weakly correlated with other commodities and is less used in the industry. Unlike national currencies, the yellow metal is not tied to any particular country. Gold is a global monetary asset and its price reflects the global sentiment, however, it is mostly influenced by the U.S. macroeconomic conditions.

Read more

-

Interest Rates

In economics, an interest rate is the ratio in the mutual valuation of present goods against future goods. Since people prefer goods now to later, in a free market there will be a positive interest rate to reward deferring consumption. From the financial point of view, an interest rate is a rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). To simplify, an interest rate is the cost of borrowing money, typically expressed as an annual percentage of principal.

Read more

-

Jerome Powell

Jerome Powell was born on February 4, 1953 in Washington, D.C. He does not have a PhD in economics – instead, he earned a Juris Doctor degree from Georgetown University Law Center in 1979. Under President George H. W. Bush, he worked as Undersecretary of the Treasury. He also has rich experience in the private sector – for example, in 1997-2005, he was a partner at the Carlyle Group, a New York-based private equity firm.

He is a current Federal Reserve Governor – he took office on May 25, 2012, to fill the unexpired term of Frederic Mishkin. In 2014, he was nominated for another term ending January 31, 2028.

On November 2, President Donald Trump nominated Powell to be the next Fed Chair. He took office on February 5, 2018, replacing Janet Yellen in that position.

Read more

-

Monetary Policy

Monetary policy is an economic policy which aims to achieve macroeconomic goals such as low inflation, low unemployment, high economic growth and financial stability. The second major macroeconomic policy is fiscal policy conducted by governments. Monetary policy is usually conducted by independent central banks.

Read more

-

Precious Metals

A precious metal is defined as a rare, naturally occurring chemical element that has high economic value and is chemically resistant. In the past, precious metals served as a currency. Now they are an investment or industrial commodity.

Read more