Inflation missed estimates, which is a sign the Fed won’t need to hike rates more than it plans to in 2018. That’s good news for the markets as investors look for an improvement in growth without a shock to inflation, writes Don Kaufman..

I’ve established that the rally in stocks on Thursday was technically important which means the increase loomed large. I think the April CPI report supported the market.

The best reports are ones which show a healthy amount of inflation which signals growth is improving. At the same time, investors don’t want to see inflation beating estimates because if the economy runs hotter than expected, the Fed will need to raise rates quicker than anticipated.

This report hit the sweet spot. The CPI was up 0.2% month over month which missed the consensus for 0.3% growth, but was above the previous growth of -0.1%. CPI was 2.5% year over year which met estimates and was up one tenth from last month.

Gasoline prices helped boost this headline number as they were up 3% month over month and 13.4% year over year.

The all-important core CPI growth was 0.1% which missed estimates for 0.2%; it was 0.2% last month. Core CPI was up 2.1% year over year which was the same as last month and below the consensus for 2.2%.

As you can see, the rise in energy prices boosted the overall number, but the core inflation was stable. This signals the core PCE, which the Fed uses to measure inflation, will probably stay at 1.9% growth year over year. That’s the perfect level for the Fed.

The longer it stays below 2%, the less pressure on the Fed to raise rates 4-5 times this year.

PPI-FD Growth Was Subdued

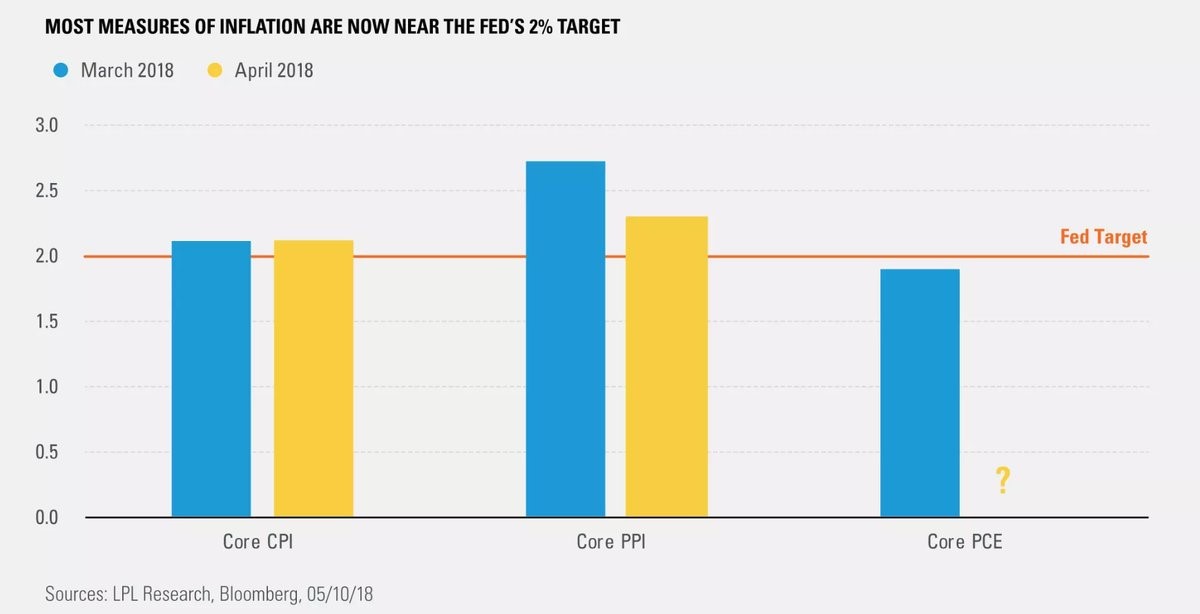

The chart below shows the core CPI, core PCE, and core PPI. The core PPI showed deceleration unlike the core CPI as the year over year growth fell from 2.7% to 2.3%. Month over month core inflation met estimates for 0.2% growth which was below last month’s 0.3% growth.

This is even while steel and aluminum prices increased after the tariffs. Steel was up 7.4% year over year and aluminum was 11.9%. The headline PPI was up 2.6% year over year which was down from 3% last month. This report seems to indicate the core PCE will fall slightly.

These inflation reports are all consistent with the hourly wage growth missing estimates in the BLS report for April. While the core PCE report is the most important measurement of inflation, because it comes out so late, there’s little uncertainty about it. There’s rarely a big miss or beat like in the BLS headline jobs report.

The April PCE report will be released on May 31.

Inflation’s Effect on the Markets

We know the stock market has had a great week: S&P 500 (SPX).

Let’s look at the other markets to see how inflation affected them. Obviously, it’s not the only news that was released, but it is one of the most important metrics at this point in the cycle. The Fed funds futures continue to show the same results they’ve shown for the past few weeks.

There’s an 83.9% chance the Fed raises rates either three or four times this year. These odds can easily change if the data moves, but for now it’s great to have a fairly high level of certainty on monetary policy for the next 7 and a half months. The Fed remains in a hawkish mode.

The 10 year yield has recently fallen back to where it was for two weeks. It has been in a tight range for almost a month. From April 20 to May 11 the yield has been between 2.946% and 3.026%.

There was a fear that once the 10-year yield broke 3%, it would increase very quickly. That’s based on technical analysis and an obsession with round numbers. The 10-year peaked at 3% in late 2013. I think it’s ridiculous to think inflation and growth will suddenly increase because of a psychologically important number. If growth accelerates like it’s expected to do in Q2, we could see yields move up a bit, but the talk of 4% yields is simply misguided rhetoric.

The 2-year yield is at 2.53% which is the highest level since 2008 as the Fed is in the meat of its rate hiking cycle. This means the curve is flattening almost every day. The difference between 10-year yield and the 2-year yield is now only 42 basis points.

It’s clear that my window for an inversion which is from the second half of 2018 to the first half of 2019 isn’t going to be missed because the curve inverts too early.

Monetary Policy to Get Interesting in the Next 18 Months

It’s obvious that there will be an inversion in the medium term which sets us up for a recession potentially in 2020. I’m most interested in how the Fed will react.

The Fed has stated it doesn’t want the curve to invert. The Fed also needs to keep inflation low. The Fed could let inflation run hot to avoid an inversion since inflation was below its target for many years.

One way the Fed could push off an inversion would be to hike rates three times in 2018 and temper the hawkish guidance for 2019.

The reality is monetary policy hasn’t mattered as much as the media would like to make investors think it has as the Fed has simply followed the unemployment rate and inflation.

The Fed being wrong on inflation didn’t matter much in 2017 because the rate hikes didn’t push rates high enough to slow the economy down. However, when the yield curve flattens further in the next few months the guidance will matter more. Even the tiny decision of hiking rates three or four times could matter.

Conclusion

Inflation missed estimates which is a sign the Fed won’t need to hike rates more than it plans to in 2018. That’s good news for the markets as investors look for an improvement in growth without a shock to inflation.

I’m expecting April core PCE to be somewhere between 1.8% to 2%. Clearly, there’s no reason to be alarmed by the Fed hitting its goal finally.

Don Kaufman is co-founder of TheoTrade.

About MoneyShow.com: Founded in 1981, MoneyShow is a privately held financial media company headquartered in Sarasota, Florida. As a global network of investing and trading education, MoneyShow presents an extensive agenda of live and online events that attract over 75,000 investors, traders and financial advisors around the world.