Spain’s central government said that it would suspend Catalonia’s autonomy on Saturday. What does it imply for the gold market?

As we informed on Tuesday, Madrid set Thursday morning as the ultimate deadline for Catalonia to declare independence or its willingness to remain a part of Spain. But Catalan president Carles Puigdemont ignored the deadline and did not clarify his position. Instead, he wrote a letter to Rajoy, threatening with a formal declaration of independence in the regional parliament:

“If the government continues to impede dialogue and continues with the repression, the Catalan parliament could proceed, if it is considered opportune, to vote on a formal declaration of independence.”

In response, the Spanish government is to suspend Catalonia’s autonomy on Saturday. In a statement, the central government wrote:

“At an emergency meeting on Saturday, the cabinet will approve measures to be put before the senate to protect the general interest of Spaniards, including the citizens of Catalonia, and to restore constitutional order in the autonomous community.”

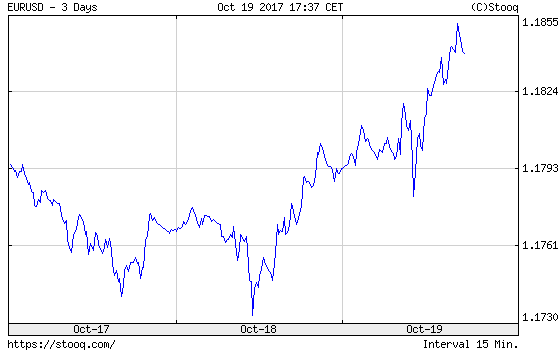

Although the crisis over Catalonia deepened (importantly, two pro-independence organizers, Jordi Cuixart and Jordi Sanchez, were imprisoned on Monday), investors were unmoved. Actually, the euro rose against the U.S. dollar yesterday, as one can see in the chart below. So the price of gold increased as well.

Chart 1: EUR/USD from October 17 to October 19, 2017.

It implies that the uncertainty about Catalonia’s fate has been already priced in, at least unless something really bad happens. It might be also the case that investors believe that Madrid will finally deal with the problem and Spain will not split up (especially given Puigdemont’s hesitation). It is also worth remembering that traders are now focused on the upcoming ECB meeting, which can be a turning point for the bank’s monetary policy.

To sum up, Puigdemont ignored another deadline set by Madrid to clarify his position on Catalonia’s independence. The central government is to trigger Article 155 of the Spanish Constitution to suspend Catalonia’s autonomy. Although the euro and gold shrugged off the deepening conflict about Catalonia (actually, both assets appreciated yesterday), we could see some volatility during the weekend and in the aftermath. The Spanish central government may trigger Article 155, while Japan will hold a parliamentary election. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview