Yesterday, Catalan leaders signed a declaration of independence. What does it mean for the gold market?

So it really happened. On Tuesday, the Catalan President, Carles Puigdemont, signed a document declaring Catalonia’s independence from Spain. He also delivered a speech in the regional parliament saying that the recent referendum gave his government the mandate to create a sovereign state: “I assume the mandate that Catalonia should become an independent state in the form of a republic.” (By the way, we learned from well-informed sources that the independence referendum lacked official electoral standards).

However, just seconds later, Puigdemont proposed to suspend the effects of a declaration of independence for a few weeks to allow a more dialogue with Madrid. He said: “We propose the suspension of the effects of the declaration of independence for a few weeks, to open a period of dialogue.”

So has Catalonia declared independence or not? Well, nobody knows. It seems that secessionists have recently been undecided. Remember the referendum on Brexit? After more than a year, we still do not know any details of the divorce. Actually, it seems that the Brexit might not happen at all. The behavior of Puigdemont looks similar: he apparently wants to secede, but without upsetting Madrid and changing the status quo.

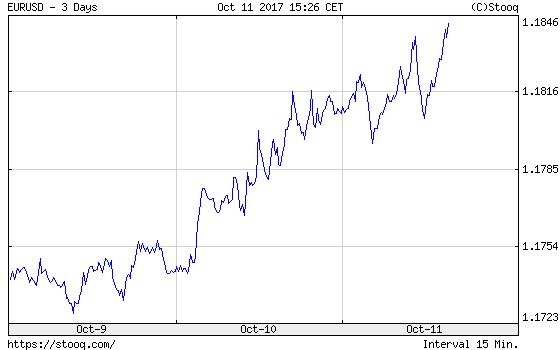

But what does it all mean for the gold market? Well, the lack of a strong and decisive declaration of independence calmed the investors and caused relief in the euro. As one can see in the chart below, the shared currency strengthened against the U.S. dollar.

Chart 1: EUR/USD exchange rate over last three days.

The decline in the greenback against the euro benefited the yellow metal. The next chart shows that the price of gold increased today.

Chart 2: Gold prices over last three days.

To sum up, Catalan leaders declared independence, but they suspended it immediately. The ambiguity of their position may be only a political tactic, but it calmed the investors, as it turned out that there will be no “hard independence”, but rather a soft version. This is rather positive news for the gold market. Although the Catalan shilly-shally reduced the safe-haven demand for the yellow metal, it strengthened the euro against the U.S. dollar, which is supportive for gold. However, some uncertainty remains. The Spanish government has already asked the Catalan leaders to confirm whether it has declared independence or not. The ball is again in Puigdemont’s court – if the crisis unfolds badly, Spain’s government may invoke article 155 of the Spanish constitution which allows it to take control of an autonomous region. Today’s minutes from the last FOMC meeting could also have some impact on the gold market. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview