Source: Streetwise Reports 06/25/2018

Ron Struthers of Struthers’ Resource Stock Report says this cannabis royalty company offers experienced management and fills a unique niche.

There are more and more pot deals coming to the market every week and

not all of them will do well or even survive. I find it best to stick with

proven, successful people and those exploiting a niche or where there is

little competition.

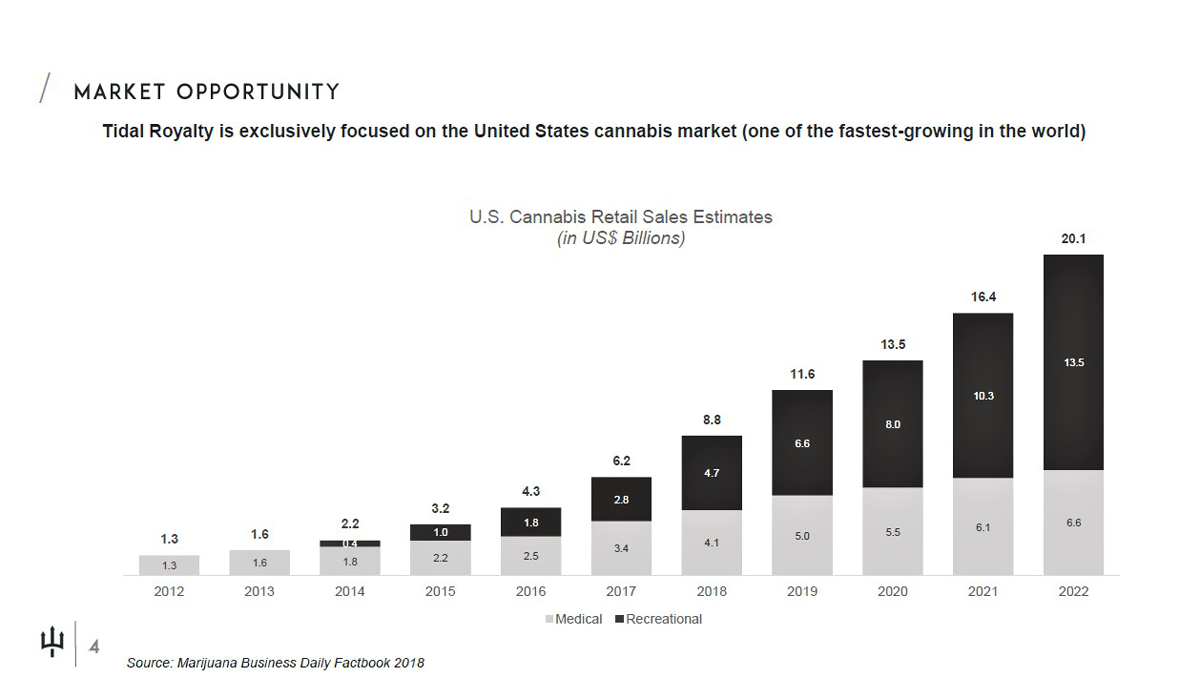

Tidal Royalty Corp. (RLTY:CSE) fits both bills. CSE:RLTY; Shares outstanding 153.6 million

Tidal involves many of the same people who started up Cannabis Wheaton

and it has the same royalty stream plan but in this case the focus is on the

U.S. market. Most Americans support legalization and every year we see

new states adopt some form of legalization. Despite this significant

growth, the inconsistency between federal and state laws restricts

capital. In Canada, just now have the big banks started to tip their

toes in the market and in the U.S. capital investment has been mostly

from private investment and some hedge funds.

The Tidal team has built, led and advised some of the most iconic

cannabis businesses in Canada and across the world. They plan to

leverage this expertise to provide non-dilutive and value-adding

capital to exceptional operators and help position them as a model for

best-in-class businesses. Tidal investors get top line access to the

companies that will form the future of this society-benefiting

industry.

Management

Paul Rosen, Chairman & CEO, is a noted career entrepreneur and

management consultant. Over the last five years, he has become one of

Canada’s most active and diversified investors in the emerging cannabis

industry. He is the founder and managing director of BreakWater Venture

Capital, a private venture capital fund and advisory based in Toronto.

Mr. Rosen was a co-founder of PharmaCan Capital, now operating as The

Cronos Group (CRON:NASDAQ, CRON.V), where he served as president and

CEO for three years. Mr. Rosen sits on the board and chairs the audit

committee of iAnthus Capital Holdings (IAN.C), a publicly traded New

York-based investment bank, sits on the

board of Hill Street Beverages, and acts as an advisory to several

companies in the industry. Mr. Rosen is a member of the Law Society of

Upper Canada and received a B.A. in Economics from Western University

in 1985 and LL.B. from the University of Toronto in 1988.

Terry Taouss, president, is an entrepreneur with operational experience

scaling fast-growing businesses. Mr. Taouss was part of the founding

management team at SiteScout, an advertising technology company that he

helped profitably build through its successful acquisition in 2013. In

that role, Mr. Taouss had carriage over all finance, legal and

corporate development functions. Mr. Taouss then served as the managing

director of Centro Canada, with carriage over strategy, product,

marketing and sales, and was a member of the Centro executive team,

helping guide strategy for the company’s broader technology and

services offering. Mr. Taouss received a J.D. from Osgood Hall Law

School and an MBA from the University of Toronto.

Theo van der Linde, CFO, is a Chartered Accountant with 20 years of

extensive experience in finance, reporting, regulatory requirements,

public company administration, equity markets and financing of publicly

traded companies. He has served as a CFO & director for a number of

TSX Venture Exchange and Canadian Securities Exchange (CSE) listed

companies over the past several years.

Courtland Livesley-James, Executive VP, Strategy, is an active investor

and entrepreneur with significant experience in corporate finance and

investment banking. Mr. Livesley-James helped develop the cannabis

practice at Dundee Capital Markets, playing a key role in a wide

variety of domestic and international corporate and commercial

transactions. His work included advising on some of the largest deals

in the cannabis sector. Mr. Livesley-James is also a partner at a

private venture capital fund with a focus on emerging companies in a

variety of sectors. Mr. Livesley-James received an Honours Degree in

Accounting and Financial Management from the University of Waterloo.

Jonathan Beland, VP, corporate development, has been focused on

investing and providing corporate advisory to some of the marquee

clients in the cannabis sector since 2016. Prior to joining Tidal, Mr.

Beland spent seven years in sell-side investment banking roles with

BMO, Deloitte and other firms focusing on the cannabis and mining

sectors. Some of the core clients Mr. Beland was responsible for

covering included Canopy Growth, Aurora Cannabis, MedReleaf,

PotashCorp, Mosaic, Agrium, BHP, Vale, CN, CP and Aecon. Mr. Beland

holds a B.A. in Architectural Theory and History from Carleton

University, an Associate’s Degree in Architectural Technology from

George Brown College, an M.B.A. from the University of Toronto

specializing in investment banking.

Iniataly Tidal will focus on U.S states with adult use markets that are

seeing strong growth like California, Massachusetts. Florida, New York,

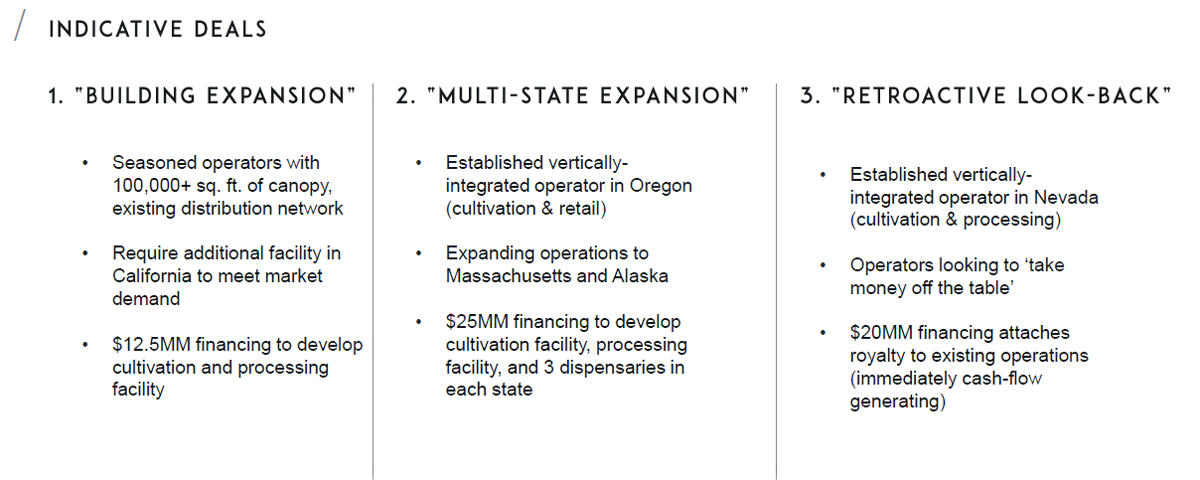

Illinois and Nevada. The company is in advanced talks with about 10 possible

royalties deals.

Tidal put out a news release today indicating it has had discussions

with over 100 prospect companies, and have entered into three separate

Letters of Intent to date. Its pipeline of opportunities to fund

high-caliber operators across nearly a dozen key U.S. states continues

to grow and it anticipates that current efforts will lead to multiple

additional agreements as discussions progress.

Today Tidal also announced four advisors.

Hugo Alves is the president of Auxly Cannabis Group Inc. (TSXV:XLY),

formerly known as Cannabis Wheaton Income Corp. Auxly is one of the

world’s first and foremost cannabis streaming companies.

Marc Lustig is the founder and CEO of CannaRoyalty Corp. (CSE:CRZ).

CannaRoyalty is a North American cannabis consumer product company

currently focused on building a leading distribution business in

California, the world’s largest regulated cannabis market.

Joel Sherlock is the co-founder of Doventi Capital Inc. and the

chairman of Vitalis Extraction Technologies. Doventi Capital is a

private equity firm specializing in investment in the regulated

cannabis industry in North America. Vitalis Extraction is an

engineering and manufacturing company producing the highest-flowing

industrial extraction systems for the cannabis industry.

Richard Brooks is the managing partner of Brooks Business Lawyers. The

Brooks firm provides corporate and commercial legal services to some of

the fastest-growing companies in Canada across a number of industries,

including cannabis.

Finance

As part of the go public process, Tidal set out to raise $20 million at

33 cents per share and ended up raising $30 million. This gives them

about $38 million cash on the balance sheet.

Summary

Tidal has the right people to do the job, but not just the royalty

agreements but the influence in financial circles to raise the

necessary funds.

I believe as this becomes known in the investment community we will see

much higher share prices. That said it is always difficult to know how

these new issues will trade. I would use the approach of

buying half of the intended position now and the other half after some trading

history. With a longer-term view, you could just buy your whole position

now and I would bet at some point down the road it will be much higher.

At $0.65, the market cap is about $100 million, not very high in the

marijuana field. I bought into the 33 cent financing and currently own

38,000 shares.

For 27 years, Ron Struthers, founder and editor of Struthers’ Resource Stock Report and Playstocks.net, has consistently beat the comparable benchmarks selecting stocks in the precious metals, oil and gas, clean-tech and disruptive technology sectors. In 2017, 35 stocks in the precious metals sector saw an average gain of 62% and energy clean-tech an average gain of 65%. In disruptive technology, 16 picks saw an average gain of 55%. Past performance is no guarantee of future gains. Struthers leverages his vast network of contacts, approaches investments from a value perspective seeking several 100% gain potential and uses technical analysis to aid in buy and sell levels.

Want to read more Streetwise Reports articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Tidal Royalty. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tidal Royalty, a company mentioned in this article.

Charts and graphics provided by the author.

Struthers Resource Stock Report disclosures:

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

(c) Copyright 2018, Struther’s Resource Stock Report

( Companies Mentioned: RLTY:CSE,

)